- China

- /

- Electrical

- /

- SZSE:002635

Suzhou Anjie Technology Co., Ltd.'s (SZSE:002635) Shares Climb 42% But Its Business Is Yet to Catch Up

Suzhou Anjie Technology Co., Ltd. (SZSE:002635) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

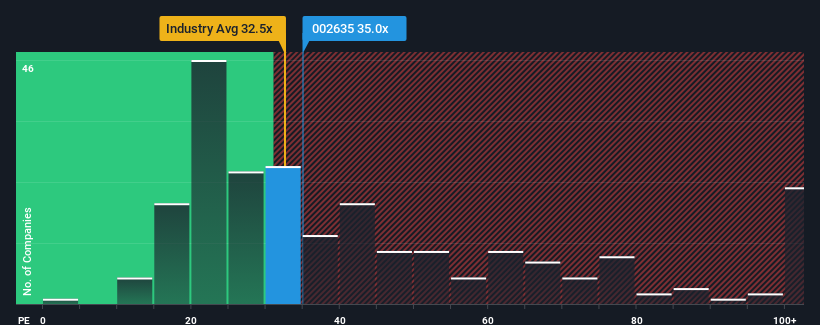

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Suzhou Anjie Technology's P/E ratio of 35x, since the median price-to-earnings (or "P/E") ratio in China is also close to 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Suzhou Anjie Technology has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Suzhou Anjie Technology

How Is Suzhou Anjie Technology's Growth Trending?

Suzhou Anjie Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 53%. The latest three year period has also seen an excellent 414% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 29% during the coming year according to the only analyst following the company. With the market predicted to deliver 37% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that Suzhou Anjie Technology's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Suzhou Anjie Technology's P/E?

Its shares have lifted substantially and now Suzhou Anjie Technology's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Suzhou Anjie Technology currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Suzhou Anjie Technology you should be aware of.

If these risks are making you reconsider your opinion on Suzhou Anjie Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002635

Suzhou Anjie Technology

Engages in the research, development, production, and sale of intelligent terminal components in China and internationally.

Excellent balance sheet average dividend payer.