- China

- /

- Auto Components

- /

- SHSE:603596

Insider Favorites Bethel Automotive Safety Systems And Two Other Growth Leaders

Reviewed by Simply Wall St

As global markets navigate a period of volatility, with U.S. stocks experiencing fluctuations due to AI competition and mixed corporate earnings, investors are keenly observing companies with strong fundamentals and insider confidence. In this environment, growth companies like Bethel Automotive Safety Systems that exhibit high insider ownership can be particularly appealing, as such ownership often signals alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

We're going to check out a few of the best picks from our screener tool.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China with a market cap of CN¥30.50 billion.

Operations: The company's revenue primarily comes from the manufacturing and selling of automobile and related accessories, amounting to CN¥8.95 billion.

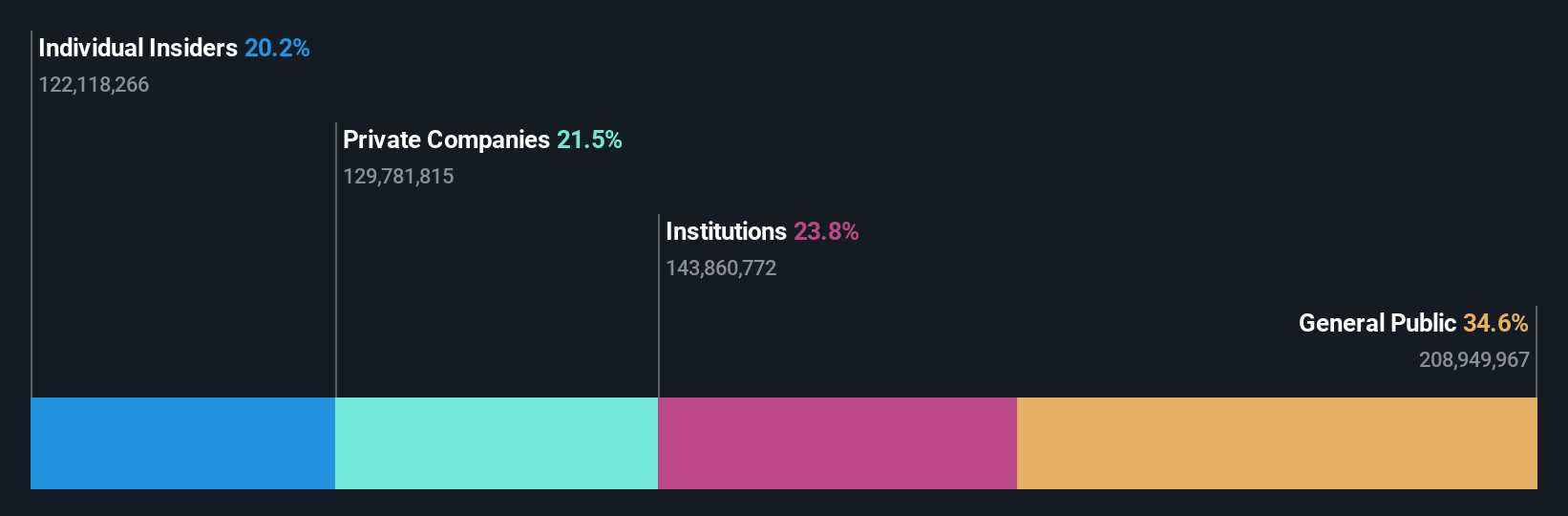

Insider Ownership: 20.1%

Earnings Growth Forecast: 25.3% p.a.

Bethel Automotive Safety Systems is trading at a significant discount, 67.8% below its estimated fair value, with earnings projected to grow 25.27% annually over the next three years, outpacing the broader Chinese market. Despite being removed from key indices like SSE 180, recent share buybacks totaling CNY 78.1 million indicate confidence in its prospects. However, forecasted return on equity remains modest at 19.4%, which might temper some growth expectations.

- Navigate through the intricacies of Bethel Automotive Safety Systems with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Bethel Automotive Safety Systems' current price could be quite moderate.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector with a market capitalization of CN¥24.26 billion.

Operations: Unfortunately, the provided text for revenue segments is incomplete or missing. Please provide the necessary details to summarize the company's revenue segments accurately.

Insider Ownership: 18.2%

Earnings Growth Forecast: 25% p.a.

Shenzhen Zhaowei Machinery & Electronics is poised for significant revenue growth, forecasted at 20.9% annually, outpacing the Chinese market's 13.3%. However, its earnings growth of 25% per year slightly lags behind the market average of 25.1%, and its return on equity is expected to be low at 9.2%. Recent amendments to company bylaws and participation in CES 2025 highlight active corporate governance and strategic engagement with global markets.

- Click to explore a detailed breakdown of our findings in Shenzhen Zhaowei Machinery & Electronics' earnings growth report.

- Our valuation report here indicates Shenzhen Zhaowei Machinery & Electronics may be overvalued.

Shin Zu Shing (TWSE:3376)

Simply Wall St Growth Rating: ★★★★★☆

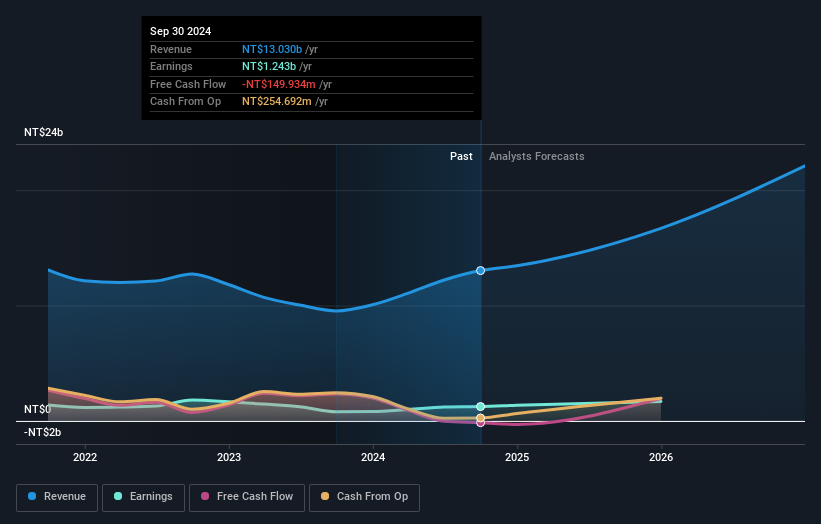

Overview: Shin Zu Shing Co., Ltd. is involved in the research, design, development, production, assembly, testing, manufacturing, and trading of precision springs and related components across Taiwan, Singapore, and China with a market cap of NT$46.39 billion.

Operations: The company's revenue segments include NT$12.49 billion from pivot products, NT$277.31 million from MIM products, and NT$116.96 million from milled car parts products.

Insider Ownership: 22.5%

Earnings Growth Forecast: 24.5% p.a.

Shin Zu Shing's earnings are forecast to grow 24.49% annually, surpassing the TW market's 17.5%, with revenue expected to increase at 20.9% per year. Despite high volatility in its share price recently, insider ownership remains substantial without significant selling or buying in the past three months. Recent adjustments in leasing agreements for business premises reflect strategic operational decisions, potentially impacting cost structures and financial planning positively over the lease term through December 2026.

- Click here and access our complete growth analysis report to understand the dynamics of Shin Zu Shing.

- In light of our recent valuation report, it seems possible that Shin Zu Shing is trading beyond its estimated value.

Next Steps

- Gain an insight into the universe of 1478 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bethel Automotive Safety Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603596

Bethel Automotive Safety Systems

Develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives