- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

3 Growth Companies With High Insider Ownership And Up To 117% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to recover from recent sell-offs, investors are increasingly optimistic about the potential for a "soft landing" in the U.S. economy. Growth stocks, particularly in the technology and consumer discretionary sectors, have outpaced value shares, driven by positive earnings reports and strong retail sales data. In this favorable market environment, identifying growth companies with high insider ownership can be particularly rewarding. High insider ownership often indicates that those closest to the company believe strongly in its future prospects, aligning their interests with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 26.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.6% | 82.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Top Glove Corporation Bhd (KLSE:TOPGLOV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Top Glove Corporation Bhd., with a market cap of MYR7.93 billion, is an investment holding company that manufactures, trades in, and sells gloves in Malaysia, Thailand, the People's Republic of China, and internationally.

Operations: The company generates MYR2.16 billion from its gloves manufacturing industry segment.

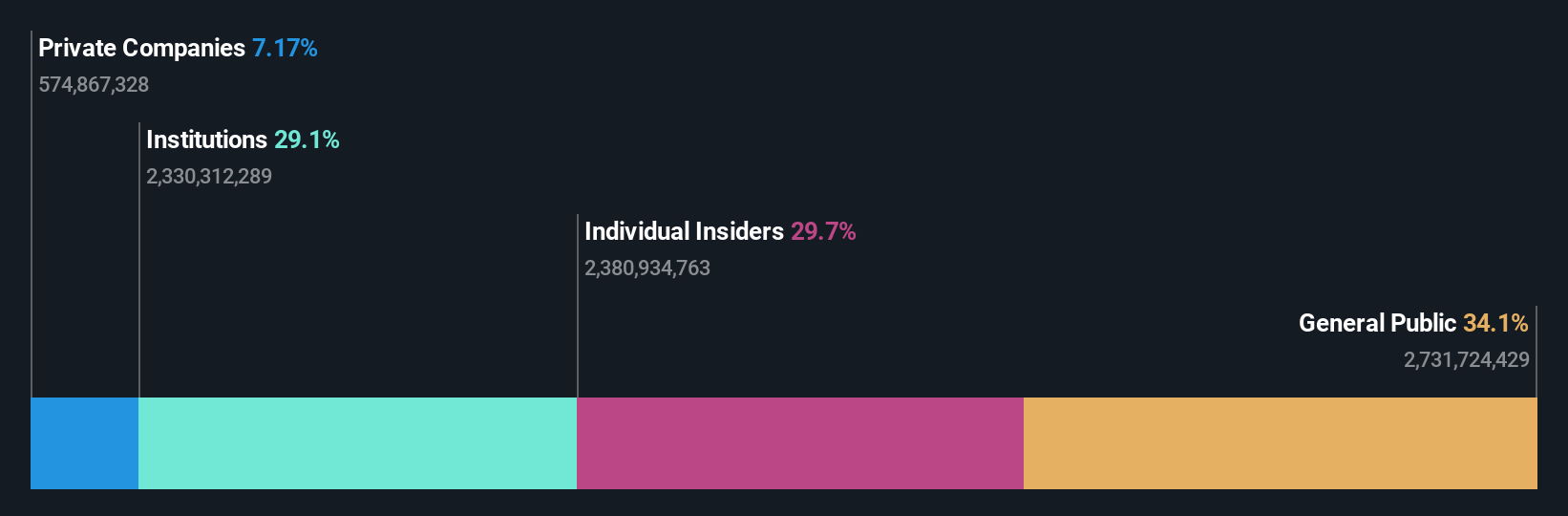

Insider Ownership: 29.9%

Earnings Growth Forecast: 117.5% p.a.

Top Glove Corporation Bhd. showcases significant growth potential with forecasted revenue growth of 34.9% per year, outpacing the Malaysian market's 6.2%. The company is expected to become profitable within three years, indicating strong future performance. Recent board changes include appointing Mr. Lee Ah Too and Ms. Gan Mei Mei to key committees, enhancing governance structures. Despite a net loss for nine months ending May 2024, the third quarter showed a turnaround with MYR 62.42 million in net income.

- Click here to discover the nuances of Top Glove Corporation Bhd with our detailed analytical future growth report.

- Our valuation report here indicates Top Glove Corporation Bhd may be undervalued.

iFAST (SGX:AIY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: iFAST Corporation Ltd. offers investment products and services across Singapore, Hong Kong, Malaysia, China, and the United Kingdom, with a market cap of SGD2.16 billion.

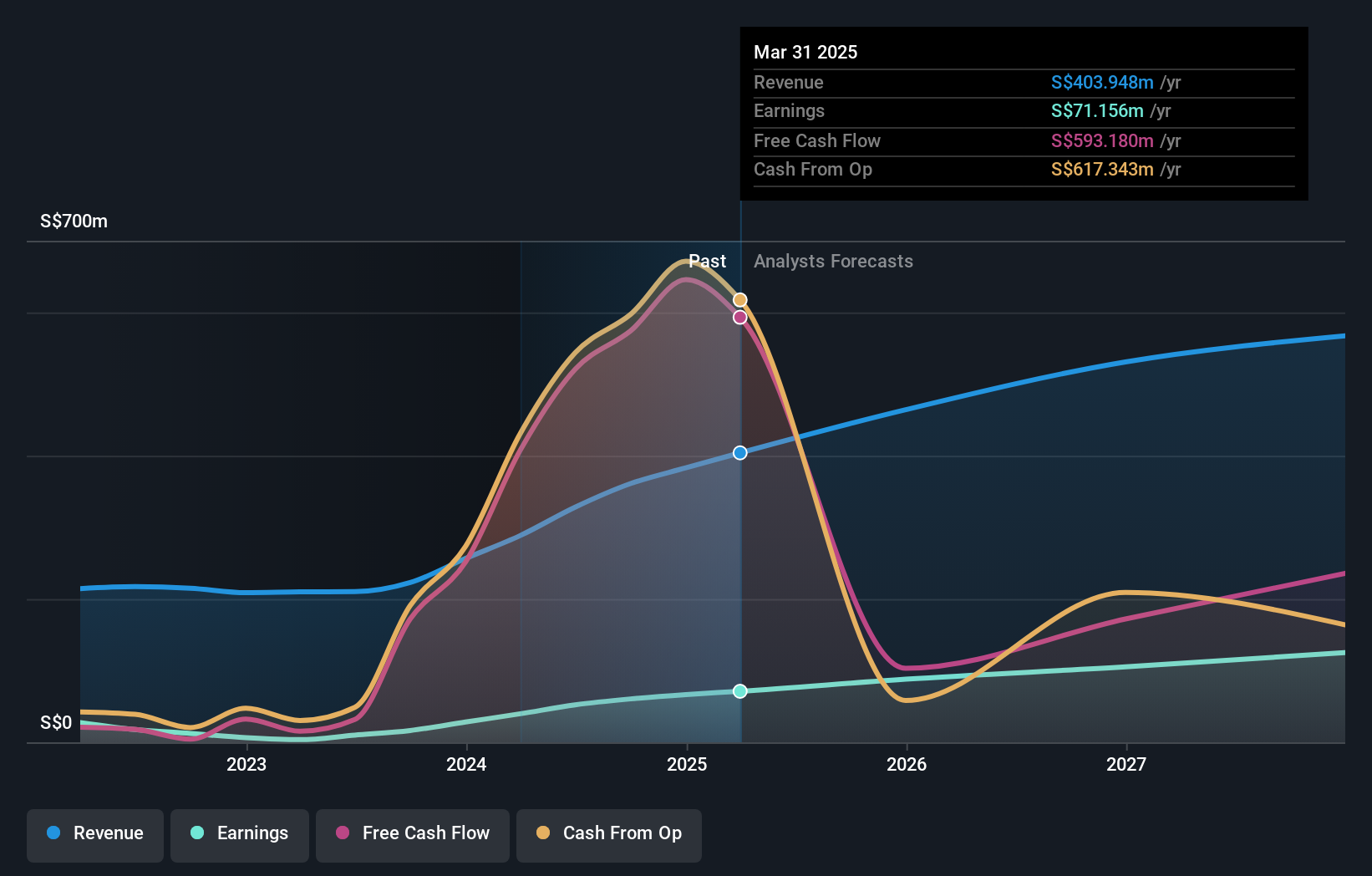

Operations: iFAST generates revenue through its investment products and services provided in Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

Insider Ownership: 28.7%

Earnings Growth Forecast: 28.3% p.a.

iFAST Corporation Ltd. demonstrates strong growth potential with substantial insider ownership, reporting significant revenue and net income increases for Q2 2024. Revenue rose to S$93.75 million from S$54.21 million a year ago, while net income surged to S$16.03 million from S$3.59 million. The company also completed a fixed-income offering of S$100 million and announced an interim dividend of 1.50 cents per share, reflecting robust financial health and shareholder commitment.

- Take a closer look at iFAST's potential here in our earnings growth report.

- Our valuation report unveils the possibility iFAST's shares may be trading at a premium.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. (SZSE:003021) specializes in the production of precision transmission systems and has a market cap of CN¥10.16 billion.

Operations: Shenzhen Zhaowei Machinery & Electronics generates revenue primarily from the production of precision transmission systems.

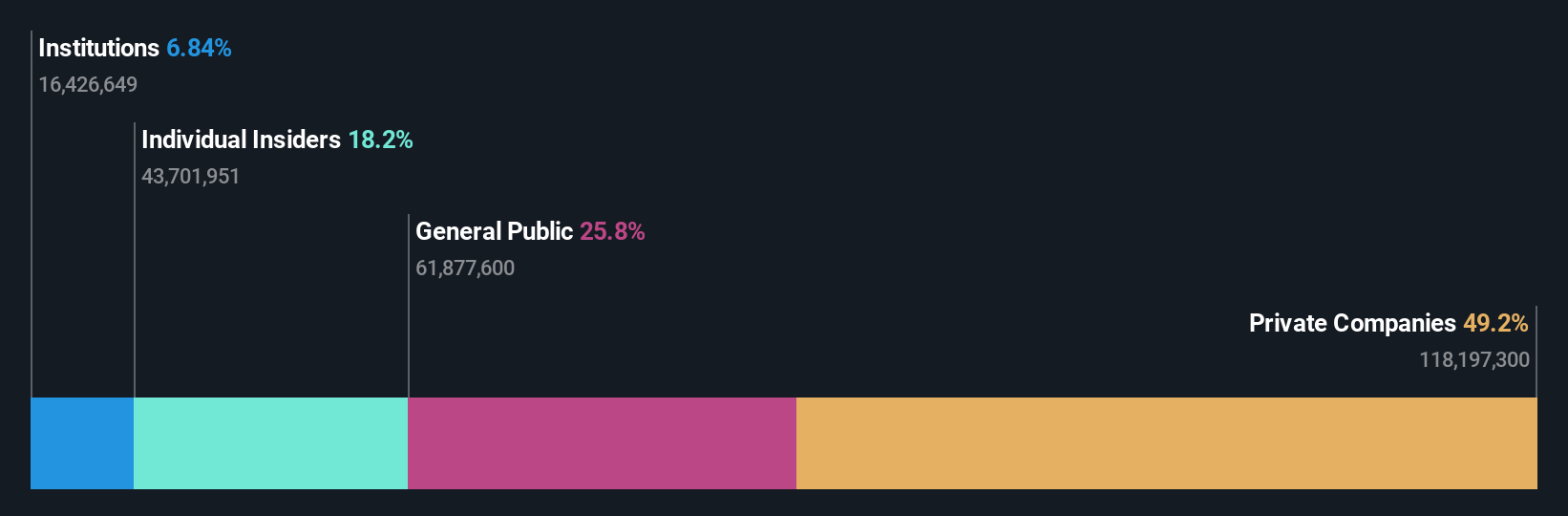

Insider Ownership: 18.3%

Earnings Growth Forecast: 25.1% p.a.

Shenzhen Zhaowei Machinery & Electronics exhibits strong growth prospects with high insider ownership, as its earnings are forecast to grow 25.1% annually, outpacing the CN market's 21.9%. Revenue is also expected to rise by 24.3% per year, surpassing the market average of 13.4%. Despite a low forecasted Return on Equity of 9.9%, recent earnings grew by 32.7%. The upcoming shareholders meeting will address changes in registered capital and amendments to the articles of association.

- Navigate through the intricacies of Shenzhen Zhaowei Machinery & Electronics with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Shenzhen Zhaowei Machinery & Electronics implies its share price may be too high.

Turning Ideas Into Actions

- Explore the 1498 names from our Fast Growing Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Top Glove Corporation Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives