There's Reason For Concern Over Shenzhen Changhong Technology Co., Ltd.'s (SZSE:300151) Massive 28% Price Jump

Shenzhen Changhong Technology Co., Ltd. (SZSE:300151) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

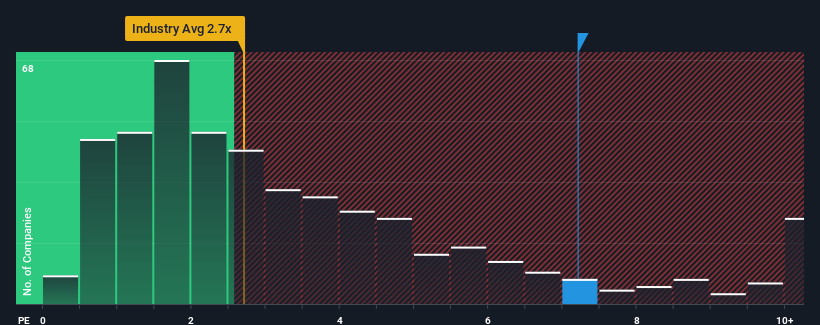

Since its price has surged higher, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Shenzhen Changhong Technology as a stock not worth researching with its 7.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Shenzhen Changhong Technology

What Does Shenzhen Changhong Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Shenzhen Changhong Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Shenzhen Changhong Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shenzhen Changhong Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Changhong Technology's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 9.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.9% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the only analyst following the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Shenzhen Changhong Technology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Shares in Shenzhen Changhong Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Shenzhen Changhong Technology, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Shenzhen Changhong Technology (1 is concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300151

Shenzhen Changhong Technology

Engages in design, manufacture, and sale of plastic molds and precision injection molded parts in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives