- China

- /

- Electronic Equipment and Components

- /

- SZSE:002869

3 Elite Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the technology sector, global markets have been influenced by strategic moves such as the ECB's rate cuts and the Fed's decision to hold steady. Despite these fluctuations, investors continue to seek growth companies with significant insider ownership, as this often indicates strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here we highlight a subset of our preferred stocks from the screener.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company that develops, manufactures, and commercializes vaccines in the People's Republic of China with a market cap of HK$10.89 billion.

Operations: The company generates revenue from the research and development of vaccine products for human use, amounting to CN¥748.53 million.

Insider Ownership: 28.9%

Earnings Growth Forecast: 128.6% p.a.

CanSino Biologics is positioned as a growth company with high insider ownership, evidenced by substantial insider buying in recent months. The company's forecasted revenue growth of 30.3% annually surpasses market averages, driven by strategic advancements in its vaccine portfolio, including the exclusive Menhycia® and new drug approvals like MCV4 in Indonesia. Despite expected net losses for 2024, CanSino's focus on commercialization and international expansion supports its potential for long-term growth.

- Unlock comprehensive insights into our analysis of CanSino Biologics stock in this growth report.

- Our comprehensive valuation report raises the possibility that CanSino Biologics is priced lower than what may be justified by its financials.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

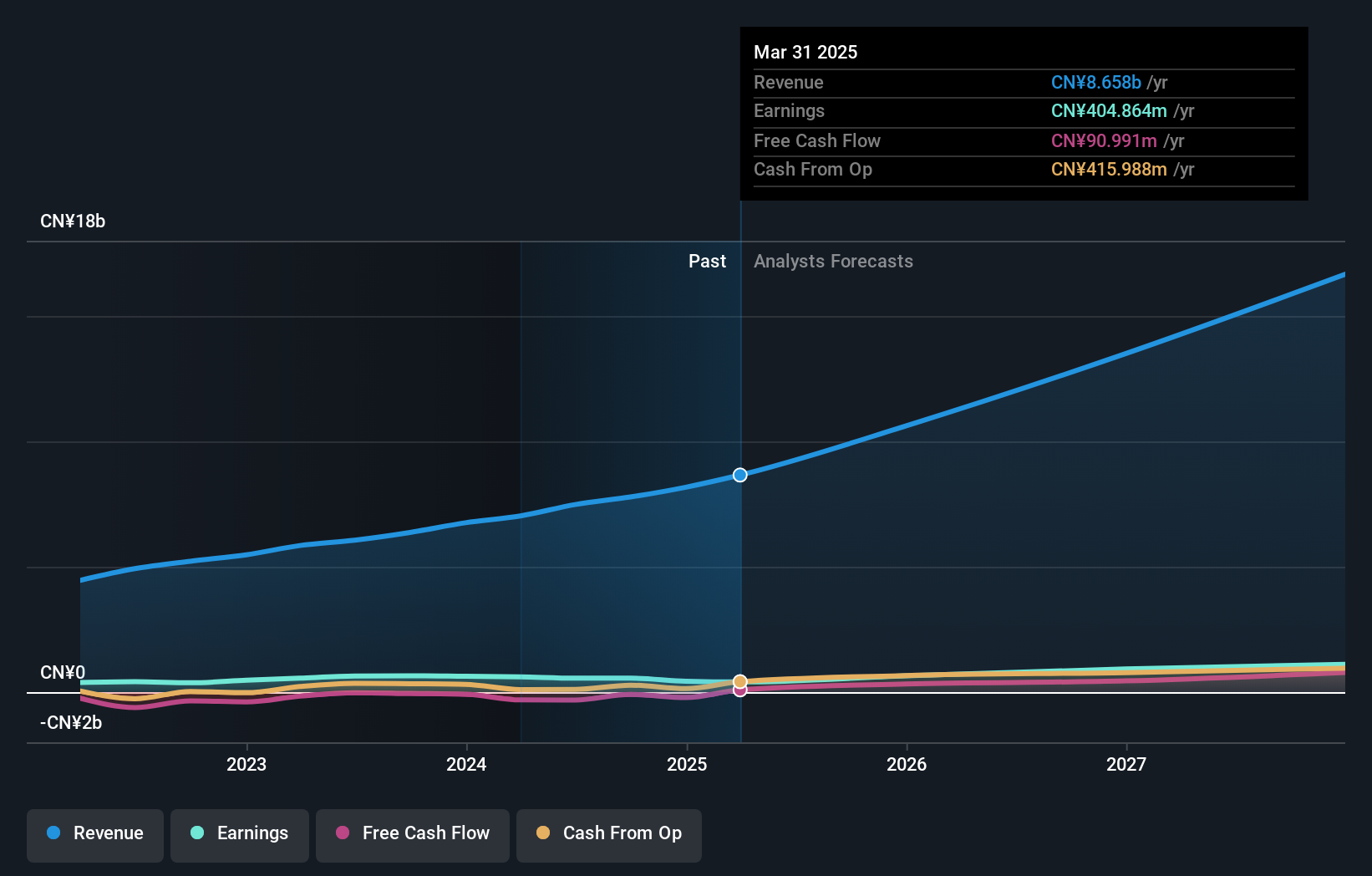

Overview: Shenzhen Megmeet Electrical Co., LTD is involved in the R&D, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥34.09 billion.

Operations: The company's revenue segments include the development and provision of hardware, software, and system solutions focused on electrical automation within China.

Insider Ownership: 33.3%

Earnings Growth Forecast: 29.9% p.a.

Shenzhen Megmeet Electrical demonstrates strong growth potential with earnings forecasted to grow 29.9% annually, outpacing the Chinese market average. Revenue is also expected to rise significantly at 22.9% per year, surpassing market trends. Despite recent volatility in its share price and no substantial insider trading activity in the past three months, the company's strategic initiatives include a completed buyback of 852,300 shares for ¥20.01 million and upcoming shareholder meetings to discuss capital changes.

- Click here to discover the nuances of Shenzhen Megmeet Electrical with our detailed analytical future growth report.

- Our valuation report unveils the possibility Shenzhen Megmeet Electrical's shares may be trading at a premium.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Growth Rating: ★★★★★☆

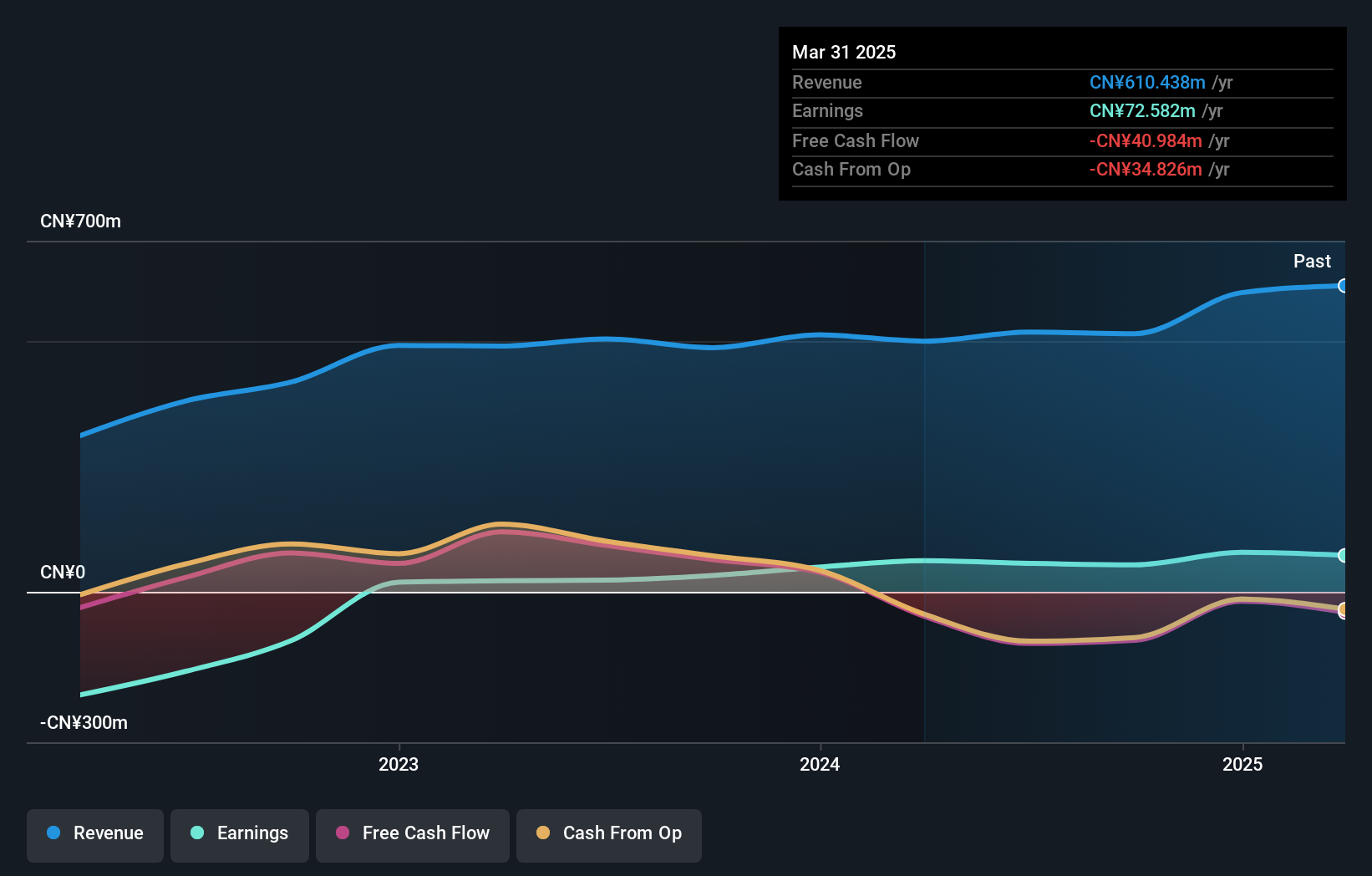

Overview: Shenzhen Genvict Technologies Co., Ltd. focuses on the research, development, and industrialization of smart transportation technology in China, with a market cap of CN¥4.48 billion.

Operations: The company's revenue primarily comes from the Intelligent Traffic Industry, amounting to CN¥514.77 million.

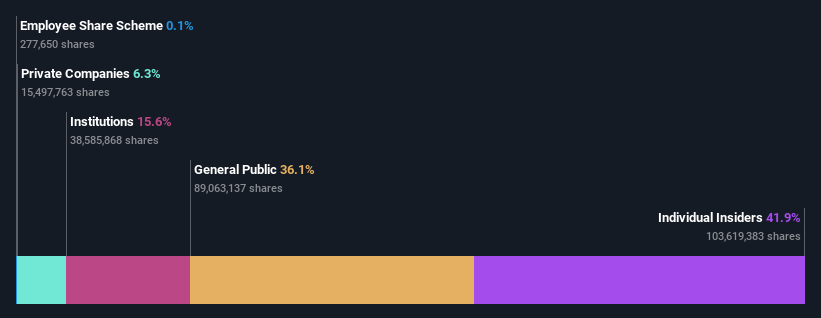

Insider Ownership: 19.6%

Earnings Growth Forecast: 40.2% p.a.

Shenzhen Genvict Technologies is poised for strong growth, with earnings projected to rise 40.2% annually, surpassing the Chinese market's average. Revenue is also expected to grow significantly at 34.9% per year. Despite no recent insider trading activity and a low forecasted return on equity of 5.7%, the company remains focused on strategic developments, including an upcoming shareholder meeting to discuss continuing connected transactions in January 2025.

- Navigate through the intricacies of Shenzhen Genvict Technologies with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shenzhen Genvict Technologies may be overvalued.

Summing It All Up

- Click here to access our complete index of 1476 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002869

Shenzhen Genvict Technologies

Engages in the research, development, and industrialization of smart transportation technology in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives