- China

- /

- Electronic Equipment and Components

- /

- SZSE:300445

High Growth Tech And 2 Other Exciting Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks closing out 2024 on a high note despite recent economic indicators like the Chicago PMI showing contraction, investors are keenly observing sectors that have shown resilience and potential for growth. In this environment, identifying high-growth tech stocks along with other promising opportunities requires attention to companies that demonstrate robust fundamentals and adaptability amid shifting economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hangzhou Arcvideo Technology (SHSE:688039)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Arcvideo Technology Co., Ltd. offers smart and secure video solutions and video cloud services for media platforms, with a market cap of CN¥2.73 billion.

Operations: Arcvideo Technology generates revenue primarily through its smart and secure video solutions and video cloud services tailored for media platforms. The company has a market cap of CN¥2.73 billion, reflecting its established position in the industry.

Hangzhou Arcvideo Technology, despite its unprofitable status, shows promising growth dynamics with a forecasted annual revenue increase of 27.9% and an impressive expected earnings growth of 124.1% per year. The company's substantial investment in R&D as a percentage of revenue underscores its commitment to innovation, crucial in the competitive tech landscape. However, challenges remain evident from its recent financial results showing a decrease in sales to CNY 169.11 million from CNY 214.07 million year-over-year and a net loss reduction to CNY 69.45 million from CNY 96.16 million, reflecting ongoing efforts to stabilize financially amidst high market volatility.

- Click here to discover the nuances of Hangzhou Arcvideo Technology with our detailed analytical health report.

Understand Hangzhou Arcvideo Technology's track record by examining our Past report.

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. specializes in offering collaborative management software, solutions, platforms, and cloud services to organizational customers in China, with a market capitalization of approximately CN¥1.99 billion.

Operations: Seeyon Internet Software generates revenue through its collaborative management software and cloud services tailored for organizational clients in China. The company focuses on delivering integrated solutions to enhance business operations and communication within enterprises.

BeiJing Seeyon Internet Software, navigating through a challenging landscape, reported a revenue drop to CNY 616.88 million from CNY 705.32 million year-over-year alongside an increased net loss of CNY 109.4 million, up from CNY 32.72 million previously. Despite these setbacks, the company's commitment to innovation is evident in its R&D spending and is poised for future growth with an expected annual revenue increase of 16.9% and a dramatic forecasted earnings surge of 124.6%. This performance underscores its potential resilience and adaptation in the evolving tech sector, although it currently remains unprofitable with high share price volatility noted over recent months.

Beijing ConST Instruments Technology (SZSE:300445)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing ConST Instruments Technology Inc. is engaged in the research, development, manufacturing, and sale of digital testing instruments and equipment both in China and internationally, with a market cap of CN¥3.21 billion.

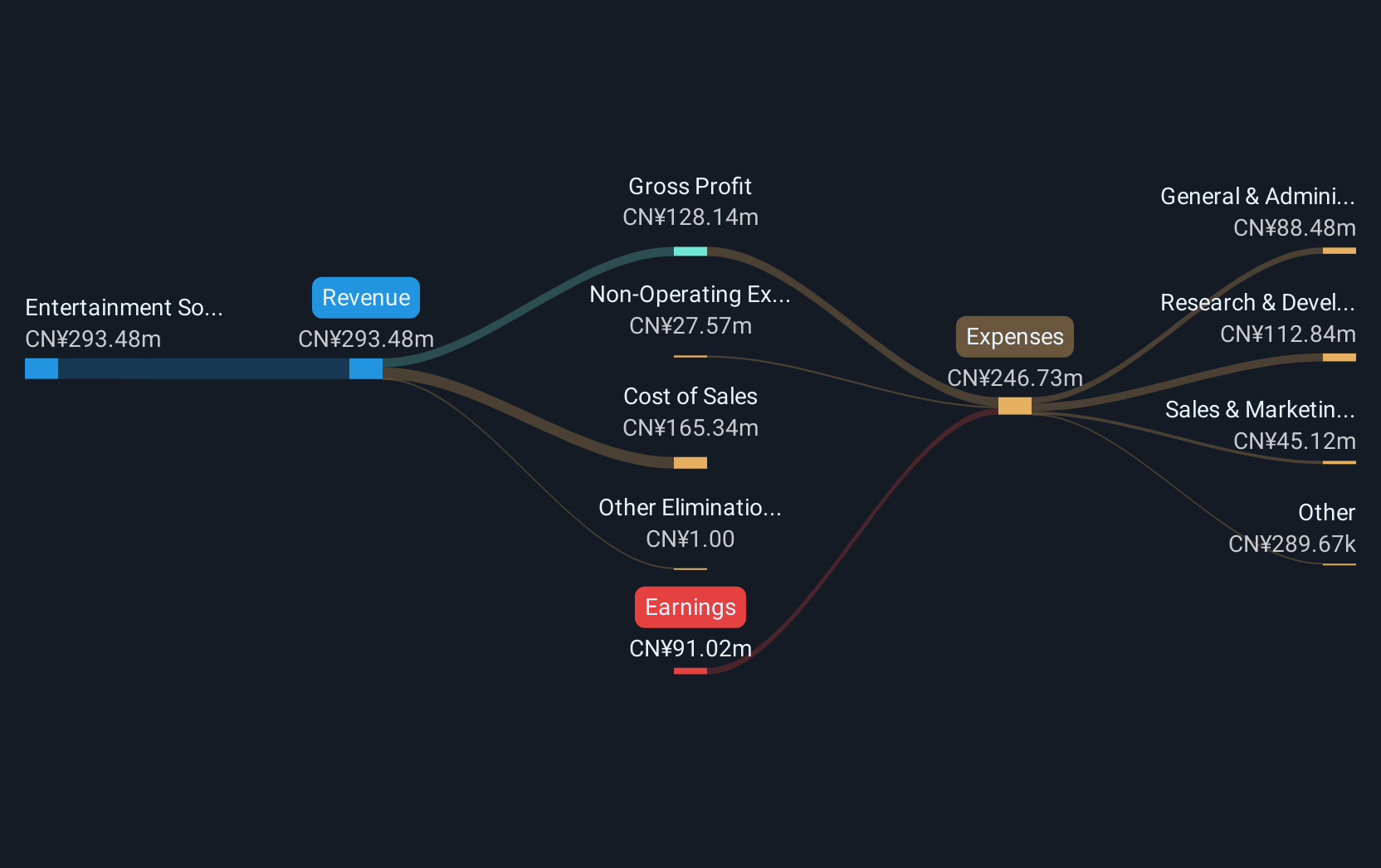

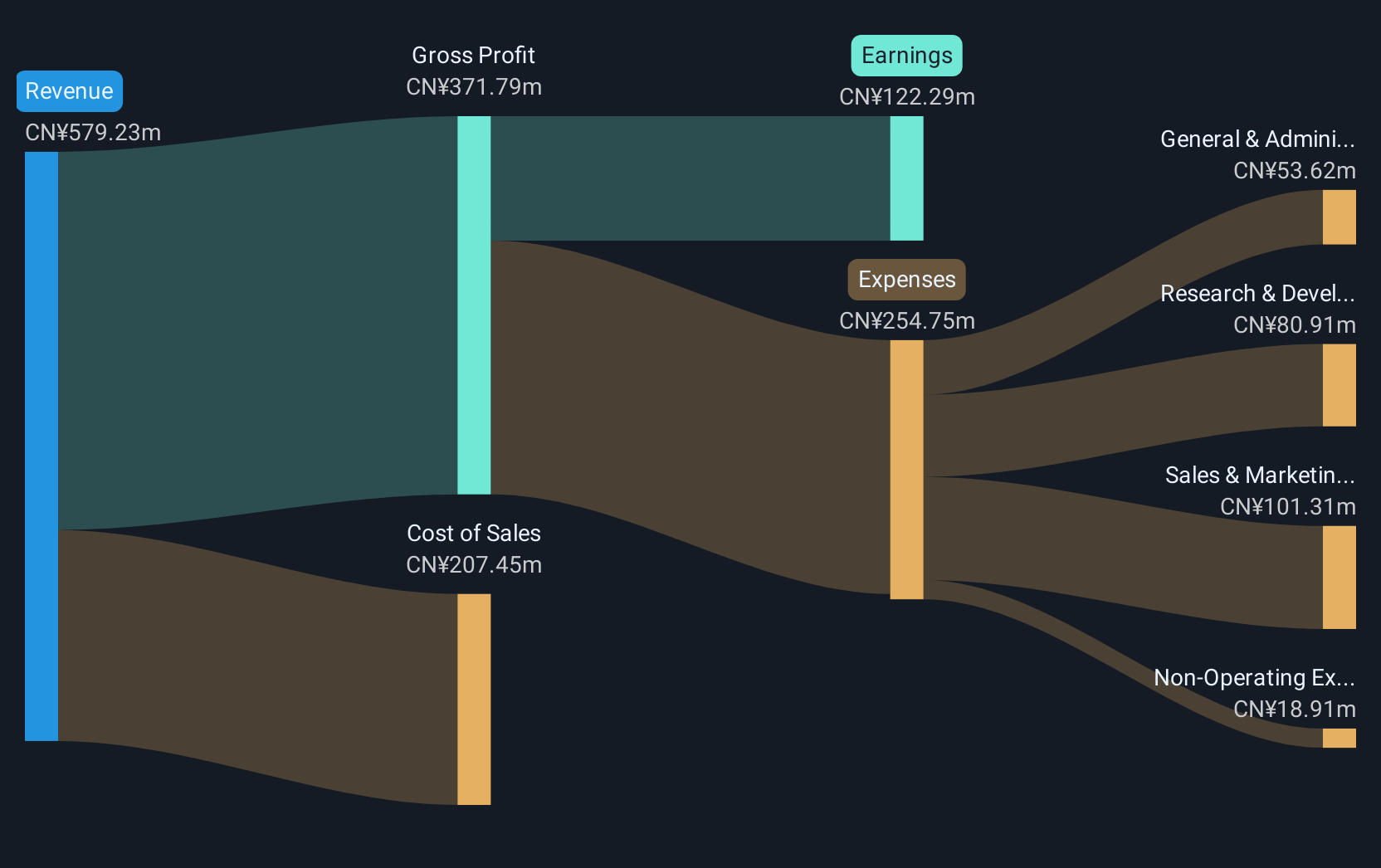

Operations: ConST Instruments focuses on the digital testing instruments sector, offering products across China and globally. The company's revenue is primarily generated through the sale of these specialized instruments.

Beijing ConST Instruments Technology has demonstrated robust financial health, with a revenue increase to CNY 358.21 million from CNY 331.46 million and net income growth to CNY 89.42 million from CNY 70.16 million in the last nine months of reporting. The company's commitment to innovation is evident as it continues investing in R&D, aligning with its impressive earnings growth of 47% over the past year and projected annual earnings growth of 26.9%. This performance not only surpasses the broader Electronic industry's average but also positions Beijing ConST favorably within a competitive tech landscape, suggesting potential for sustained advancement despite market challenges.

Make It Happen

- Delve into our full catalog of 1267 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing ConST Instruments Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300445

Beijing ConST Instruments Technology

Researches, develops, manufactures, and sells digital testing instruments and equipment in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives