Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) Stocks Pounded By 27% But Not Lagging Market On Growth Or Pricing

To the annoyance of some shareholders, Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Longer-term shareholders would now have taken a real hit with the stock declining 4.0% in the last year.

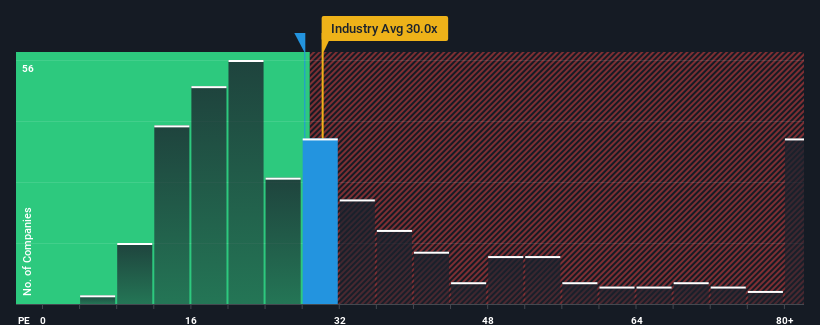

Even after such a large drop in price, there still wouldn't be many who think Bichamp Cutting Technology (Hunan)'s price-to-earnings (or "P/E") ratio of 28.2x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Bichamp Cutting Technology (Hunan)'s earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Bichamp Cutting Technology (Hunan)

Is There Some Growth For Bichamp Cutting Technology (Hunan)?

In order to justify its P/E ratio, Bichamp Cutting Technology (Hunan) would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 175% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 21% per annum, which is not materially different.

In light of this, it's understandable that Bichamp Cutting Technology (Hunan)'s P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Bichamp Cutting Technology (Hunan)'s P/E?

Following Bichamp Cutting Technology (Hunan)'s share price tumble, its P/E is now hanging on to the median market P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Bichamp Cutting Technology (Hunan)'s analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Bichamp Cutting Technology (Hunan) is showing 3 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bichamp Cutting Technology (Hunan) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002843

Bichamp Cutting Technology (Hunan)

Bichamp Cutting Technology (Hunan) Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives