A Piece Of The Puzzle Missing From Estun Automation Co., Ltd's (SZSE:002747) Share Price

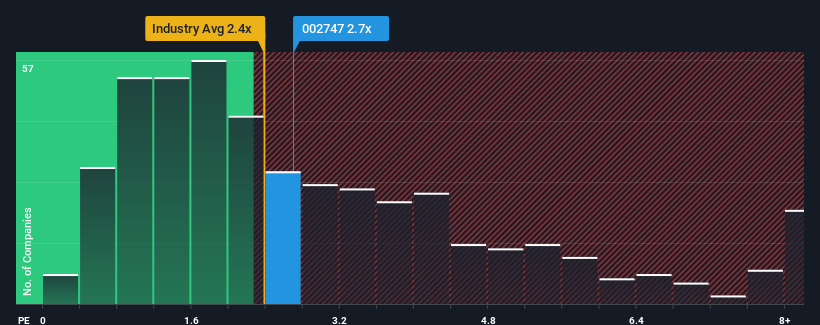

It's not a stretch to say that Estun Automation Co., Ltd's (SZSE:002747) price-to-sales (or "P/S") ratio of 2.7x right now seems quite "middle-of-the-road" for companies in the Machinery industry in China, where the median P/S ratio is around 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Estun Automation

What Does Estun Automation's Recent Performance Look Like?

Recent times have been advantageous for Estun Automation as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Estun Automation's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Estun Automation?

Estun Automation's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. The latest three year period has also seen an excellent 74% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% per year over the next three years. With the industry only predicted to deliver 19% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Estun Automation's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Estun Automation's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with Estun Automation (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Estun Automation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002747

Estun Automation

Engages in the research and development, production, and sale of intelligent equipment and its control and functional components in China.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives