Lacklustre Performance Is Driving Jiayu Holding Co.,Ltd.'s (SZSE:300117) 31% Price Drop

To the annoyance of some shareholders, Jiayu Holding Co.,Ltd. (SZSE:300117) shares are down a considerable 31% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

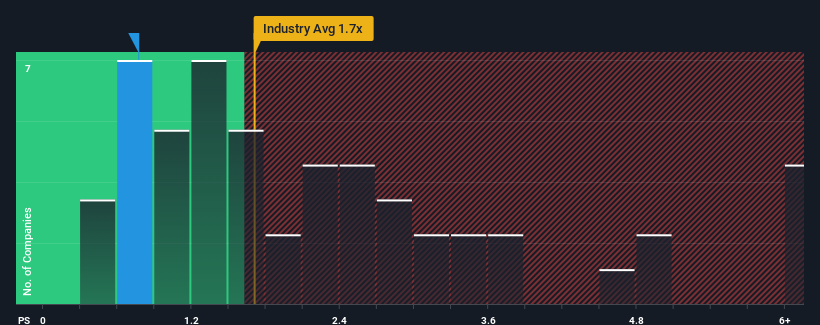

Since its price has dipped substantially, when close to half the companies operating in China's Building industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider Jiayu HoldingLtd as an enticing stock to check out with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jiayu HoldingLtd

What Does Jiayu HoldingLtd's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Jiayu HoldingLtd's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Jiayu HoldingLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiayu HoldingLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Jiayu HoldingLtd would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 28% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this in mind, we understand why Jiayu HoldingLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Jiayu HoldingLtd's P/S

Jiayu HoldingLtd's recently weak share price has pulled its P/S back below other Building companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Jiayu HoldingLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - Jiayu HoldingLtd has 4 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Jiayu HoldingLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300117

Jiayu HoldingLtd

Focuses on providing energy-saving door and window curtain walls in China.

Moderate and slightly overvalued.