- China

- /

- Electrical

- /

- SZSE:300048

Hiconics Eco-energy Technology Co., Ltd. (SZSE:300048) Soars 37% But It's A Story Of Risk Vs Reward

Hiconics Eco-energy Technology Co., Ltd. (SZSE:300048) shareholders have had their patience rewarded with a 37% share price jump in the last month. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

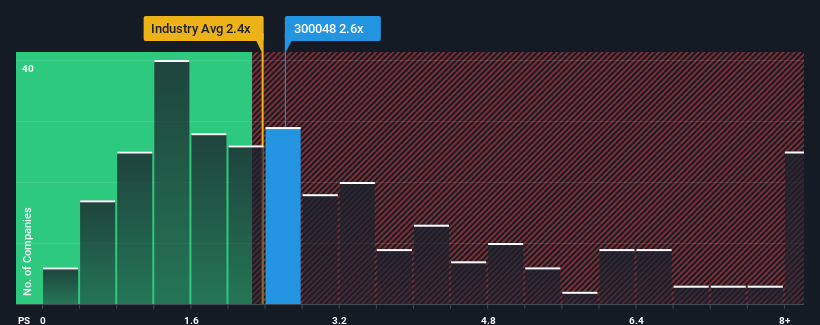

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Hiconics Eco-energy Technology's P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in China is also close to 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hiconics Eco-energy Technology

How Has Hiconics Eco-energy Technology Performed Recently?

With revenue growth that's superior to most other companies of late, Hiconics Eco-energy Technology has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hiconics Eco-energy Technology will help you uncover what's on the horizon.How Is Hiconics Eco-energy Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Hiconics Eco-energy Technology would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 62% last year. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 45% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Hiconics Eco-energy Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Hiconics Eco-energy Technology's P/S Mean For Investors?

Hiconics Eco-energy Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Hiconics Eco-energy Technology's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Hiconics Eco-energy Technology with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hiconics Eco-energy Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300048

Hiconics Eco-energy Technology

Engages in the industrial control, residential energy storage, and distributed PV EPC businesses in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives