As global markets navigate a landscape marked by climbing U.S. stock indexes and heightened inflation expectations, small-cap stocks have recently lagged behind their larger counterparts, with the Russell 2000 trailing the S&P 500 by 146 basis points for the week. Amid this backdrop of economic uncertainty and market volatility, identifying promising opportunities in lesser-known stocks can be a rewarding endeavor, especially when focusing on those with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xuelong GroupLtd (SHSE:603949)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuelong Group Co., Ltd is involved in the research, development, production, and sale of internal combustion engine cooling systems and automotive lightweight plastic products for commercial vehicles, construction machinery, and agricultural machinery sectors with a market cap of CN¥2.88 billion.

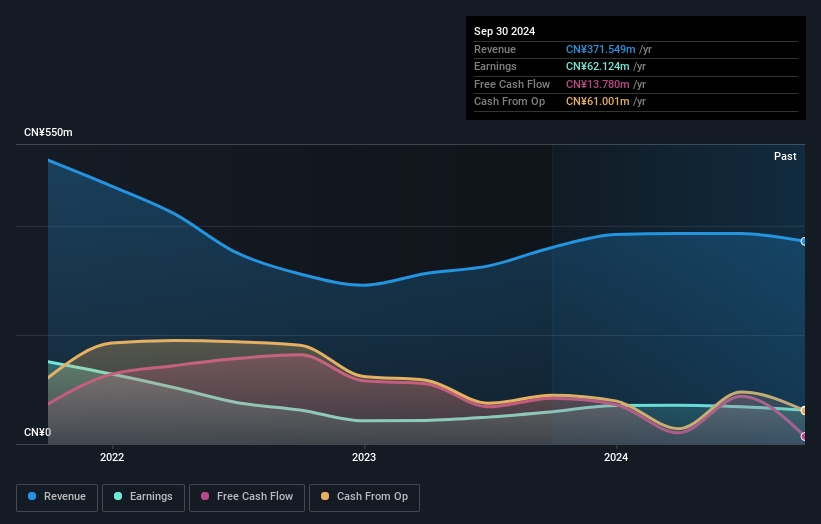

Operations: Xuelong Group generates revenue primarily from the sale of internal combustion engine cooling systems and automotive lightweight plastic products. The company's net profit margin is 8.5%, reflecting its operational efficiency in managing production and sales costs within its industry sectors.

Xuelong Group, a nimble player in the auto components sector, demonstrates financial resilience with its debt-free status and positive free cash flow. Despite a 16.8% annual drop in earnings over the past five years, it maintains high-quality earnings and profitability. The company's recent earnings growth of 5% lags behind the industry average of 10.5%, suggesting room for improvement. A special shareholders meeting is slated for December 2024, hinting at potential strategic shifts or decisions on the horizon that could influence future performance and investor sentiment positively or negatively depending on outcomes discussed during this meeting.

- Dive into the specifics of Xuelong GroupLtd here with our thorough health report.

Evaluate Xuelong GroupLtd's historical performance by accessing our past performance report.

Jiangsu Yawei Machine Tool (SZSE:002559)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Yawei Machine Tool Co., Ltd. is a company that manufactures and sells metal forming machine tools and laser processing equipment both in China and internationally, with a market cap of CN¥5.59 billion.

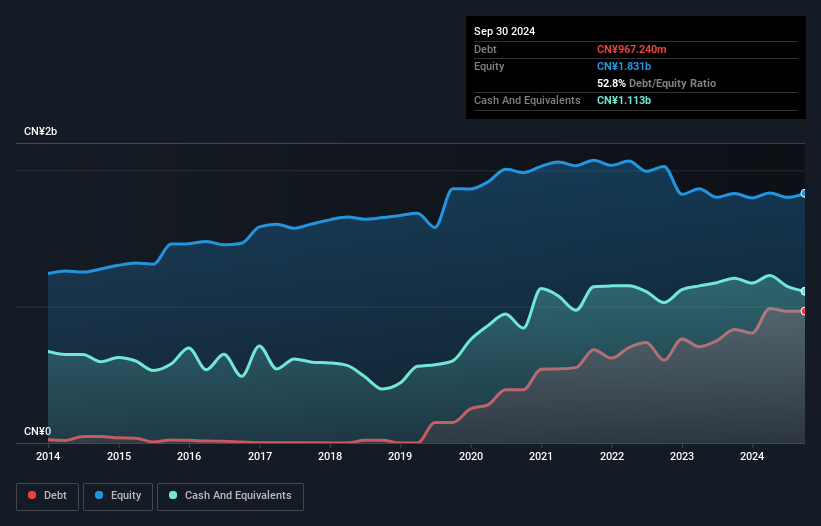

Operations: Yawei's primary revenue stream comes from its general equipment manufacturing segment, generating CN¥1.90 billion.

Jiangsu Yawei Machine Tool, a dynamic player in the machinery industry, has seen its earnings skyrocket by 5296.9% over the past year, outpacing industry norms. Despite a notable one-off loss of CN¥29M affecting recent results, the company remains profitable with more cash than debt and interest coverage not being a concern. A recent private placement aims to raise CN¥933.55M through issuing 128 million A shares at CNY 7.28 each, signaling strategic growth intentions backed by new investor participation from Yangzhou Industrial Investment Development Group Co., Ltd., pending regulatory approvals for listing on Shenzhen Stock Exchange.

Xuzhou Handler Special Vehicle (SZSE:300201)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuzhou Handler Special Vehicle Co., Ltd focuses on the research, development, production, and sales of aerial work vehicles, electric emergency support vehicles, military products, and fire trucks with a market capitalization of CN¥5.38 billion.

Operations: The company generates revenue primarily through the sales of aerial work vehicles, electric emergency support vehicles, military products, and fire trucks. Its market capitalization is approximately CN¥5.38 billion.

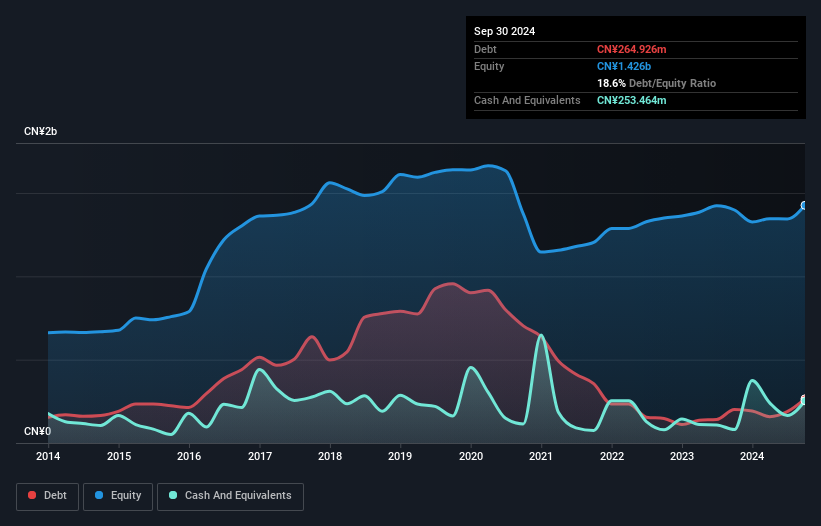

Xuzhou Handler Special Vehicle, a nimble player in the machinery industry, has shown impressive financial health with earnings growth of 45.8% over the past year, outpacing the industry's -0.06%. The company's net debt to equity ratio stands at a satisfactory 0.8%, reflecting prudent financial management as it reduced its debt from 58.2% to 18.6% over five years. Trading at 22.4% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector. Recent shareholder meetings indicate active governance, addressing director changes and amendments to key management systems, hinting at strategic adaptability and forward-thinking leadership.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4737 more companies for you to explore.Click here to unveil our expertly curated list of 4740 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002559

Jiangsu Yawei Machine Tool

Manufactures and sells metal forming machine tools and laser processing equipment in China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives