Why Investors Shouldn't Be Surprised By Kunshan Kinglai Hygienic Materials Co.,Ltd.'s (SZSE:300260) 38% Share Price Surge

Those holding Kunshan Kinglai Hygienic Materials Co.,Ltd. (SZSE:300260) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

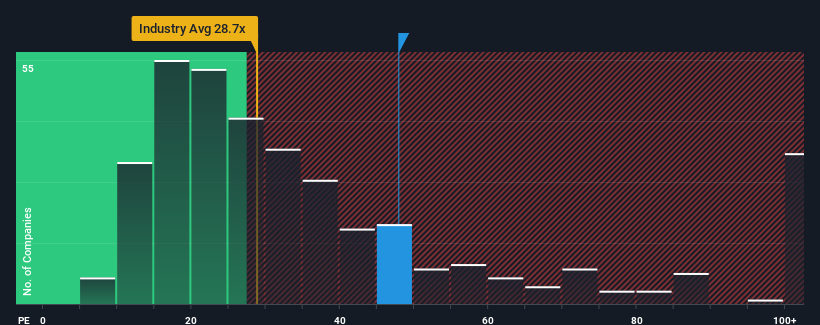

Since its price has surged higher, Kunshan Kinglai Hygienic MaterialsLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 47.9x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Kunshan Kinglai Hygienic MaterialsLtd has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Kunshan Kinglai Hygienic MaterialsLtd

Does Growth Match The High P/E?

Kunshan Kinglai Hygienic MaterialsLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 162% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 49% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Kunshan Kinglai Hygienic MaterialsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has got Kunshan Kinglai Hygienic MaterialsLtd's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kunshan Kinglai Hygienic MaterialsLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Kunshan Kinglai Hygienic MaterialsLtd (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Kinglai Hygienic MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300260

Kunshan Kinglai Hygienic MaterialsLtd

Kunshan Kinglai Hygienic Materials Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives