Shenzhen Xinyichang Technology And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, characterized by fluctuating indices and economic uncertainties, investors are seeking opportunities to diversify their portfolios with promising small-cap stocks. As corporate earnings reports and geopolitical developments continue to sway market sentiment, identifying undiscovered gems like Shenzhen Xinyichang Technology can offer strategic advantages.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Xinyichang Technology (SHSE:688383)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Xinyichang Technology Co., Ltd. specializes in the R&D, production, and sale of intelligent manufacturing equipment for industries such as LED, capacitor, semiconductor, and lithium battery in China with a market cap of CN¥4.70 billion.

Operations: Xinyichang Technology generates revenue primarily through the sale of intelligent manufacturing equipment across various industries, including LED, capacitor, semiconductor, and lithium battery sectors in China. The company has a market capitalization of CN¥4.70 billion.

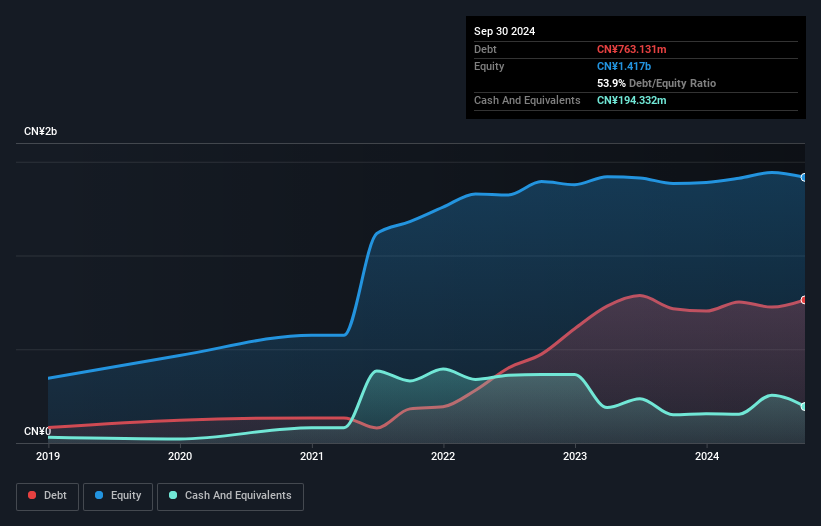

Shenzhen Xinyichang Technology, a small player in the tech space, is trading at 21.6% below its estimated fair value, suggesting potential undervaluation. The company has shown impressive earnings growth of 40.2% over the past year, outpacing the broader semiconductor industry’s 12.9%. However, it carries a high net debt to equity ratio of 40.1%, which could be a concern for some investors despite having well-covered interest payments with EBIT covering them 3.2 times over. Recently, they completed a share buyback worth CNY16.99 million for about 0.31% of shares announced earlier in February 2024.

Uroica Precision Information EngineeringLtd (SZSE:300099)

Simply Wall St Value Rating: ★★★★★☆

Overview: Uroica Precision Information Engineering Co., Ltd. operates in the field of precision information engineering and has a market capitalization of CN¥4.63 billion.

Operations: Uroica Precision Information Engineering Co., Ltd. generates revenue from its precision information engineering operations, contributing to a market capitalization of CN¥4.63 billion.

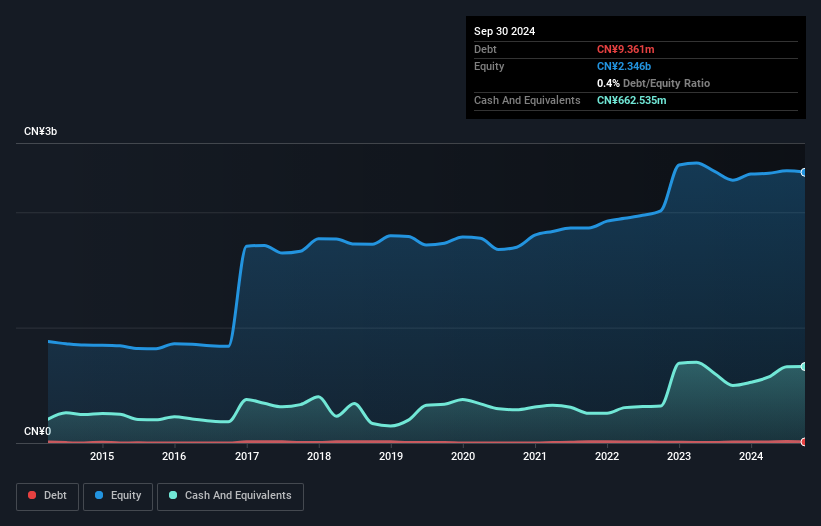

Uroica Precision Information Engineering Ltd., a nimble player in its field, has demonstrated robust earnings growth of 32.7% over the past year, outpacing the Machinery industry average of -0.4%. With a debt-to-equity ratio rising from 0.3 to 0.4 over five years, it still maintains more cash than total debt, indicating sound financial health. Despite this uptick in leverage, interest coverage remains strong as profits exceed interest payments comfortably. A special shareholders meeting scheduled for February will address strategic decisions like equity disposal in a subsidiary and fulfilling performance commitments early, hinting at proactive corporate governance and potential future adjustments.

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. is a company engaged in the construction and development of residential and commercial properties, with a market cap of NT$28.70 billion.

Operations: Yungshin Construction & Development generates revenue primarily from its residential and commercial home building segment, amounting to NT$12.55 billion.

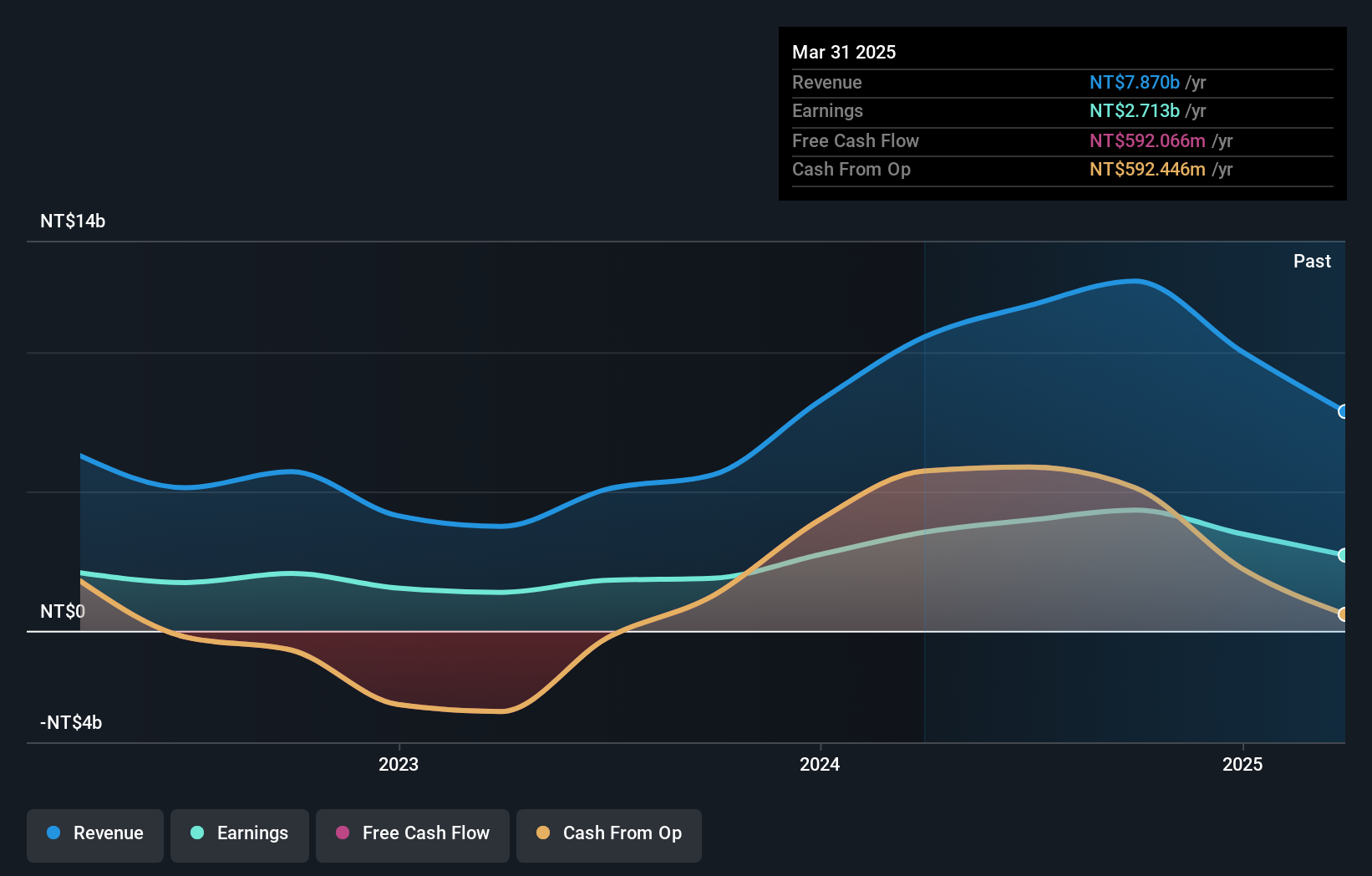

Yungshin Construction & Development, a nimble player in the real estate sector, has shown impressive earnings growth of 129% over the past year, outpacing the industry's 52%. Despite its high net debt to equity ratio of 90%, debt levels have improved from 109% to 94% over five years. The company boasts substantial EBIT coverage for interest payments at an astounding 2126 times. Recent contracts in Kaohsiung totaling TWD 614 million highlight ongoing expansion efforts. Trading nearly 95% below fair value estimates suggests potential undervaluation, making it an intriguing prospect for those eyeing opportunities in smaller firms.

- Take a closer look at Yungshin Construction & DevelopmentLtd's potential here in our health report.

Understand Yungshin Construction & DevelopmentLtd's track record by examining our Past report.

Taking Advantage

- Dive into all 4721 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300099

Uroica Precision Information EngineeringLtd

Uroica Precision Information Engineering Co.,Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives