As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, small-cap stocks have been under the spotlight with indices like the S&P 600 reflecting broader sentiment shifts. In this environment, identifying promising small-cap stocks often hinges on uncovering companies that demonstrate resilience through innovation and adaptability amidst fluctuating market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

RIAMB (Beijing) Technology Development (SHSE:603082)

Simply Wall St Value Rating: ★★★★★☆

Overview: RIAMB (Beijing) Technology Development Co., Ltd. focuses on providing intelligent logistics systems and holds a market cap of approximately CN¥6.53 billion.

Operations: The company generates revenue primarily from its intelligent logistics system, amounting to approximately CN¥1.94 billion.

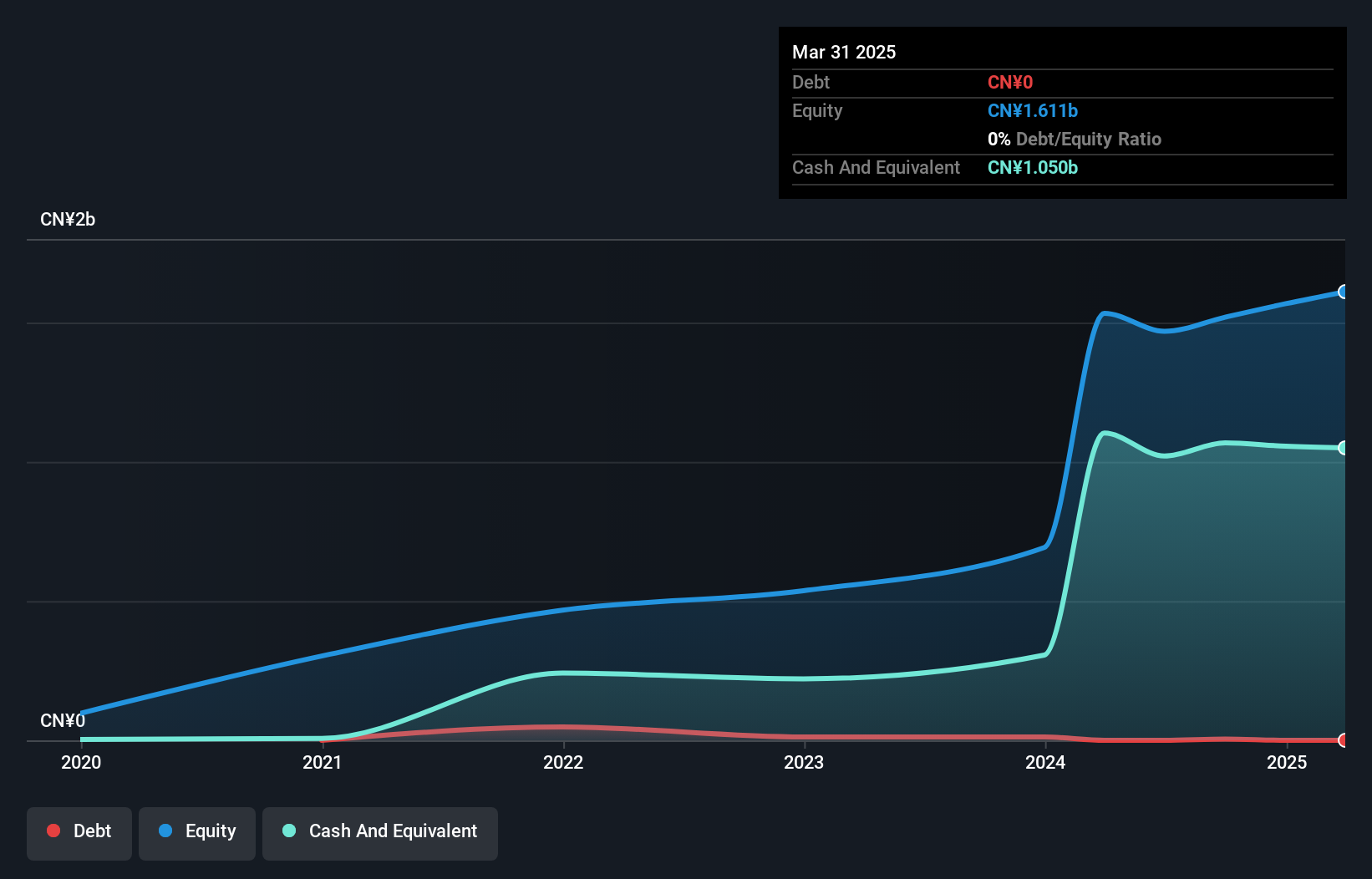

RIAMB (Beijing) Technology Development showcases a promising profile with earnings growth of 5.6% over the past year, outpacing the Machinery industry's -0.06%. The company is profitable and has more cash than its total debt, indicating financial stability. Levered free cash flow reached US$136.93 million by March 2024, reflecting positive cash generation trends. Despite insufficient data on debt reduction over five years, RIAMB's high-quality earnings and ability to cover interest payments suggest resilience in operations. Recent shareholder meetings hint at strategic discussions that could shape future directions for this intriguing player in the technology sector.

Shenzhen Changhong Technology (SZSE:300151)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Changhong Technology Co., Ltd. is involved in the design, manufacture, and sale of plastic molds and precision injection molded parts both domestically and internationally, with a market cap of CN¥8.93 billion.

Operations: Shenzhen Changhong Technology generates revenue primarily through the sale of plastic molds and precision injection molded parts. The company's financial performance is characterized by a focus on efficient production processes, with particular attention to managing costs associated with manufacturing. Over recent periods, it has experienced fluctuations in its gross profit margin, reflecting changes in production efficiency and market conditions.

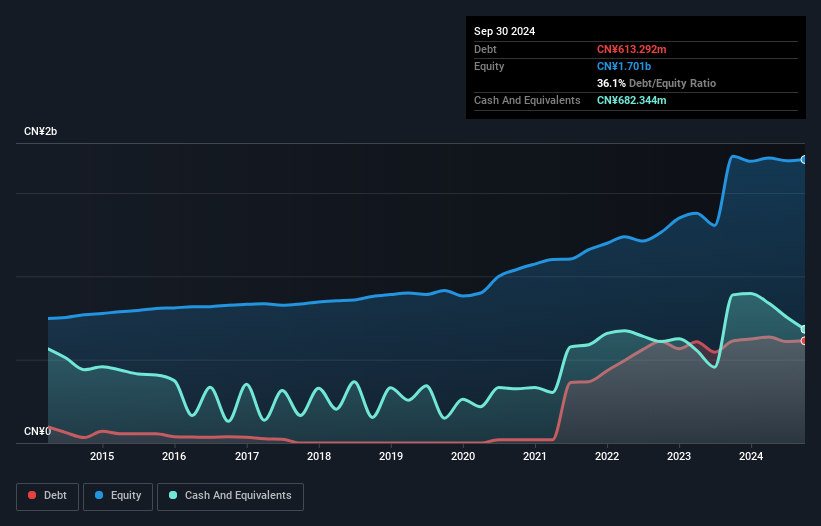

Shenzhen Changhong Technology, a promising player in the machinery sector, has seen its earnings grow by 4.3% over the past year, outpacing the industry's -0.06%. The company's debt to equity ratio has climbed from 0% to 36.1% over five years, yet it remains well-positioned with more cash than total debt. Despite a CN¥11M one-off gain impacting recent financials, interest payments are comfortably covered at 9.3 times by EBIT. Although not free cash flow positive currently, profitability ensures that cash runway isn't an immediate concern for this intriguing contender in its field.

- Click to explore a detailed breakdown of our findings in Shenzhen Changhong Technology's health report.

Gain insights into Shenzhen Changhong Technology's past trends and performance with our Past report.

EMTEK (Shenzhen) (SZSE:300938)

Simply Wall St Value Rating: ★★★★★☆

Overview: EMTEK (Shenzhen) Co., Ltd. operates as a third-party testing institution in China with a market cap of approximately CN¥4.89 billion.

Operations: The company's primary revenue stream is from research services, generating approximately CN¥719.98 million.

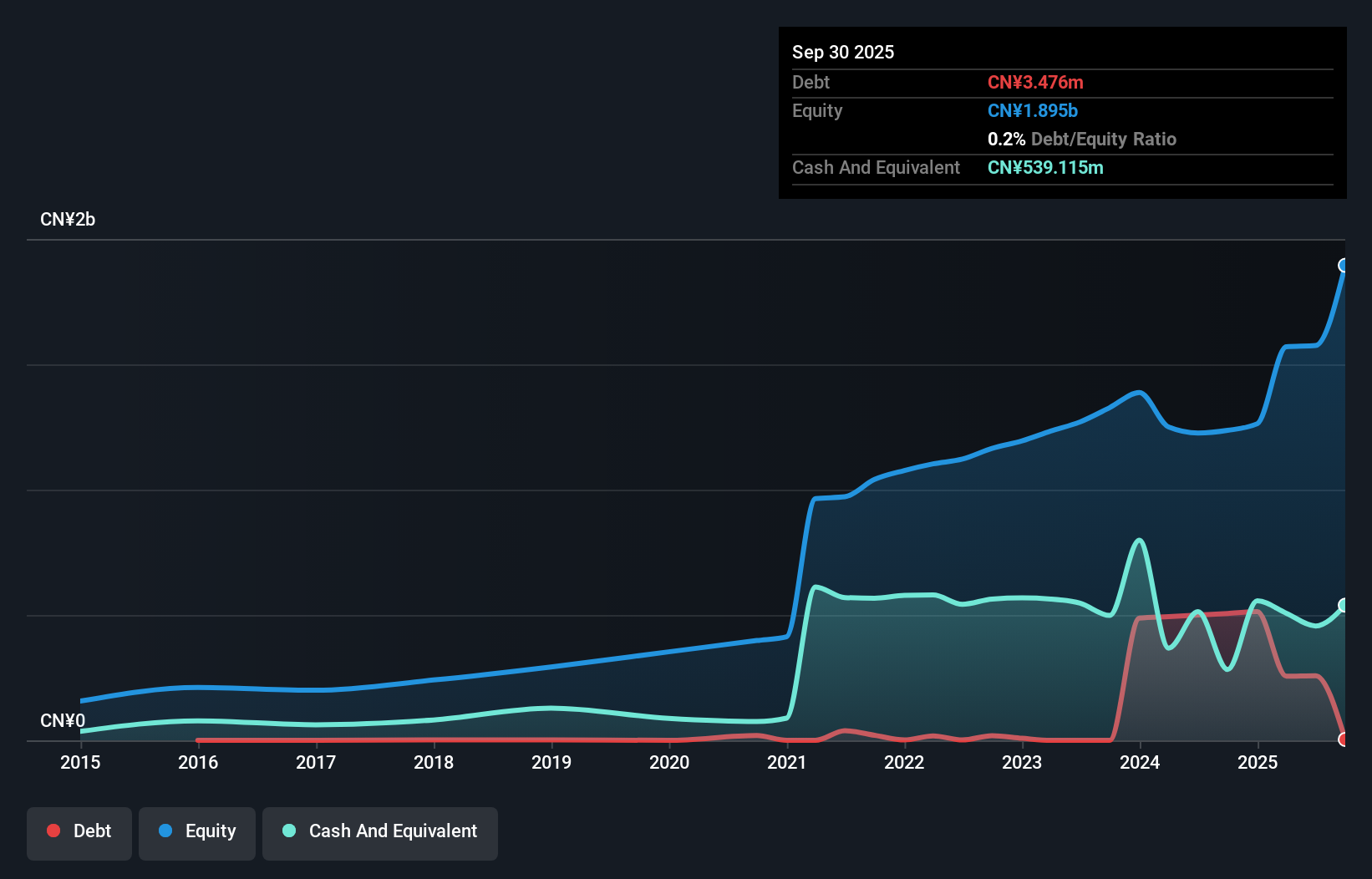

EMTEK, a promising player in the professional services sector, has shown strong earnings growth of 10.7% over the past year, surpassing industry averages. The company's price-to-earnings ratio stands at 28.2x, which is favorable compared to the broader CN market's 36.3x, suggesting potential value for investors. Despite an increase in its debt-to-equity ratio from 0.1% to 40.9% over five years, EMTEK maintains satisfactory debt levels with a net debt-to-equity ratio of 18%. With positive free cash flow and high-quality earnings reported recently, EMTEK seems well-positioned for continued profitability and stability within its niche market segment.

- Dive into the specifics of EMTEK (Shenzhen) here with our thorough health report.

Assess EMTEK (Shenzhen)'s past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 4721 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603082

RIAMB (Beijing) Technology Development

RIAMB (Beijing) Technology Development Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives