- China

- /

- Entertainment

- /

- SZSE:300860

Undiscovered Gems Three Stocks with Strong Fundamentals for January 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to the year, small-cap stocks have struggled, with the Russell 2000 Index slipping into correction territory amid inflation concerns and political uncertainty. In this challenging environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 23.14% | -3.64% | 30.64% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Xinjiang Communications Construction Group (SZSE:002941)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xinjiang Communications Construction Group Co., Ltd. is involved in infrastructure construction and engineering services, with a market cap of CN¥6.83 billion.

Operations: Xinjiang Communications Construction Group generates revenue primarily from infrastructure construction and engineering services. The company's financial performance shows a focus on optimizing costs to enhance profitability. It is important to note the trends in their net profit margin, which provides insights into their operational efficiency over time.

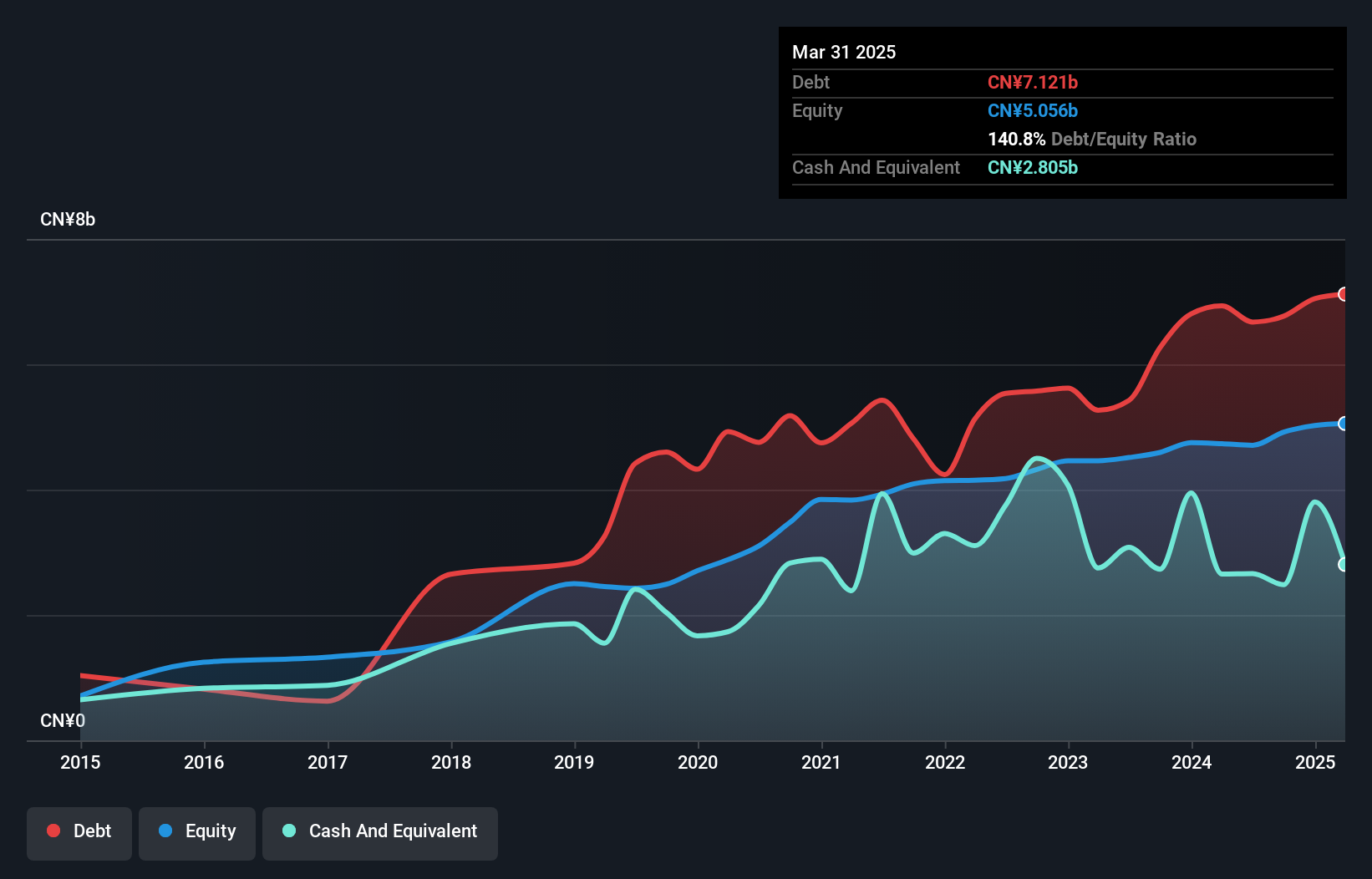

Xinjiang Communications Construction Group, a notable player in its field, has shown some intriguing financial dynamics. With a price-to-earnings ratio of 23.2x, it stands below the broader CN market average of 34.2x, indicating potential undervaluation. Despite a reduction in debt to equity from 184.8% to 137.6% over five years, the net debt to equity remains high at 87.1%. Recent earnings reveal sales of CNY 4.15 billion for nine months ending September 2024, down from CNY 5.43 billion year-on-year with net income slipping slightly to CNY 181 million compared to CNY 214 million previously.

Toread Holdings Group (SZSE:300005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toread Holdings Group Co., Ltd. focuses on the research, development, operation, and sales of outdoor products in China with a market cap of CN¥5.65 billion.

Operations: Toread Holdings generates revenue primarily from the sale of outdoor products in China. The company's financial performance includes a notable net profit margin trend, which has shown variability over recent periods.

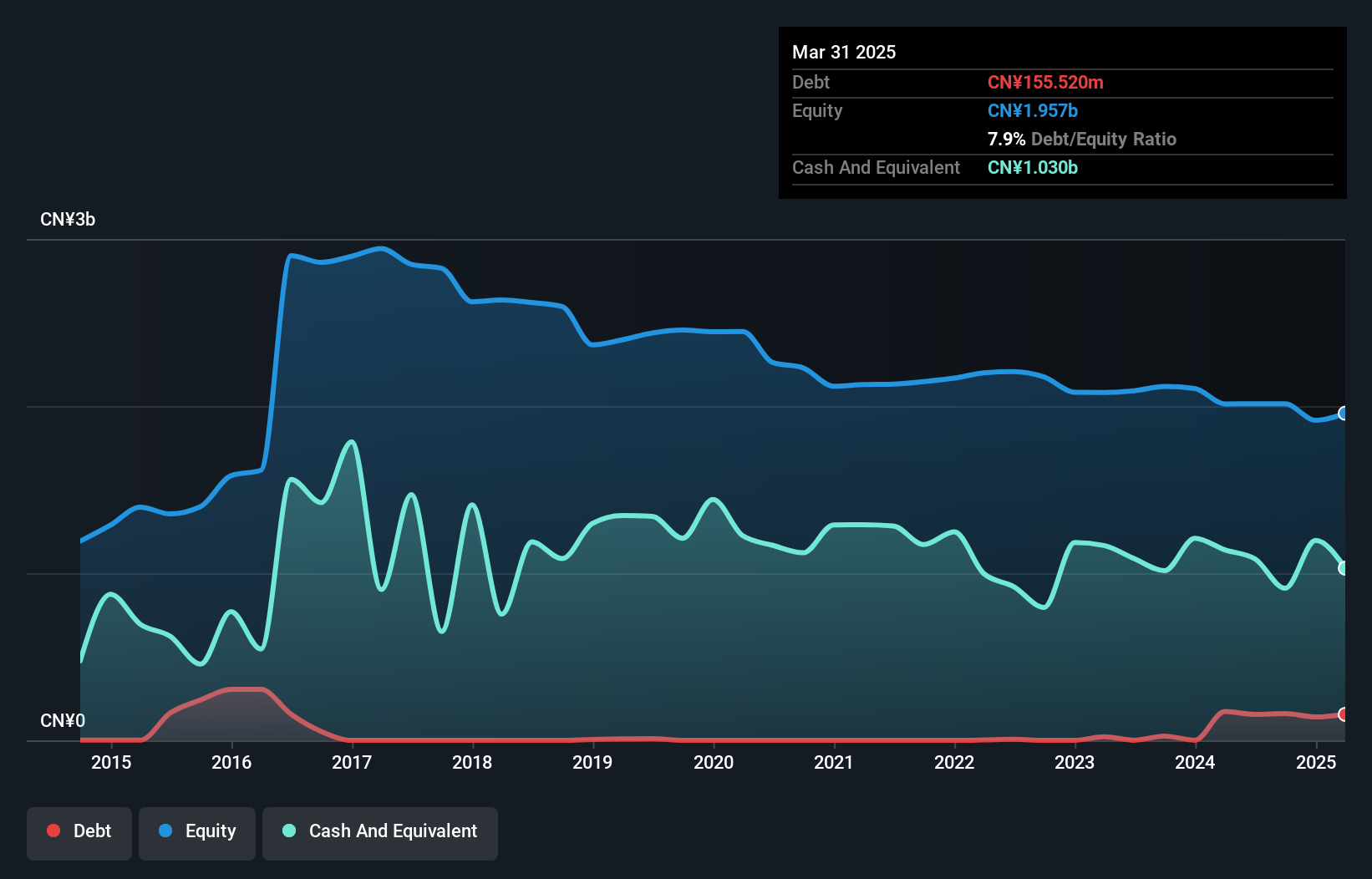

Toread Holdings Group, a smaller player in the leisure industry, has shown impressive performance with earnings growth of 21.8% over the past year, outpacing the industry's -0.7%. The company reported sales of CN¥1.11 billion for the nine months ending September 2024, up from CN¥930 million previously. Net income also improved to CN¥101.75 million compared to CN¥46.08 million last year. Despite a rise in its debt-to-equity ratio to 7.9% over five years, Toread's interest coverage and cash runway are not concerns due to its profitability and free cash flow positivity.

- Navigate through the intricacies of Toread Holdings Group with our comprehensive health report here.

Funshine Culture GroupLtd (SZSE:300860)

Simply Wall St Value Rating: ★★★★★★

Overview: Funshine Culture Group Co., Ltd. operates in the cultural performing events, cultural tourism, and public artistic lighting sectors in China with a market cap of CN¥5.07 billion.

Operations: Funshine Culture Group generates revenue primarily from cultural performing events, cultural tourism, and public artistic lighting. The company's financial performance is reflected in its market capitalization of CN¥5.07 billion.

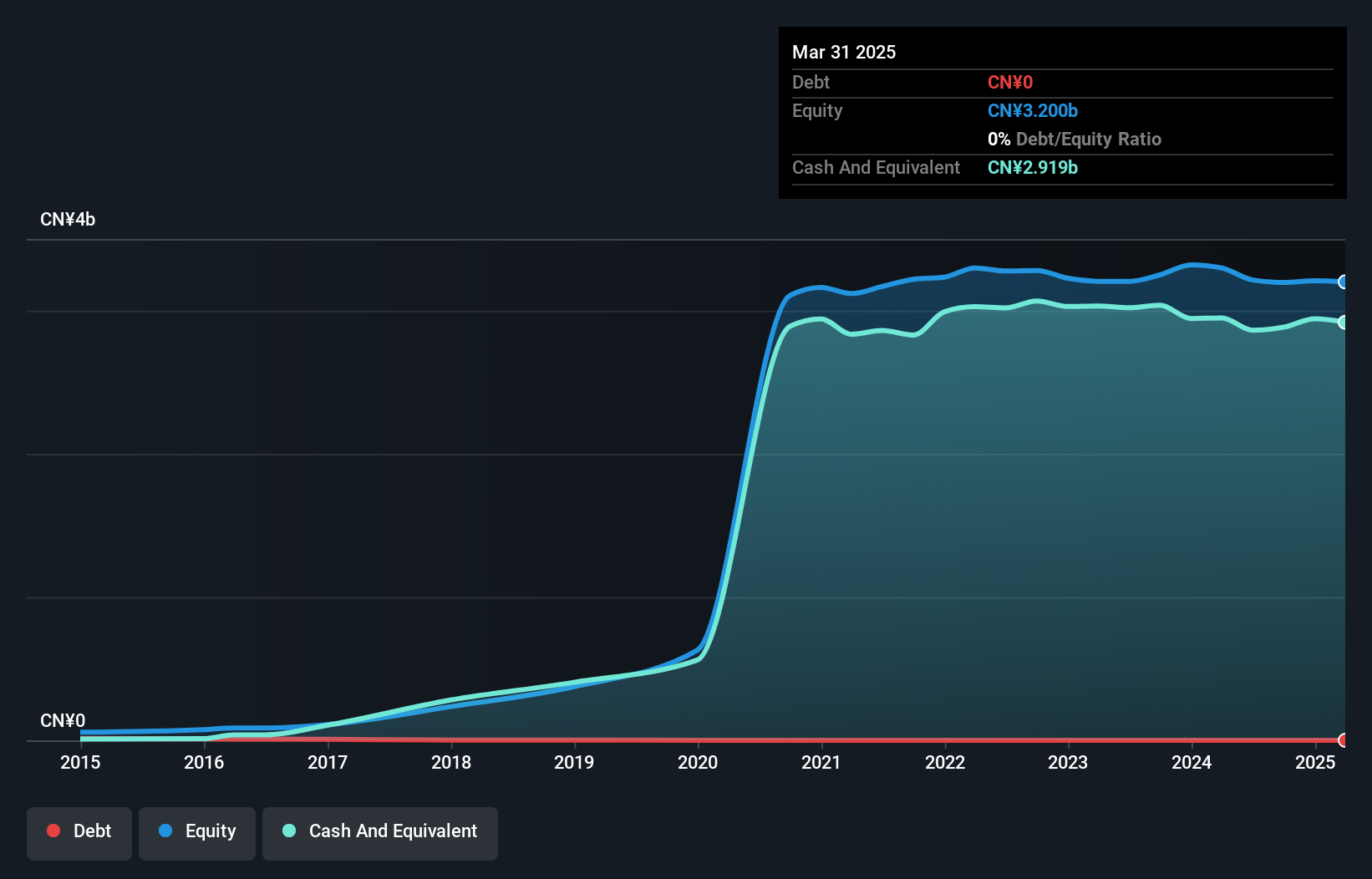

Funshine Culture Group, a small player in the entertainment sector, has seen its earnings grow by an impressive 296.8% over the past year, far outpacing the industry average of -16.1%. Despite this growth, recent financial results show a mixed picture with net income dropping to CNY 22.04 million from CNY 58.65 million compared to last year for the nine months ending September 2024. The company is debt-free now, contrasting with a debt-to-equity ratio of 0.08% five years ago, which likely supports its high-quality earnings and profitability outlook despite share price volatility recently observed over three months.

- Dive into the specifics of Funshine Culture GroupLtd here with our thorough health report.

Gain insights into Funshine Culture GroupLtd's past trends and performance with our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4631 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300860

Funshine Culture GroupLtd

Engages in cultural performing events, cultural tourism, and public artistic lighting business in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives