While Xiamen Zhongchuang Environmental Technology (SZSE:300056) shareholders have made 149% in 5 years, increasing losses might now be front of mind as stock sheds 7.8% this week

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the Xiamen Zhongchuang Environmental Technology Co., Ltd (SZSE:300056) share price has soared 149% in the last half decade. Most would be very happy with that. Unfortunately, though, the stock has dropped 7.8% over a week. However, this might be related to the overall market decline of 1.3% in a week.

In light of the stock dropping 7.8% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Xiamen Zhongchuang Environmental Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Xiamen Zhongchuang Environmental Technology saw its revenue shrink by 24% per year. Given that scenario, we wouldn't have expected the share price to rise 20% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

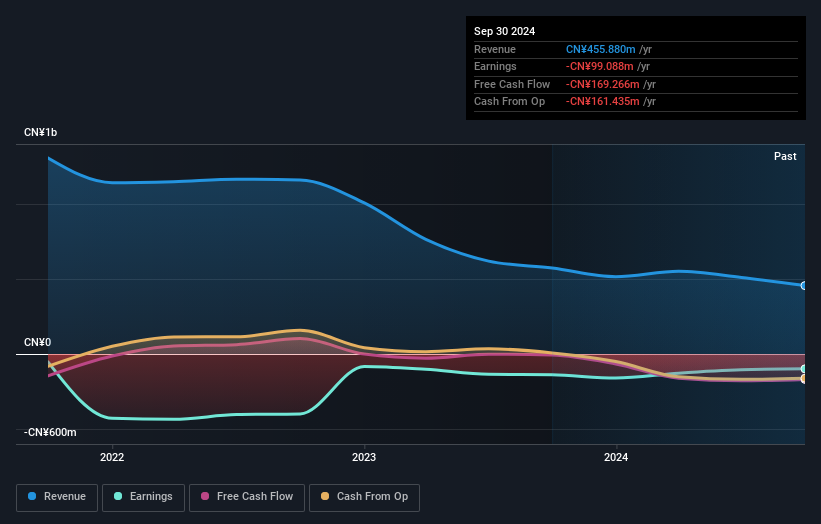

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Xiamen Zhongchuang Environmental Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Xiamen Zhongchuang Environmental Technology shareholders have received a total shareholder return of 43% over the last year. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Xiamen Zhongchuang Environmental Technology you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Xiamen Zhongchuang Environmental Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300056

Xiamen Zhongchuang Environmental Technology

Xiamen Zhongchuang Environmental Technology Co., Ltd.

Low with worrying balance sheet.

Market Insights

Community Narratives