- Hong Kong

- /

- Commercial Services

- /

- SEHK:1855

Discovering 3 Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets continue to experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are increasingly turning their attention to the potential of small-cap stocks. With U.S. indexes approaching record highs and positive economic indicators like falling jobless claims and rising home sales, the search for undiscovered gems becomes ever more pertinent. Identifying a promising stock often involves finding companies that demonstrate resilience and adaptability in dynamic market conditions, particularly those with strong fundamentals poised to benefit from current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

ZONQING Environmental (SEHK:1855)

Simply Wall St Value Rating: ★★★★☆☆

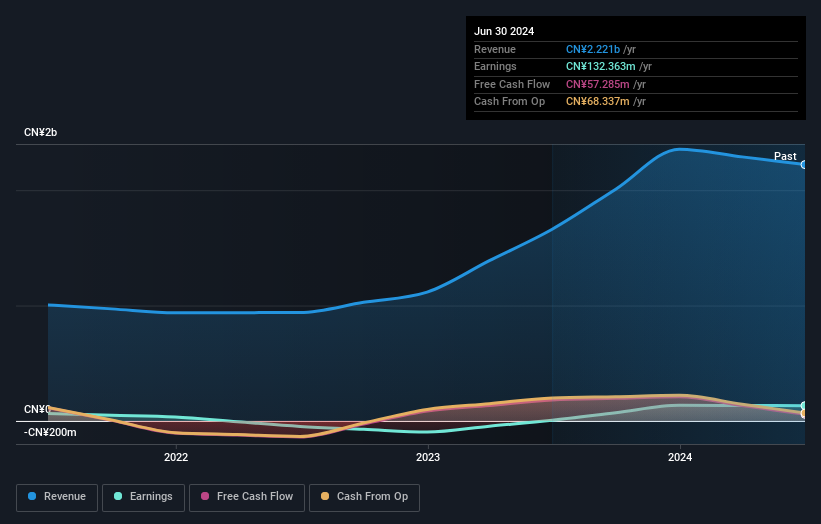

Overview: Zonbong Landscape Environmental Limited, along with its subsidiaries, operates in landscaping and ecological restoration activities within the People’s Republic of China, with a market capitalization of HK$5.50 billion.

Operations: Zonbong Landscape Environmental Limited generates revenue primarily from city renewal construction services (CN¥1.85 billion), design and consultancy services (CN¥86.75 million), and city operation and maintenance services (CN¥280.90 million).

ZONQING Environmental, a smaller player in the environmental sector, shows intriguing financial dynamics. Over the past year, its earnings skyrocketed by 2106%, significantly outpacing the commercial services industry average of -8.5%. The company's debt to equity ratio improved from 137.7% to 107.9% over five years, indicating better leverage management despite a high net debt to equity ratio of 100.2%. On a positive note, interest payments are well-covered with EBIT at 4.8 times those obligations, suggesting solid operational efficiency and financial resilience within its niche market space.

- Click here to discover the nuances of ZONQING Environmental with our detailed analytical health report.

Evaluate ZONQING Environmental's historical performance by accessing our past performance report.

Jiangsu SOPO Chemical (SHSE:600746)

Simply Wall St Value Rating: ★★★★★☆

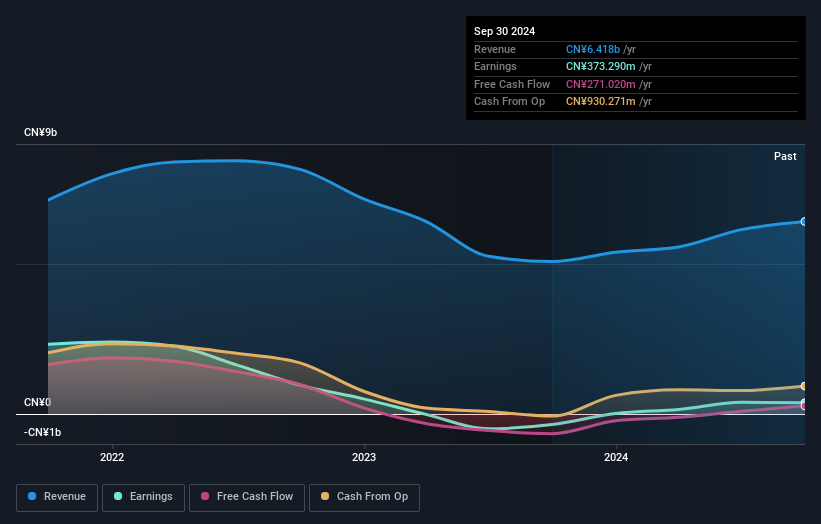

Overview: Jiangsu SOPO Chemical Co. Ltd. is a company engaged in the manufacturing and selling of chemical products both within China and internationally, with a market capitalization of CN¥8.40 billion.

Operations: Jiangsu SOPO Chemical generates revenue primarily through the sale of chemical products, amounting to CN¥6.42 billion. The company's market capitalization is CN¥8.40 billion.

Jiangsu SOPO Chemical, a nimble player in the chemicals sector, has shown impressive financial resilience. The company reported sales of CNY 4.94 billion for the first nine months of 2024, up from CNY 3.92 billion last year, and turned a net income of CNY 207.13 million from a loss of CNY 148.25 million previously. Its price-to-earnings ratio stands at an attractive 22.5x, undercutting the broader CN market's average of 34.6x, suggesting potential undervaluation. Despite an increase in its debt to equity ratio to 3.2% over five years, it maintains more cash than total debt and covers interest payments comfortably.

- Navigate through the intricacies of Jiangsu SOPO Chemical with our comprehensive health report here.

Assess Jiangsu SOPO Chemical's past performance with our detailed historical performance reports.

Wuchan Zhongda GeronLtd (SZSE:002722)

Simply Wall St Value Rating: ★★★★★★

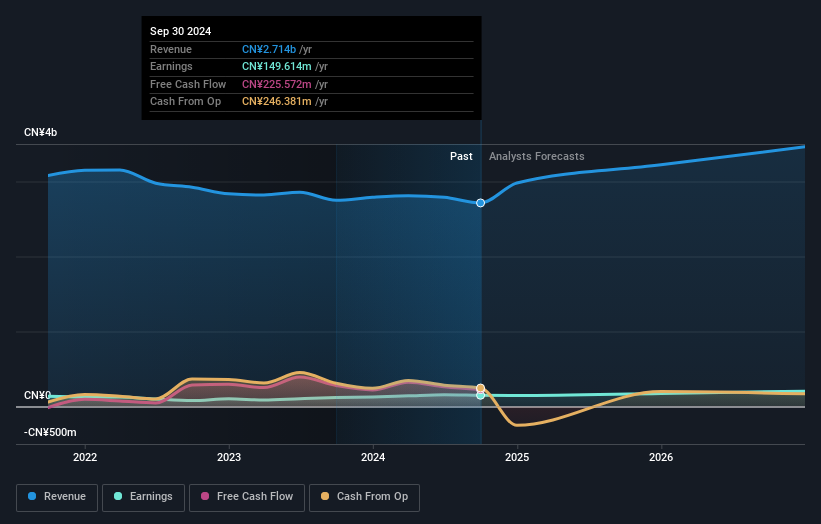

Overview: Wuchan Zhongda Geron Co., Ltd. engages in the research, development, manufacturing, and sale of textile carders and stainless steel decorative plates in China with a market cap of approximately CN¥3.50 billion.

Operations: Wuchan Zhongda Geron generates revenue primarily from its industrial segment, amounting to approximately CN¥2.71 billion. The company focuses on managing costs effectively to optimize profitability.

Wuchan Zhongda Geron Ltd. is making strides with a notable earnings growth of 26% over the past year, outpacing the Machinery industry's -0.4%. The company has successfully reduced its debt-to-equity ratio from 42% to 21% in five years, demonstrating effective financial management. Its interest payments are well-covered by EBIT at 27.8 times, indicating strong operational efficiency. Despite a slight dip in sales to CNY 1,953 million from CNY 2,028 million last year, net income rose to CNY 113 million from CNY 89 million. With a P/E ratio of 23x below the market average and positive free cash flow, Wuchan Zhongda appears well-positioned for continued growth.

Summing It All Up

- Click through to start exploring the rest of the 4635 Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZONQING Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1855

ZONQING Environmental

Zonbong Landscape Environmental Limited, together with its subsidiaries, engages in landscaping, ecological restoration, and other related activities in the People’s Republic of China.

Solid track record with adequate balance sheet.