- China

- /

- Construction

- /

- SZSE:003001

Zhongyan Technology Co., Ltd.'s (SZSE:003001) 30% Jump Shows Its Popularity With Investors

Despite an already strong run, Zhongyan Technology Co., Ltd. (SZSE:003001) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 196% in the last year.

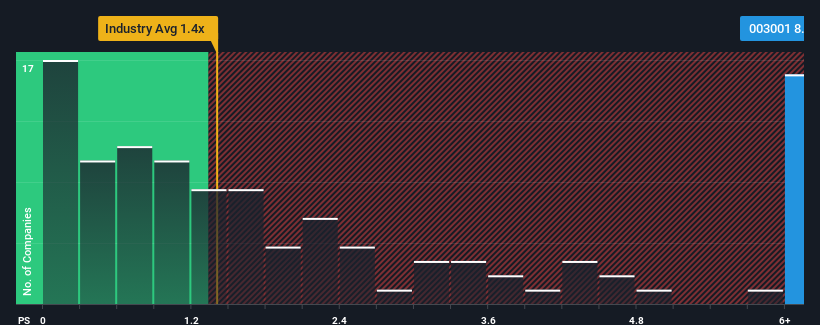

Following the firm bounce in price, when almost half of the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Zhongyan Technology as a stock not worth researching with its 8.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Zhongyan Technology

How Zhongyan Technology Has Been Performing

Recent times haven't been great for Zhongyan Technology as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Zhongyan Technology will help you uncover what's on the horizon.How Is Zhongyan Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Zhongyan Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. As a result, revenue from three years ago have also fallen 41% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 54% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Zhongyan Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Zhongyan Technology's P/S Mean For Investors?

Zhongyan Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Zhongyan Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for Zhongyan Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhongyan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003001

Zhongyan Technology

Operates as a geotechnical technology company in China.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives