Does Shenzhen Jasic TechnologyLtd (SZSE:300193) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Shenzhen Jasic Technology Co.,Ltd. (SZSE:300193) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Shenzhen Jasic TechnologyLtd

What Is Shenzhen Jasic TechnologyLtd's Debt?

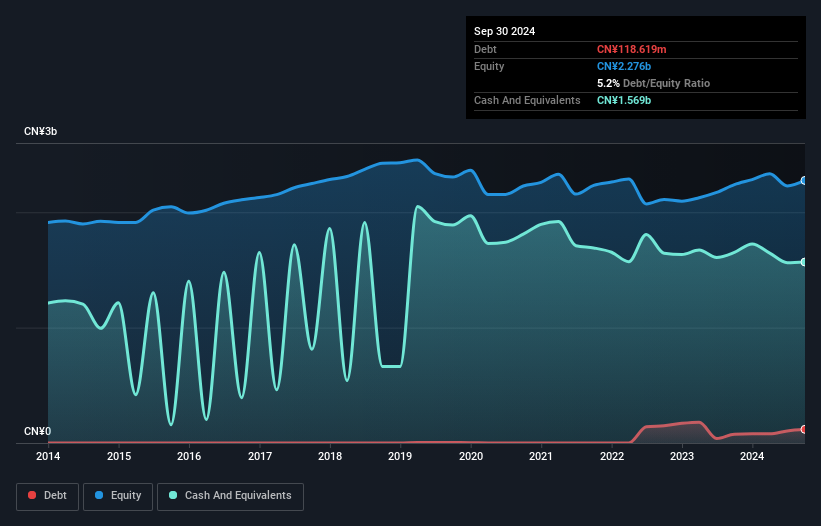

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Shenzhen Jasic TechnologyLtd had CN¥118.6m of debt, an increase on CN¥76.1m, over one year. However, it does have CN¥1.57b in cash offsetting this, leading to net cash of CN¥1.45b.

How Strong Is Shenzhen Jasic TechnologyLtd's Balance Sheet?

According to the last reported balance sheet, Shenzhen Jasic TechnologyLtd had liabilities of CN¥669.8m due within 12 months, and liabilities of CN¥22.1m due beyond 12 months. On the other hand, it had cash of CN¥1.57b and CN¥330.4m worth of receivables due within a year. So it actually has CN¥1.21b more liquid assets than total liabilities.

This excess liquidity suggests that Shenzhen Jasic TechnologyLtd is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Shenzhen Jasic TechnologyLtd has more cash than debt is arguably a good indication that it can manage its debt safely.

And we also note warmly that Shenzhen Jasic TechnologyLtd grew its EBIT by 16% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shenzhen Jasic TechnologyLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Shenzhen Jasic TechnologyLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Shenzhen Jasic TechnologyLtd generated free cash flow amounting to a very robust 83% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Shenzhen Jasic TechnologyLtd has net cash of CN¥1.45b, as well as more liquid assets than liabilities. The cherry on top was that in converted 83% of that EBIT to free cash flow, bringing in CN¥57m. So is Shenzhen Jasic TechnologyLtd's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Shenzhen Jasic TechnologyLtd , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300193

Shenzhen Jasic TechnologyLtd

Engages in the research and development, production, and sale of welding and cutting equipment in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026