Global markets have faced a challenging week, with U.S. stocks experiencing losses amid inflation concerns and geopolitical uncertainties. In such times, investors often look beyond the usual suspects to find opportunities that may offer both value and growth potential. Penny stocks, though an older term, still hold relevance as they often represent smaller or newer companies with the possibility of significant returns when backed by strong financials. Here, we explore three penny stocks that stand out for their financial resilience and potential in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.675 | £296.89M | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.265 | MYR737.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.16 | HK$49.29B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £425.4M | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.33 | SGD9.2B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £2.99 | £297.37M | ★★★★☆☆ |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.81 | MYR430.6M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.31 | HK$831.57M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.20 | A$151.37M | ★★★★★★ |

Click here to see the full list of 5,699 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi operates as a real estate investment trust, having transformed from Sinpas Insaat in 2007, with a market capitalization of TRY14.36 billion.

Operations: No specific revenue segments are reported for this real estate investment trust.

Market Cap: TRY14.36B

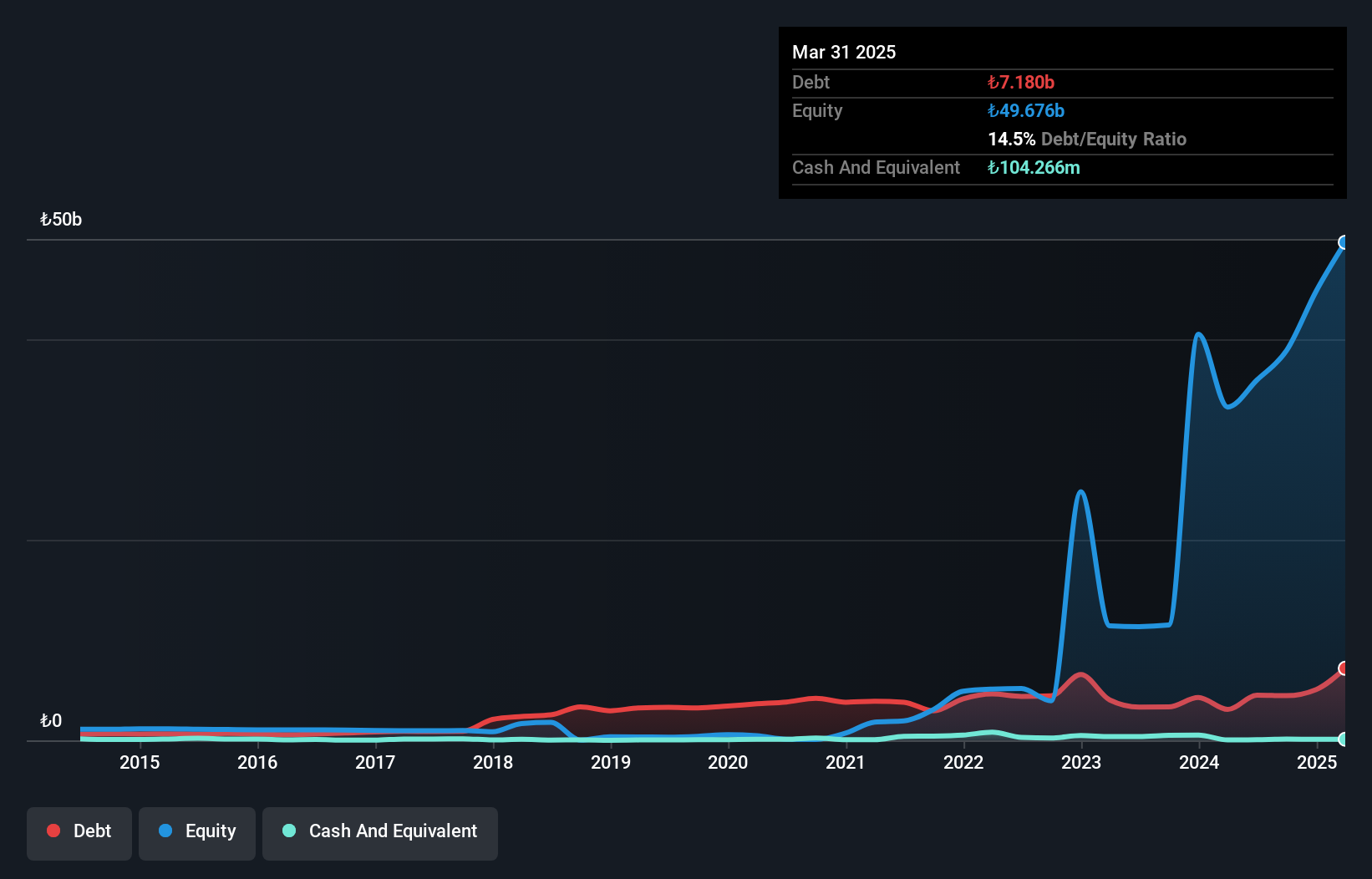

Sinpas Gayrimenkul Yatirim Ortakligi, with a market cap of TRY14.36 billion, reported significant earnings growth, achieving a net income of TRY5.23 billion for 2024. The company benefits from a low price-to-earnings ratio of 2.7x compared to the broader Turkish market and has seen debt levels decrease significantly over five years to a satisfactory net debt to equity ratio of 12.2%. However, its profit margins have declined from last year and short-term assets do not cover long-term liabilities despite being strong against short-term obligations. The experienced management team supports stable operations amidst these dynamics.

- Click here to discover the nuances of Sinpas Gayrimenkul Yatirim Ortakligi with our detailed analytical financial health report.

- Understand Sinpas Gayrimenkul Yatirim Ortakligi's track record by examining our performance history report.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and sales of chemical fibers, textile materials, and rubber and plastic products both in China and internationally, with a market cap of CN¥5.30 billion.

Operations: Zhejiang Hailide New Material Co., Ltd does not report specific revenue segments, focusing instead on its activities in chemical fibers, textile materials, and rubber and plastic products across both domestic and international markets.

Market Cap: CN¥5.3B

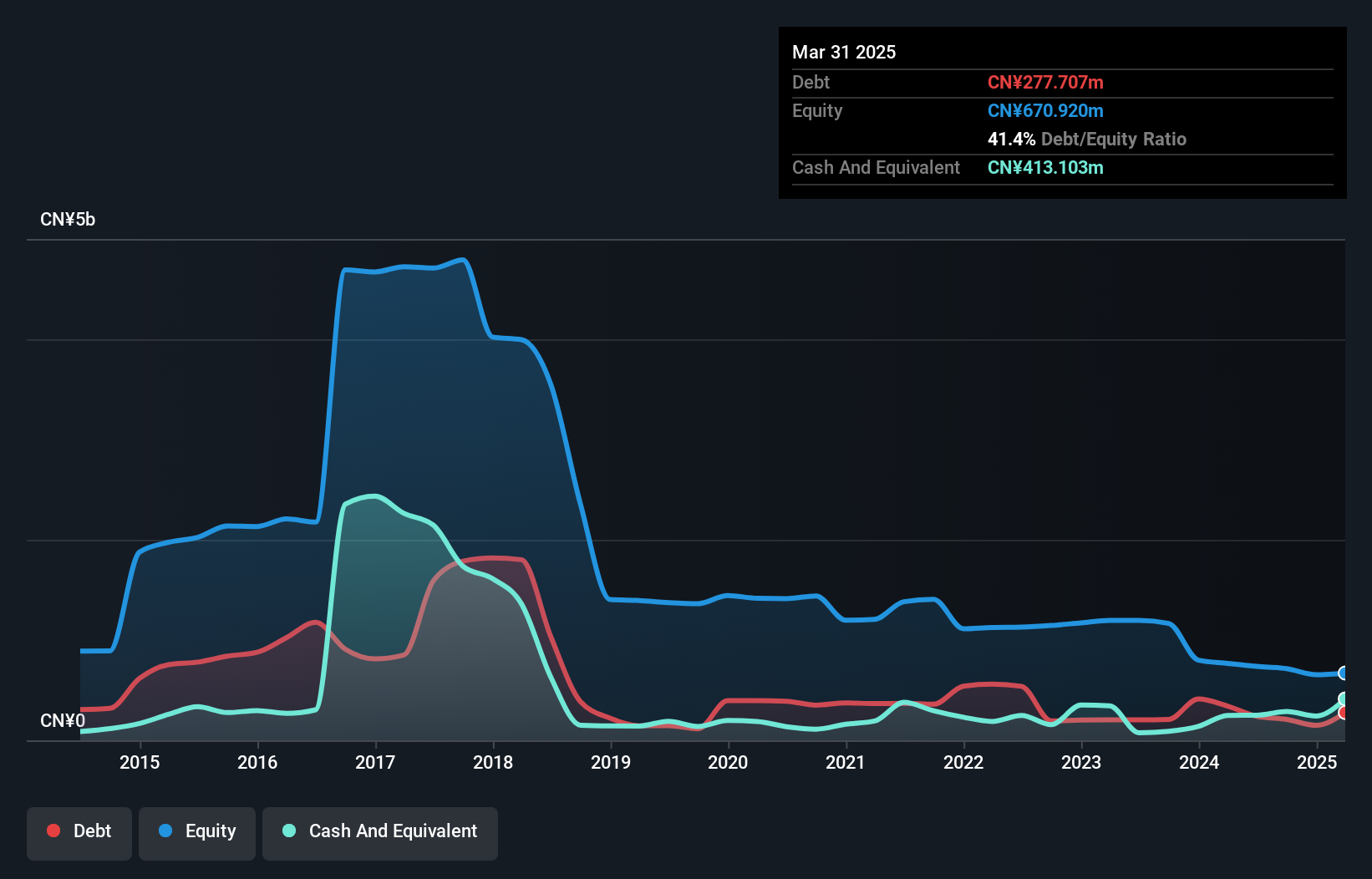

Zhejiang Hailide New Material Co., Ltd, with a market cap of CN¥5.30 billion, has demonstrated robust earnings growth of 15.5% over the past year, outpacing the chemicals industry. Its price-to-earnings ratio of 14.6x is favorable compared to the broader Chinese market, indicating potential value for investors. The company's debt is well covered by operating cash flow and its interest payments are adequately managed with EBIT coverage at 13.6x. Recent announcements include a share repurchase program worth up to CN¥300 million aimed at equity incentives or employee stock ownership plans, reflecting strategic capital management initiatives.

- Get an in-depth perspective on Zhejiang Hailide New MaterialLtd's performance by reading our balance sheet health report here.

- Evaluate Zhejiang Hailide New MaterialLtd's prospects by accessing our earnings growth report.

Jinlong Machinery & ElectronicLtd (SZSE:300032)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinlong Machinery & Electronic Co., Ltd engages in the research, production, and sale of motors both in China and internationally, with a market cap of CN¥4.05 billion.

Operations: Jinlong Machinery & Electronic Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.05B

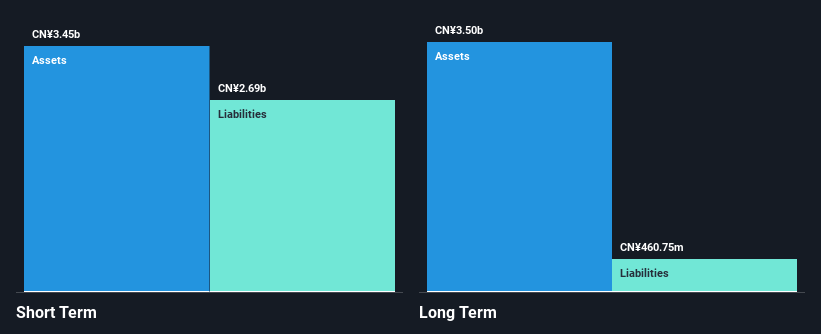

Jinlong Machinery & Electronic Co., Ltd, with a market cap of CN¥4.05 billion, is currently unprofitable and has seen its losses increase by 11.9% annually over the past five years. Despite this, the company maintains a stable cash runway exceeding one year and holds more cash than total debt, indicating financial resilience. Short-term assets surpass both short- and long-term liabilities, suggesting sound liquidity management. However, the management team is relatively inexperienced with an average tenure of 1.3 years. Recent events include an extraordinary shareholders meeting to discuss terminating external investments and negotiating land use rights return with government departments.

- Take a closer look at Jinlong Machinery & ElectronicLtd's potential here in our financial health report.

- Explore historical data to track Jinlong Machinery & ElectronicLtd's performance over time in our past results report.

Make It Happen

- Unlock our comprehensive list of 5,699 Global Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hailide New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002206

Zhejiang Hailide New MaterialLtd

Engages in the research, development, production, and sales of chemical fibers, other textile materials, and rubber and plastic products in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.