Shanghai Jinjiang Shipping Group And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 advancing for several weeks. In this context, identifying promising opportunities in Asia's dynamic market could hinge on finding companies that demonstrate strong fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Korea Ratings | NA | 0.74% | 1.47% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| ISE Chemicals | 1.40% | 15.34% | 32.61% | ★★★★★★ |

| HeBei Jinniu Chemical IndustryLtd | NA | -1.52% | 14.74% | ★★★★★★ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Yukiguni Factory | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Jinjiang Shipping (Group) (SHSE:601083)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Jinjiang Shipping (Group) Co., Ltd. operates as a shipping and logistics company with a market cap of CN¥14.35 billion.

Operations: The company generates revenue primarily through its shipping and logistics services. Its financial performance is characterized by a net profit margin of 12.5%, indicating the efficiency of its operations in generating profit from total revenue.

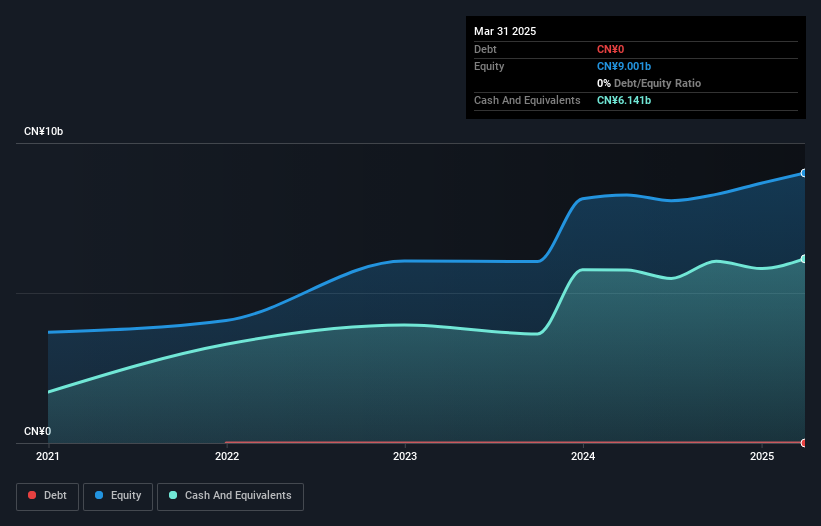

Shanghai Jinjiang Shipping shows robust financial health, with earnings soaring 117.5% over the past year, outpacing the industry’s 33.3% growth. The company is debt-free for five years, eliminating concerns about interest coverage and demonstrating high-quality earnings. Recent figures highlight a strong performance, with Q1 2025 net income reaching CNY 356.72 million compared to CNY 124.26 million last year, and revenue climbing to CNY 1,666.07 million from CNY 1,250.31 million in the same period. Despite its small size in the market landscape, it trades at a notable discount of 67% below estimated fair value, suggesting potential for investors seeking undervalued opportunities in Asia's shipping sector.

Chengdu Leejun Industrial (SZSE:002651)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Leejun Industrial Co., Ltd. is engaged in the research, development, design, manufacture, sale, and servicing of grinding process system equipment both within China and internationally, with a market cap of CN¥7.64 billion.

Operations: Chengdu Leejun Industrial generates revenue primarily from the sale and servicing of grinding process system equipment. The company's financial performance is reflected in its market capitalization of CN¥7.64 billion.

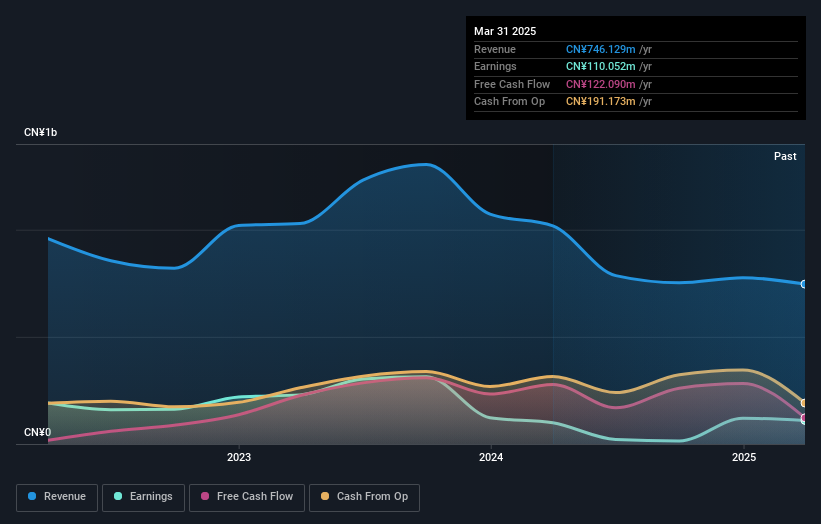

Chengdu Leejun Industrial, a smaller player in the machinery sector, has shown resilience despite facing revenue challenges. Over the past year, its earnings grew by 11%, outpacing the industry average of 1.8%. The company is financially stable with more cash than debt and high-quality past earnings. However, sales for Q1 2025 dipped to CNY 175.2 million from CNY 205.32 million in the prior year, while net income decreased to CNY 46.39 million from CNY 56.44 million. A recent dividend increase suggests confidence in financial health despite a challenging market environment.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advanced Echem Materials Company Limited specializes in developing and manufacturing special chemical materials for semiconductor and display applications in Taiwan, with a market capitalization of approximately NT$43.69 billion.

Operations: The primary revenue stream for Advanced Echem Materials comes from its Electronic Components & Parts segment, generating NT$3.32 billion. The company's market capitalization stands at approximately NT$43.69 billion.

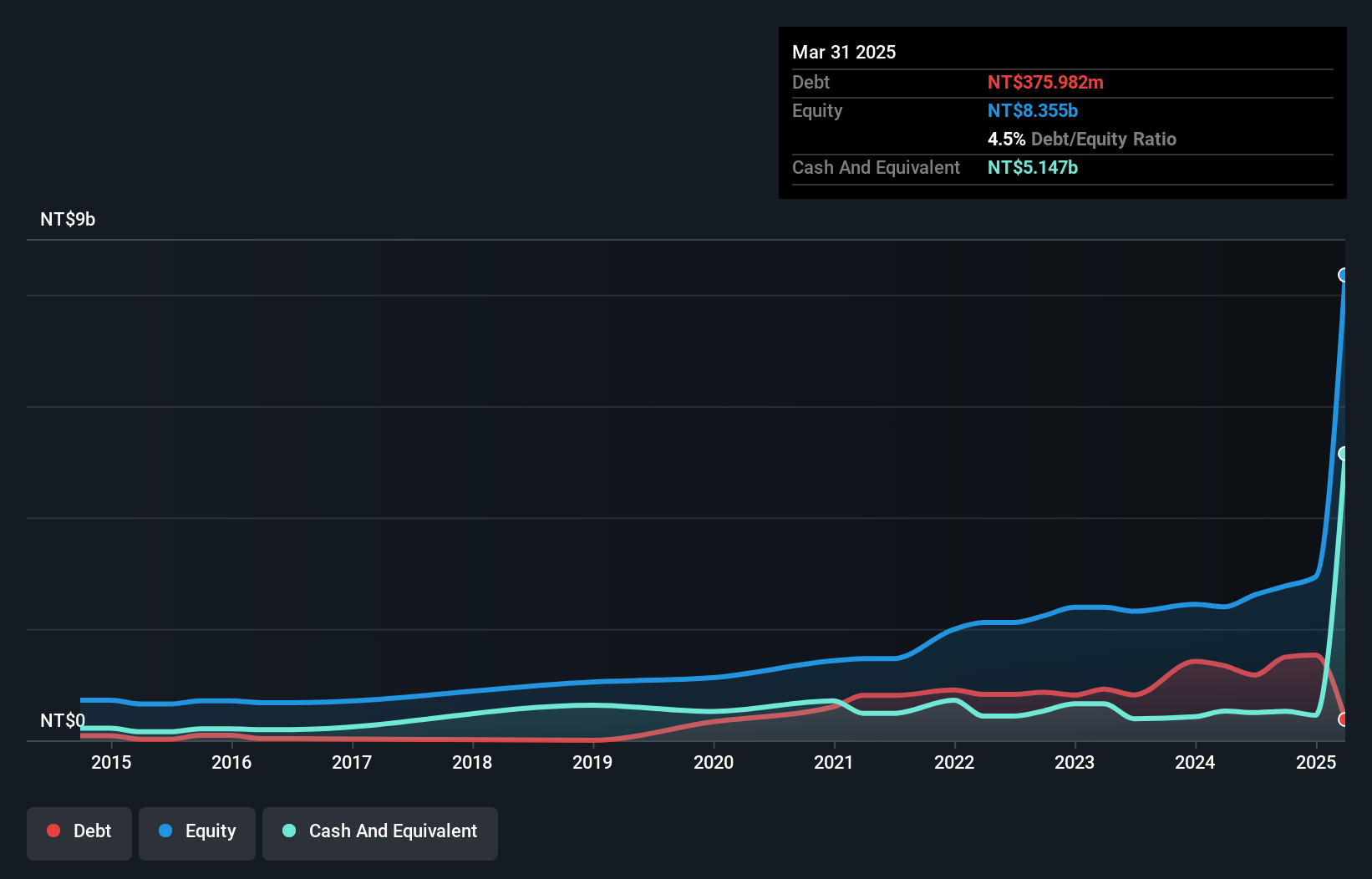

Advanced Echem Materials, a nimble player in the semiconductor industry, has seen its earnings leap by 119% over the past year, outpacing the industry's 20.2% growth rate. Despite this impressive performance, the company grapples with a rising debt to equity ratio, now at 52%, up from 29% five years ago. The net debt to equity ratio remains satisfactory at 37%, and interest payments are well covered by EBIT at 36 times coverage. However, free cash flow is negative. Recent dividends of TWD 6 per share reflect confidence in future prospects as revenue climbed to TWD 3.32 billion from TWD 2.36 billion last year.

- Click here to discover the nuances of Advanced Echem Materials with our detailed analytical health report.

Assess Advanced Echem Materials' past performance with our detailed historical performance reports.

Make It Happen

- Click through to start exploring the rest of the 2676 Asian Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Chengdu Leejun Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002651

Chengdu Leejun Industrial

Researches and develops, designs, manufactures, sells, and services grinding process system equipment in the People’s Republic of China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives