- China

- /

- Electrical

- /

- SZSE:002723

Kennede Electronics MFG. Co., Ltd. (SZSE:002723) Surges 38% Yet Its Low P/S Is No Reason For Excitement

Those holding Kennede Electronics MFG. Co., Ltd. (SZSE:002723) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

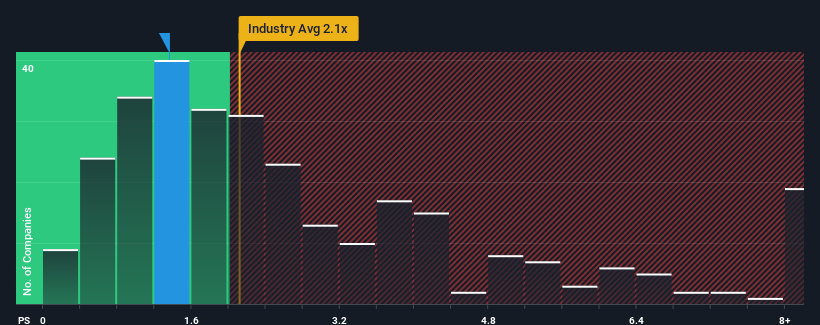

In spite of the firm bounce in price, it would still be understandable if you think Kennede Electronics MFG is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in China's Electrical industry have P/S ratios above 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kennede Electronics MFG

How Has Kennede Electronics MFG Performed Recently?

Kennede Electronics MFG's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Kennede Electronics MFG will be hoping that this isn't the case.

Keen to find out how analysts think Kennede Electronics MFG's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kennede Electronics MFG's Revenue Growth Trending?

In order to justify its P/S ratio, Kennede Electronics MFG would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 68% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this in consideration, its clear as to why Kennede Electronics MFG's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift Kennede Electronics MFG's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Kennede Electronics MFG's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Kennede Electronics MFG that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kennede Electronics MFG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002723

Kennede Electronics MFG

Engages in the design, development, production, and sale of fans, rechargeable lighting products, and electric kettles in China.

Mediocre balance sheet and slightly overvalued.