- China

- /

- Electrical

- /

- SZSE:300222

There's Reason For Concern Over CSG Smart Science&Technology Co.,Ltd.'s (SZSE:300222) Massive 59% Price Jump

Despite an already strong run, CSG Smart Science&Technology Co.,Ltd. (SZSE:300222) shares have been powering on, with a gain of 59% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

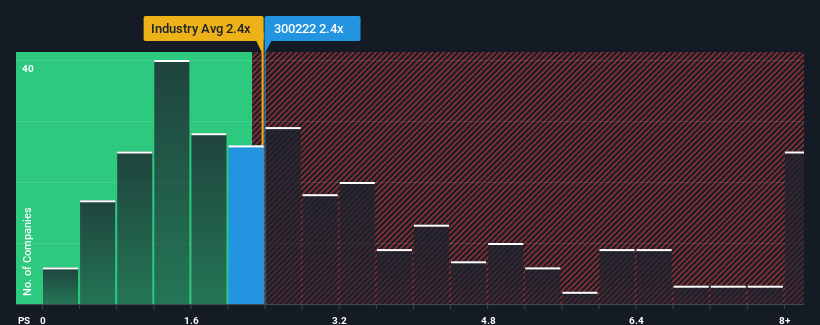

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about CSG Smart Science&TechnologyLtd's P/S ratio of 2.4x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in China is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for CSG Smart Science&TechnologyLtd

What Does CSG Smart Science&TechnologyLtd's P/S Mean For Shareholders?

For instance, CSG Smart Science&TechnologyLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on CSG Smart Science&TechnologyLtd's earnings, revenue and cash flow.How Is CSG Smart Science&TechnologyLtd's Revenue Growth Trending?

CSG Smart Science&TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

With this in mind, we find it intriguing that CSG Smart Science&TechnologyLtd's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does CSG Smart Science&TechnologyLtd's P/S Mean For Investors?

Its shares have lifted substantially and now CSG Smart Science&TechnologyLtd's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of CSG Smart Science&TechnologyLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware CSG Smart Science&TechnologyLtd is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on CSG Smart Science&TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300222

CSG Smart Science&TechnologyLtd

Manufactures and sells industrial intelligent solutions in China.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026