- China

- /

- Construction

- /

- SZSE:300029

After Leaping 26% Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd. (SZSE:300029) Shares Are Not Flying Under The Radar

Those holding Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd. (SZSE:300029) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

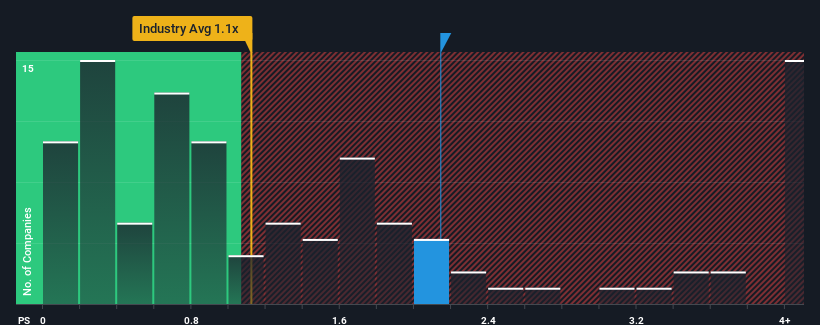

After such a large jump in price, you could be forgiven for thinking Jiangsu Huasheng Tianlong PhotoelectricLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in China's Construction industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Jiangsu Huasheng Tianlong PhotoelectricLtd

How Has Jiangsu Huasheng Tianlong PhotoelectricLtd Performed Recently?

With revenue growth that's exceedingly strong of late, Jiangsu Huasheng Tianlong PhotoelectricLtd has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Huasheng Tianlong PhotoelectricLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Jiangsu Huasheng Tianlong PhotoelectricLtd?

The only time you'd be truly comfortable seeing a P/S as high as Jiangsu Huasheng Tianlong PhotoelectricLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 52% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 166% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Jiangsu Huasheng Tianlong PhotoelectricLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Jiangsu Huasheng Tianlong PhotoelectricLtd's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Jiangsu Huasheng Tianlong PhotoelectricLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Jiangsu Huasheng Tianlong PhotoelectricLtd that you should be aware of.

If these risks are making you reconsider your opinion on Jiangsu Huasheng Tianlong PhotoelectricLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300029

Jiangsu Huasheng Tianlong PhotoelectricLtd

Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd.

Mediocre balance sheet minimal.

Market Insights

Community Narratives