- China

- /

- Construction

- /

- SZSE:300008

Bestway Marine & Energy Technology Co.,Ltd's (SZSE:300008) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

With its stock down 21% over the past three months, it is easy to disregard Bestway Marine & Energy TechnologyLtd (SZSE:300008). However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Bestway Marine & Energy TechnologyLtd's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Bestway Marine & Energy TechnologyLtd

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bestway Marine & Energy TechnologyLtd is:

4.5% = CN¥91m ÷ CN¥2.0b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.04 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Bestway Marine & Energy TechnologyLtd's Earnings Growth And 4.5% ROE

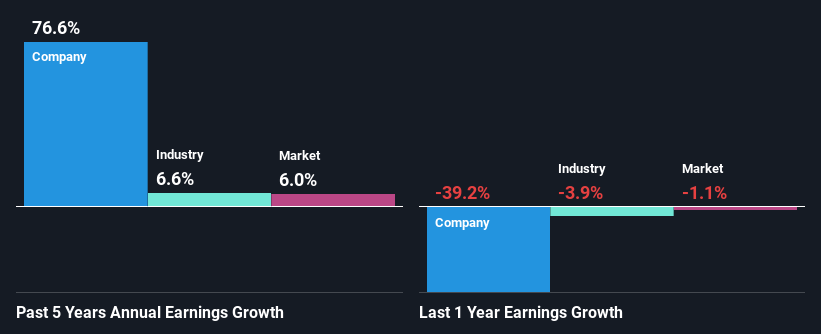

As you can see, Bestway Marine & Energy TechnologyLtd's ROE looks pretty weak. Even when compared to the industry average of 6.9%, the ROE figure is pretty disappointing. However, we we're pleasantly surprised to see that Bestway Marine & Energy TechnologyLtd grew its net income at a significant rate of 77% in the last five years. Therefore, there could be other reasons behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Bestway Marine & Energy TechnologyLtd's growth is quite high when compared to the industry average growth of 6.6% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Bestway Marine & Energy TechnologyLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Bestway Marine & Energy TechnologyLtd Efficiently Re-investing Its Profits?

Bestway Marine & Energy TechnologyLtd doesn't pay any regular dividends to its shareholders, meaning that the company has been reinvesting all of its profits into the business. This is likely what's driving the high earnings growth number discussed above.

Conclusion

In total, it does look like Bestway Marine & Energy TechnologyLtd has some positive aspects to its business. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 1 risk we have identified for Bestway Marine & Energy TechnologyLtd by visiting our risks dashboard for free on our platform here.

Valuation is complex, but we're here to simplify it.

Discover if Bestway Marine & Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300008

Bestway Marine & Energy TechnologyLtd

Provides marine and offshore engineering research and design services in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives