Earnings Tell The Story For Rayhoo Motor Dies Co.,Ltd. (SZSE:002997) As Its Stock Soars 28%

Those holding Rayhoo Motor Dies Co.,Ltd. (SZSE:002997) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.7% over the last year.

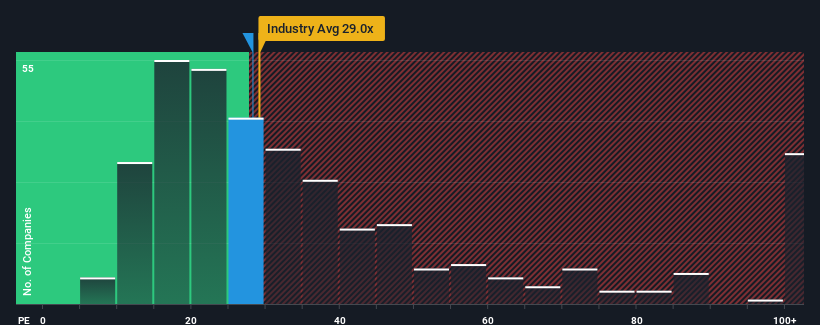

Although its price has surged higher, you could still be forgiven for feeling indifferent about Rayhoo Motor DiesLtd's P/E ratio of 28.2x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Rayhoo Motor DiesLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Rayhoo Motor DiesLtd

Does Growth Match The P/E?

In order to justify its P/E ratio, Rayhoo Motor DiesLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 40% gain to the company's bottom line. The latest three year period has also seen a 6.9% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 39% over the next year. With the market predicted to deliver 41% growth , the company is positioned for a comparable earnings result.

In light of this, it's understandable that Rayhoo Motor DiesLtd's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Rayhoo Motor DiesLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Rayhoo Motor DiesLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Rayhoo Motor DiesLtd has 3 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of Rayhoo Motor DiesLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002997

Rayhoo Motor DiesLtd

Designs, develops, manufactures, and sells stamping dies and auto welding lines in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives