3 Growth Companies With High Insider Ownership And Up To 27% Revenue Growth

Reviewed by Simply Wall St

As global markets edge closer to record highs, fueled by gains in U.S. stock indexes and a notable outperformance of growth stocks over value shares, investors are navigating an environment marked by rising inflation and cautious monetary policies. In this context, companies with strong insider ownership can be particularly appealing as they often signal confidence from those who know the business best, making them potentially attractive options for those seeking growth opportunities amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Let's explore several standout options from the results in the screener.

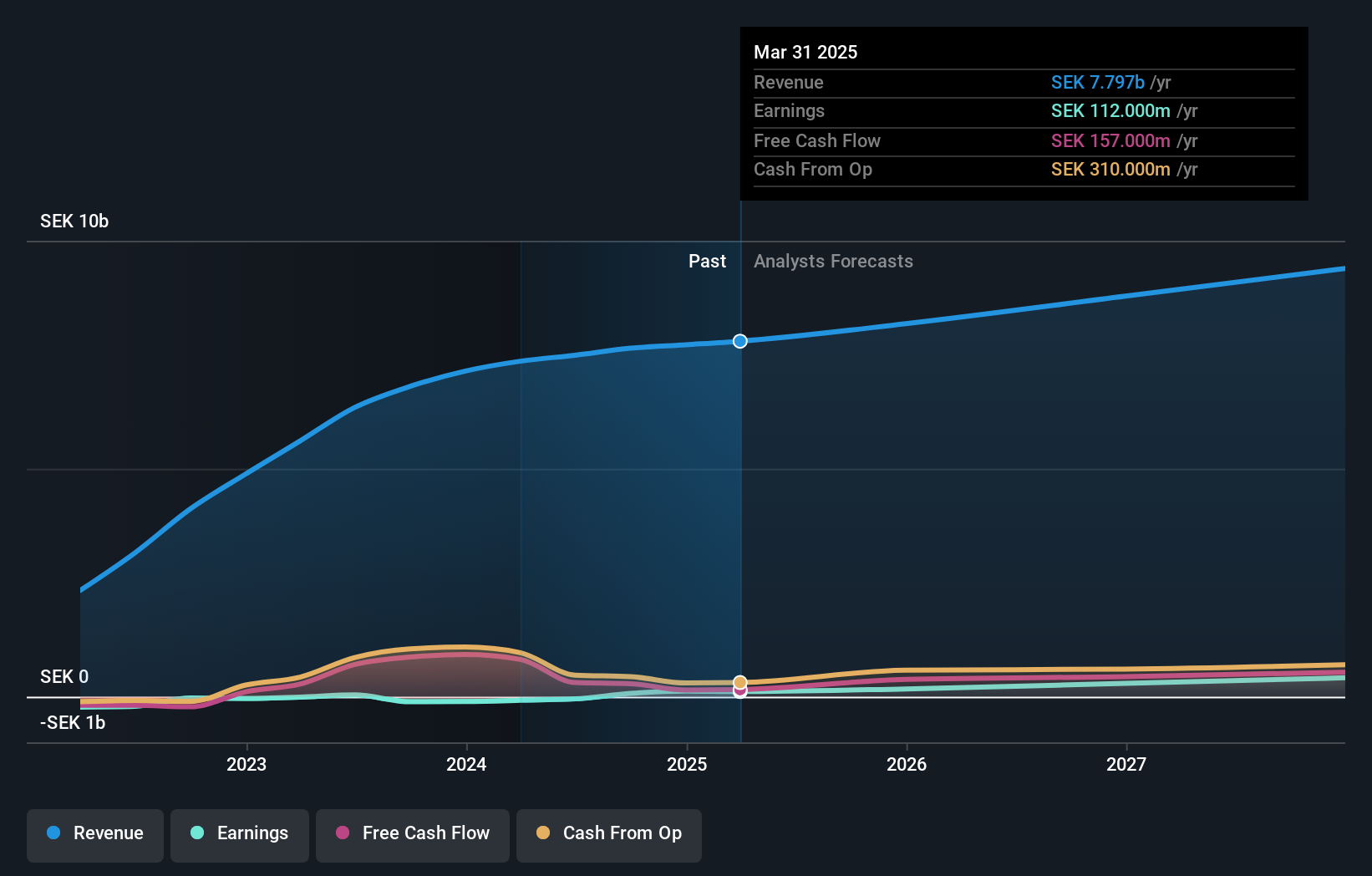

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of SEK5.09 billion.

Operations: The company generates revenue from various segments, including Future Snacking (SEK959 million), Sustainable Care (SEK2.34 billion), Quality Nutrition (SEK1.58 billion), and Nordic Distribution (SEK2.74 billion).

Insider Ownership: 14.8%

Revenue Growth Forecast: 11.5% p.a.

Humble Group shows promising growth potential with earnings forecasted to rise 64.44% annually, outpacing the Swedish market. Recent insider activity indicates more buying than selling, suggesting confidence in its future prospects. The company is trading at a significant discount to its estimated fair value and has recently secured SEK 300 million in financing for growth initiatives. However, its return on equity is projected to remain modest at 10.5%.

- Unlock comprehensive insights into our analysis of Humble Group stock in this growth report.

- Upon reviewing our latest valuation report, Humble Group's share price might be too optimistic.

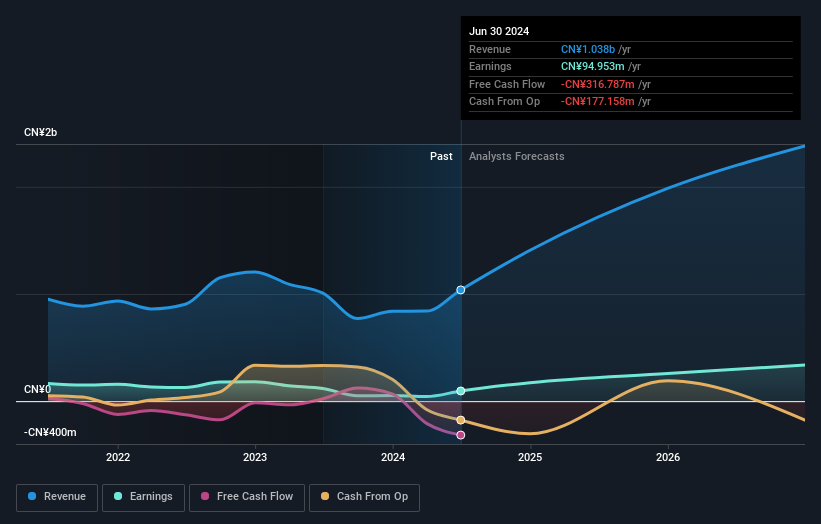

Do-Fluoride New Materials (SZSE:002407)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Do-Fluoride New Materials Co., Ltd. focuses on the development, production, and sale of inorganic fluorides, electronic chemicals, lithium-ion batteries, and related materials both in China and internationally with a market cap of CN¥14.14 billion.

Operations: The company's revenue is derived from its activities in inorganic fluorides, electronic chemicals, and lithium-ion batteries, catering to both domestic and international markets.

Insider Ownership: 13.9%

Revenue Growth Forecast: 17.2% p.a.

Do-Fluoride New Materials is poised for substantial growth, with earnings projected to increase at a significant rate of 73.7% annually, surpassing the broader Chinese market. Despite this, profit margins have decreased from last year and return on equity is expected to remain low. The company has initiated a share buyback program worth up to CNY 300 million, indicating confidence in its valuation. However, its dividend yield of 2.49% isn't well-supported by earnings or free cash flow.

- Get an in-depth perspective on Do-Fluoride New Materials' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Do-Fluoride New Materials' current price could be inflated.

Dalian Insulator Group (SZSE:002606)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dalian Insulator Group Co., Ltd, along with its subsidiaries, focuses on the research, development, manufacture, and sale of porcelain insulators both in China and internationally, with a market cap of CN¥4.09 billion.

Operations: Dalian Insulator Group Co., Ltd's revenue primarily comes from its operations in the research, development, manufacturing, and sales of porcelain insulators within China and international markets.

Insider Ownership: 13%

Revenue Growth Forecast: 27.2% p.a.

Dalian Insulator Group is positioned for robust growth, with revenue expected to rise 27.2% annually, outpacing the broader Chinese market. Earnings are also forecast to grow at a significant rate of 33% per year. Despite these prospects, return on equity is projected to be low at 14.5%. Recent dividend affirmations indicate shareholder returns remain a priority, although dividends aren't well-supported by free cash flows.

- Navigate through the intricacies of Dalian Insulator Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Dalian Insulator Group shares in the market.

Summing It All Up

- Dive into all 1460 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002407

Do-Fluoride New Materials

Engages in the development, production, and sale of inorganic fluorides, electronic chemicals, lithium-ion batteries, and related materials in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives