- China

- /

- Trade Distributors

- /

- SZSE:300226

Subdued Growth No Barrier To Shanghai Ganglian E-Commerce Holdings Co., Ltd. (SZSE:300226) With Shares Advancing 26%

Shanghai Ganglian E-Commerce Holdings Co., Ltd. (SZSE:300226) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

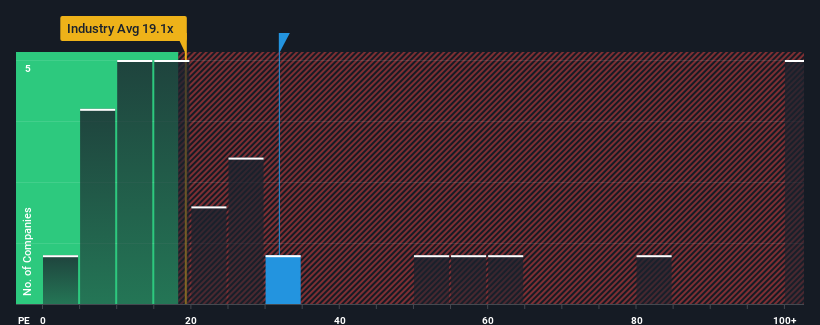

Even after such a large jump in price, it's still not a stretch to say that Shanghai Ganglian E-Commerce Holdings' price-to-earnings (or "P/E") ratio of 31.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shanghai Ganglian E-Commerce Holdings has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Shanghai Ganglian E-Commerce Holdings

What Are Growth Metrics Telling Us About The P/E?

Shanghai Ganglian E-Commerce Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. As a result, it also grew EPS by 24% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 22% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's curious that Shanghai Ganglian E-Commerce Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Shanghai Ganglian E-Commerce Holdings' P/E

Shanghai Ganglian E-Commerce Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanghai Ganglian E-Commerce Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Shanghai Ganglian E-Commerce Holdings with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300226

Shanghai Ganglian E-Commerce Holdings

Shanghai Ganglian E-Commerce Holdings Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives