- China

- /

- Trade Distributors

- /

- SZSE:002962

Hubei W-olf Photoelectric Technology Co., Ltd.'s (SZSE:002962) 31% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Hubei W-olf Photoelectric Technology Co., Ltd. (SZSE:002962) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

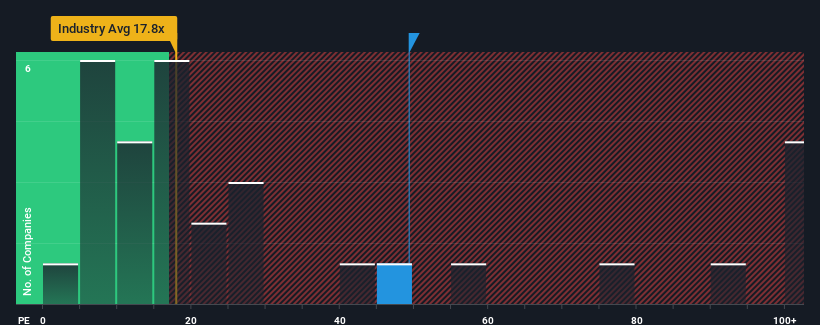

Although its price has dipped substantially, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Hubei W-olf Photoelectric Technology as a stock to avoid entirely with its 49.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Hubei W-olf Photoelectric Technology's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hubei W-olf Photoelectric Technology

Is There Enough Growth For Hubei W-olf Photoelectric Technology?

The only time you'd be truly comfortable seeing a P/E as steep as Hubei W-olf Photoelectric Technology's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 52% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Hubei W-olf Photoelectric Technology is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Hubei W-olf Photoelectric Technology's P/E

Even after such a strong price drop, Hubei W-olf Photoelectric Technology's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hubei W-olf Photoelectric Technology revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Hubei W-olf Photoelectric Technology (1 is potentially serious!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Hubei W-olf Photoelectric Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hubei W-olf Photoelectric Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002962

Hubei W-olf Photoelectric Technology

Hubei W-olf Photoelectric Technology Co., Ltd.

Excellent balance sheet with proven track record.