- China

- /

- Semiconductors

- /

- SHSE:688082

Global Stock Picks: 3 Companies Trading Below Estimated Value

Reviewed by Simply Wall St

Amidst a backdrop of declining consumer confidence and growth concerns, global markets have shown mixed performance, with U.S. indices experiencing varied results and European stocks posting gains despite uncertainties. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential value amid broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13940.00 | ₩27453.47 | 49.2% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥174.40 | CN¥348.61 | 50% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €54.05 | €107.22 | 49.6% |

| Cambi (OB:CAMBI) | NOK18.80 | NOK37.37 | 49.7% |

| OPT Machine Vision Tech (SHSE:688686) | CN¥103.65 | CN¥205.04 | 49.4% |

| Food & Life Companies (TSE:3563) | ¥4201.00 | ¥8333.87 | 49.6% |

| Star7 (BIT:STAR7) | €6.25 | €12.31 | 49.2% |

| Vinte Viviendas Integrales. de (BMV:VINTE *) | MX$32.50 | MX$64.06 | 49.3% |

| Bactiguard Holding (OM:BACTI B) | SEK35.30 | SEK69.48 | 49.2% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15980.00 | ₩31709.21 | 49.6% |

We'll examine a selection from our screener results.

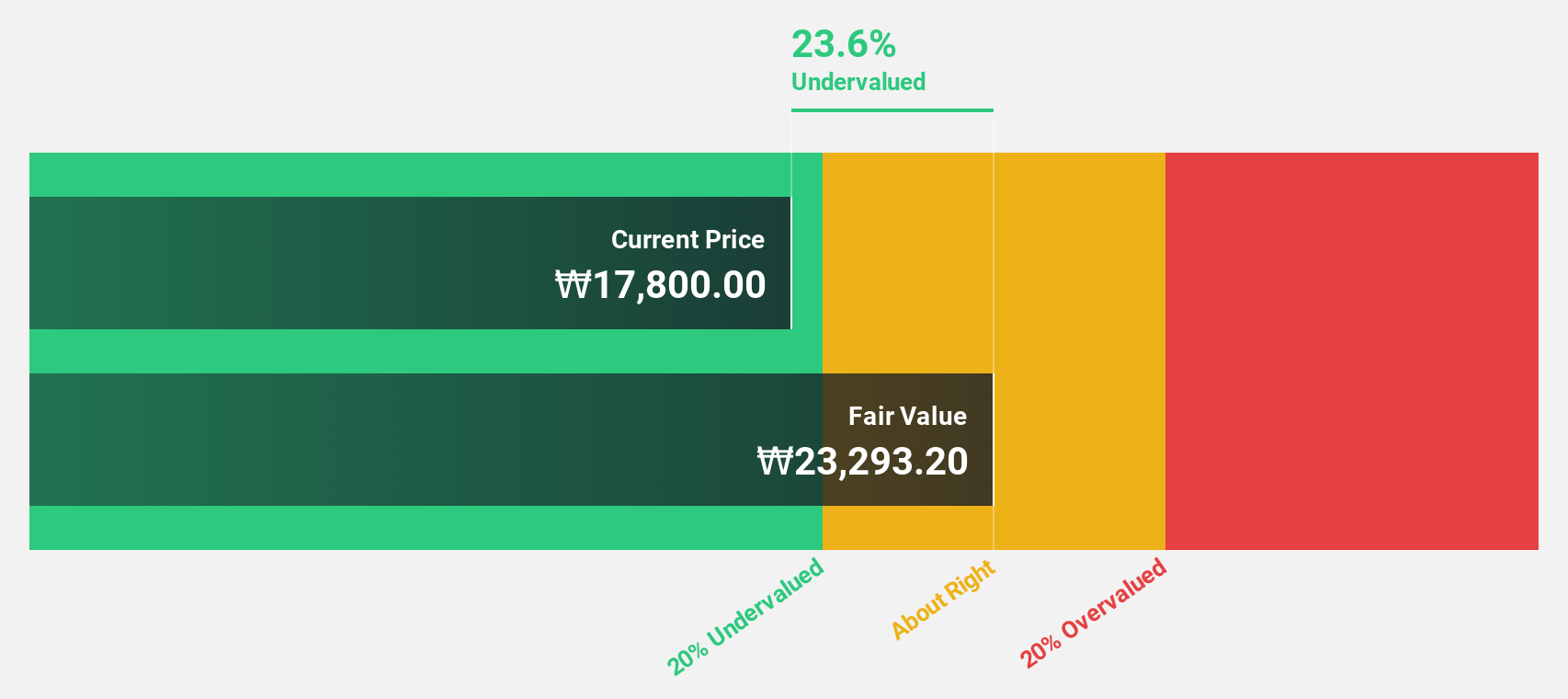

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy and infrastructure sectors with a market cap of ₩12.76 trillion.

Operations: The company's revenue segments include ₩857.58 million from construction and ₩8.97 billion from Joseon Maritime.

Estimated Discount To Fair Value: 27.1%

Samsung Heavy Industries is trading at ₩14,840, approximately 27.1% below its estimated fair value of ₩20,351.65. Over the past five years, earnings have grown significantly at 36.8% annually and are forecast to grow by 61.97% per year moving forward. The company is expected to become profitable within three years with revenue growth projected at 9.1% annually, surpassing the Korean market's average growth rate of 8.9%.

- In light of our recent growth report, it seems possible that Samsung Heavy Industries' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Samsung Heavy Industries' balance sheet health report.

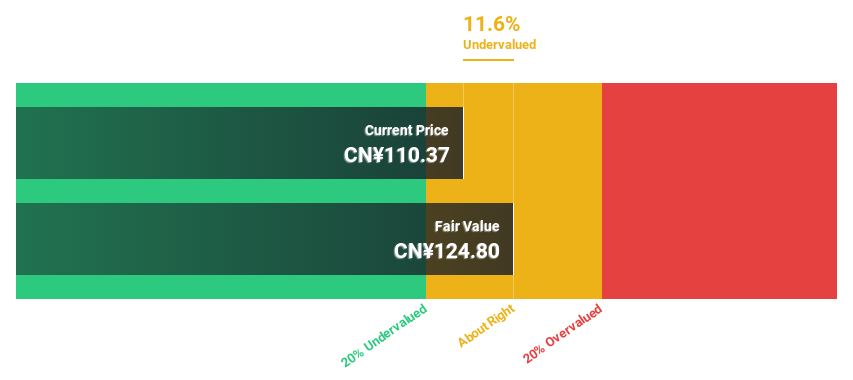

ACM Research (Shanghai) (SHSE:688082)

Overview: ACM Research (Shanghai), Inc. focuses on the research, development, production, and sale of semiconductor equipment both in China and internationally with a market cap of CN¥48.99 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated CN¥5.62 billion.

Estimated Discount To Fair Value: 11.4%

ACM Research (Shanghai) is trading at CN¥110.37, around 11.4% below its estimated fair value of CN¥124.52. The company reported a revenue increase to CN¥5.62 billion for 2024 from CN¥3.89 billion the previous year, with net income rising to CN¥1.15 billion from CN¥910 million. Earnings are expected to grow significantly at 24.67% annually over the next three years, outpacing the Chinese market's average revenue growth rate of 13.3%.

- According our earnings growth report, there's an indication that ACM Research (Shanghai) might be ready to expand.

- Take a closer look at ACM Research (Shanghai)'s balance sheet health here in our report.

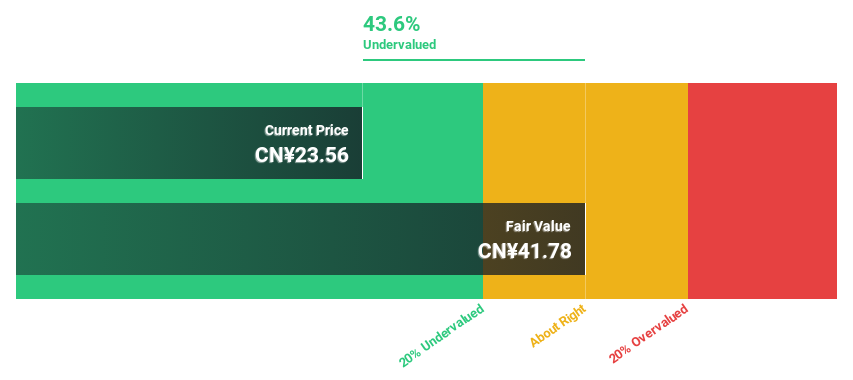

Shenzhen Megmeet Electrical (SZSE:002851)

Overview: Shenzhen Megmeet Electrical Co., LTD specializes in the R&D, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥29.59 billion.

Operations: Shenzhen Megmeet Electrical Co., LTD generates revenue through its focus on electrical automation solutions, encompassing hardware, software, and system services in China.

Estimated Discount To Fair Value: 15.2%

Shenzhen Megmeet Electrical is trading at CN¥57.82, below its fair value estimate of CN¥68.19. Despite a volatile share price recently, the company shows promising growth prospects with earnings expected to increase significantly by 30.7% annually over the next three years, surpassing the Chinese market's average of 25.5%. Revenue is also forecasted to grow robustly at 23.9% per year, outpacing the broader market growth rate of 13.3%.

- Our expertly prepared growth report on Shenzhen Megmeet Electrical implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Shenzhen Megmeet Electrical with our comprehensive financial health report here.

Turning Ideas Into Actions

- Explore the 498 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688082

ACM Research (Shanghai)

Engages in the research, development, production, and sale of semiconductor equipment in China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives