- China

- /

- Construction

- /

- SZSE:002628

Even though Chengdu Road & Bridge EngineeringLTD (SZSE:002628) has lost CN¥485m market cap in last 7 days, shareholders are still up 35% over 1 year

It's been a soft week for Chengdu Road & Bridge Engineering CO.,LTD (SZSE:002628) shares, which are down 12%. But that doesn't change the fact that the returns over the last year have been pleasing. After all, the share price is up a market-beating 35% in that time.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

See our latest analysis for Chengdu Road & Bridge EngineeringLTD

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Chengdu Road & Bridge EngineeringLTD saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Unfortunately Chengdu Road & Bridge EngineeringLTD's fell 35% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

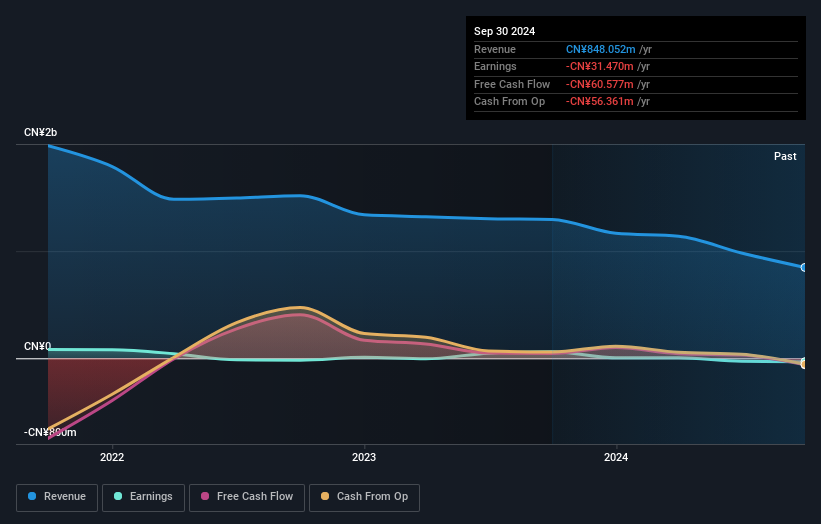

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Chengdu Road & Bridge EngineeringLTD's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Chengdu Road & Bridge EngineeringLTD has rewarded shareholders with a total shareholder return of 35% in the last twelve months. Notably the five-year annualised TSR loss of 0.4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Chengdu Road & Bridge EngineeringLTD better, we need to consider many other factors. For example, we've discovered 2 warning signs for Chengdu Road & Bridge EngineeringLTD that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Chengdu Road & Bridge EngineeringLTD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002628

Chengdu Road & Bridge EngineeringLTD

Engages in the engineering and construction business in China and internationally.

Imperfect balance sheet very low.

Market Insights

Community Narratives