Asian Stocks That May Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, Asian stock markets are drawing attention with their unique set of challenges and opportunities. In this environment, identifying stocks that may be trading below their estimated fair value can offer potential for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lingbao Gold Group (SEHK:3330) | HK$9.09 | HK$18.05 | 49.6% |

| Renesas Electronics (TSE:6723) | ¥1733.00 | ¥3424.35 | 49.4% |

| Lucky Harvest (SZSE:002965) | CN¥55.10 | CN¥108.00 | 49% |

| Rakus (TSE:3923) | ¥2184.00 | ¥4319.36 | 49.4% |

| Suzhou Dongshan Precision Manufacturing (SZSE:002384) | CN¥27.30 | CN¥53.34 | 48.8% |

| World Fitness Services (TWSE:2762) | NT$81.30 | NT$162.29 | 49.9% |

| Seegene (KOSDAQ:A096530) | ₩26550.00 | ₩52687.75 | 49.6% |

| giftee (TSE:4449) | ¥1536.00 | ¥3045.88 | 49.6% |

| Innovent Biologics (SEHK:1801) | HK$54.30 | HK$108.54 | 50% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥101.60 | CN¥199.10 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

Chinasoft International (SEHK:354)

Overview: Chinasoft International Limited, with a market cap of HK$13.37 billion, operates in the development and provision of IT solutions, IT outsourcing, and training services across several countries including China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Operations: The company's revenue primarily comes from its Technology Professional Services Group, generating CN¥14.77 billion, and its Internet Information Technology Services Group, contributing CN¥2.18 billion.

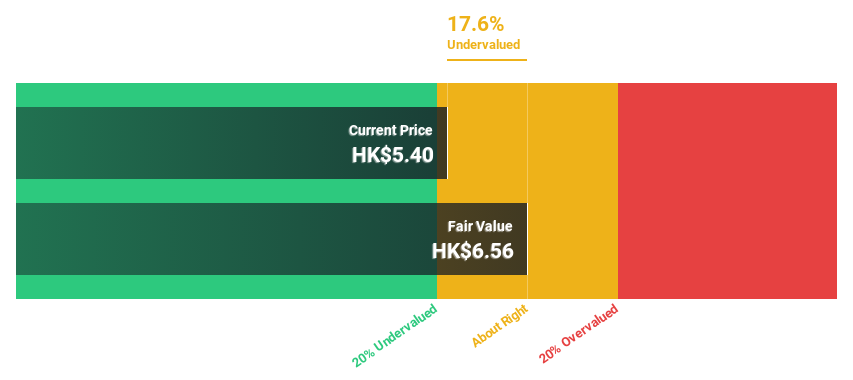

Estimated Discount To Fair Value: 17.3%

Chinasoft International, trading at HK$5.37, is undervalued compared to its estimated fair value of HK$6.50 based on discounted cash flows. Despite recent earnings declines, the company's strategic partnerships and technological advancements in smart transportation and robotics position it for growth. Earnings are forecasted to grow at 22.8% annually, outpacing the Hong Kong market's average growth rate of 10.7%. However, with a low return on equity forecasted at 7.7%, investors should weigh potential risks against growth prospects.

- Our expertly prepared growth report on Chinasoft International implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Chinasoft International with our comprehensive financial health report here.

Nanjing LES Information Technology (SHSE:688631)

Overview: Nanjing LES Information Technology Co., Ltd. operates in the technology sector and has a market cap of approximately CN¥13.41 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Nanjing LES Information Technology Co., Ltd.

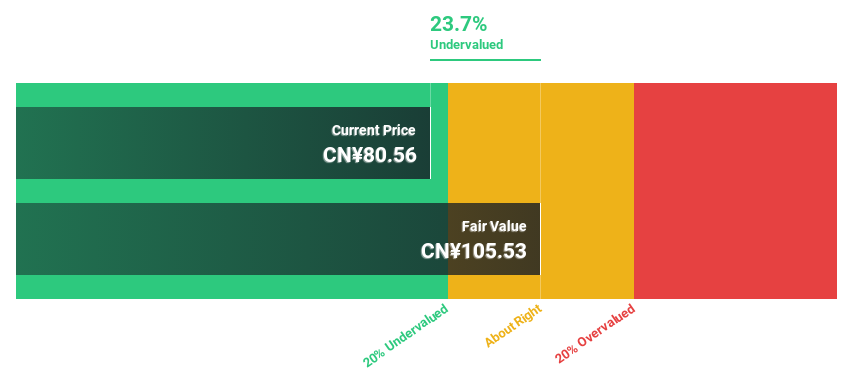

Estimated Discount To Fair Value: 22.5%

Nanjing LES Information Technology, trading at CNY 82.06, is significantly undervalued based on its estimated fair value of CNY 105.91 using discounted cash flow analysis. Despite a volatile share price and recent earnings decline, the company is poised for substantial growth with forecasted annual profit increases of 28.1%, surpassing the Chinese market average of 24%. However, investors should consider its low projected return on equity of 11.5% in three years.

- Upon reviewing our latest growth report, Nanjing LES Information Technology's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Nanjing LES Information Technology's balance sheet health report.

Lucky Harvest (SZSE:002965)

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts with a market cap of CN¥11.25 billion.

Operations: Lucky Harvest Co., Ltd. generates its revenue through the development and sale of precision stamping dies and structural metal components within China.

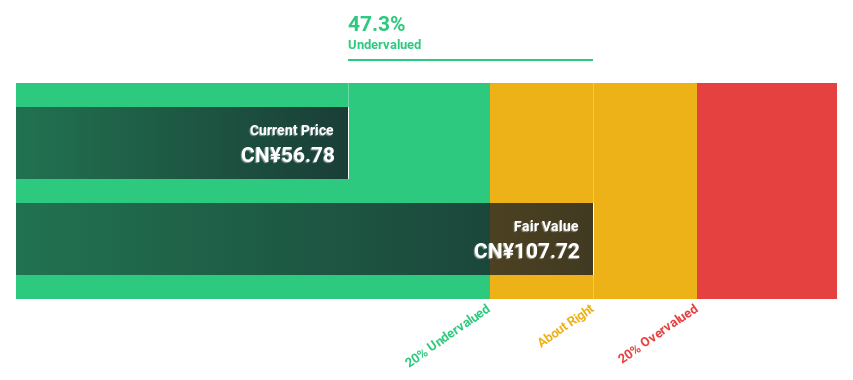

Estimated Discount To Fair Value: 49%

Lucky Harvest, trading at CN¥55.1, is significantly undervalued with an estimated fair value of CN¥108. Despite a volatile share price and recent declines in net income from CN¥121.24 million to CN¥85.9 million for Q1 2025, earnings are forecasted to grow by 27% annually, outpacing the Chinese market's average growth rate of 24%. However, investors should be cautious about its unstable dividend track record and projected low return on equity of 12.6% in three years.

- Insights from our recent growth report point to a promising forecast for Lucky Harvest's business outlook.

- Dive into the specifics of Lucky Harvest here with our thorough financial health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 268 more companies for you to explore.Click here to unveil our expertly curated list of 271 Undervalued Asian Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:354

Chinasoft International

Engages in development and provision of information technology (IT) solutions, IT outsourcing, and training services in the People’s Republic of China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives