Not Many Are Piling Into Hunan Zhongke Electric Co., Ltd. (SZSE:300035) Just Yet

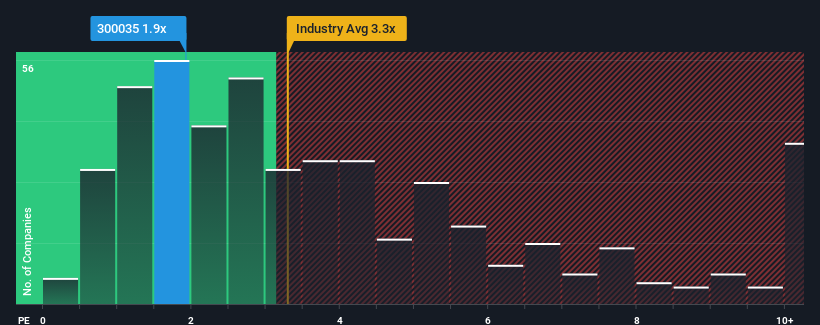

You may think that with a price-to-sales (or "P/S") ratio of 1.9x Hunan Zhongke Electric Co., Ltd. (SZSE:300035) is a stock worth checking out, seeing as almost half of all the Machinery companies in China have P/S ratios greater than 3.3x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hunan Zhongke Electric

How Hunan Zhongke Electric Has Been Performing

There hasn't been much to differentiate Hunan Zhongke Electric's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Hunan Zhongke Electric will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hunan Zhongke Electric.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hunan Zhongke Electric's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.7%. This was backed up an excellent period prior to see revenue up by 206% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 22%, which is not materially different.

With this information, we find it odd that Hunan Zhongke Electric is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Hunan Zhongke Electric's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hunan Zhongke Electric's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 2 warning signs for Hunan Zhongke Electric (1 is a bit concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Zhongke Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300035

Hunan Zhongke Electric

Manufactures electromagnetic metallurgy products in China.

High growth potential average dividend payer.

Market Insights

Community Narratives