- China

- /

- Aerospace & Defense

- /

- SZSE:002625

Kuang-Chi Technologies Co., Ltd.'s (SZSE:002625) 29% Share Price Surge Not Quite Adding Up

Kuang-Chi Technologies Co., Ltd. (SZSE:002625) shares have continued their recent momentum with a 29% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

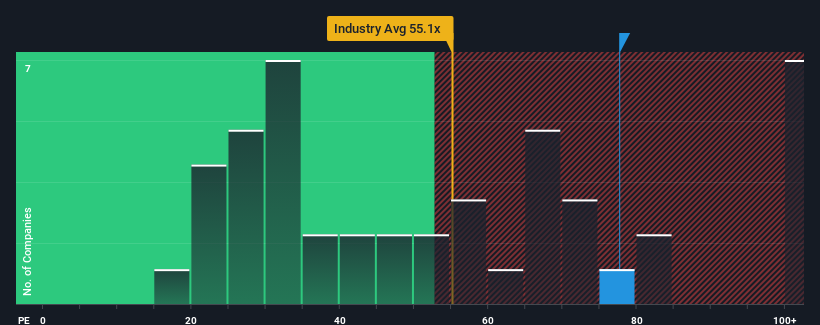

After such a large jump in price, Kuang-Chi Technologies may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 77.7x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 19x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Kuang-Chi Technologies as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Kuang-Chi Technologies

How Is Kuang-Chi Technologies' Growth Trending?

Kuang-Chi Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 15% last year. The latest three year period has also seen an excellent 316% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 39% over the next year. With the market predicted to deliver 36% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that Kuang-Chi Technologies is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

The strong share price surge has got Kuang-Chi Technologies' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Kuang-Chi Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kuang-Chi Technologies, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kuang-Chi Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002625

Kuang-Chi Technologies

Engages in the research and development, production, and sales of new-generation metamaterial cutting-edge equipment products in China.

Flawless balance sheet with high growth potential.