- China

- /

- Construction

- /

- SZSE:002941

Improved Earnings Required Before Xinjiang Communications Construction Group Co., Ltd. (SZSE:002941) Shares Find Their Feet

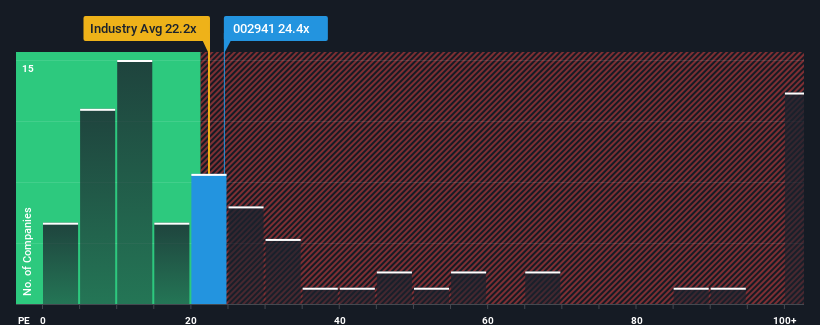

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may consider Xinjiang Communications Construction Group Co., Ltd. (SZSE:002941) as an attractive investment with its 24.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Xinjiang Communications Construction Group's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Xinjiang Communications Construction Group

How Is Xinjiang Communications Construction Group's Growth Trending?

Xinjiang Communications Construction Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 45% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Xinjiang Communications Construction Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Xinjiang Communications Construction Group's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Xinjiang Communications Construction Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Xinjiang Communications Construction Group (including 1 which is a bit unpleasant).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002941

Xinjiang Communications Construction Group

Xinjiang Communications Construction Group Co., Ltd.

Adequate balance sheet low.

Market Insights

Community Narratives