The three-year shareholder returns and company earnings persist lower as Longhua Technology GroupLtd (SZSE:300263) stock falls a further 8.5% in past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Longhua Technology Group Co.,Ltd. (SZSE:300263) shareholders. So they might be feeling emotional about the 63% share price collapse, in that time. And over the last year the share price fell 32%, so we doubt many shareholders are delighted. Furthermore, it's down 20% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 13% in the same period.

Since Longhua Technology GroupLtd has shed CN¥428m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Longhua Technology GroupLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

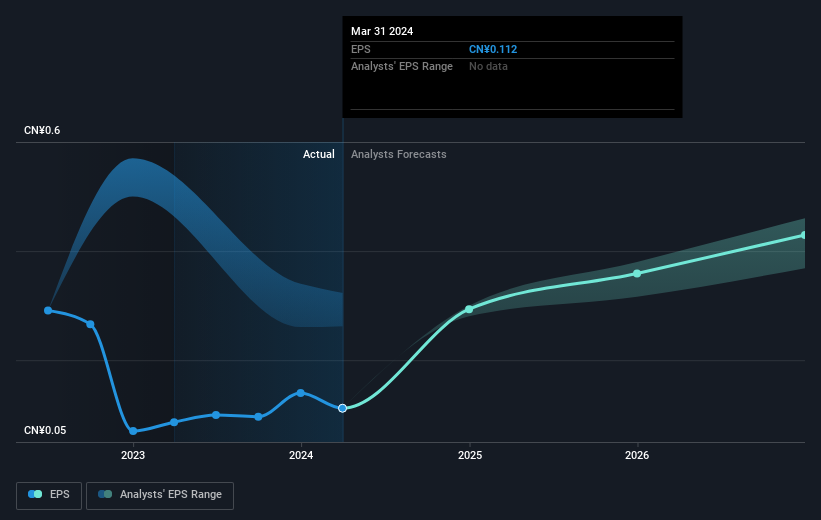

During the three years that the share price fell, Longhua Technology GroupLtd's earnings per share (EPS) dropped by 24% each year. This change in EPS is reasonably close to the 28% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Longhua Technology GroupLtd has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We regret to report that Longhua Technology GroupLtd shareholders are down 32% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Longhua Technology GroupLtd cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300263

Longhua Technology GroupLtd

Manufactures and sells heat transfer and energy-saving equipment in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives