Jiangsu Yawei Machine Tool Co., Ltd.'s (SZSE:002559) P/S Is Still On The Mark Following 28% Share Price Bounce

Those holding Jiangsu Yawei Machine Tool Co., Ltd. (SZSE:002559) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

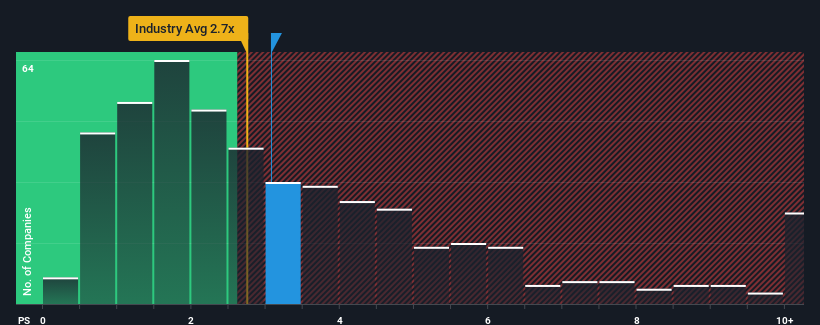

In spite of the firm bounce in price, there still wouldn't be many who think Jiangsu Yawei Machine Tool's price-to-sales (or "P/S") ratio of 3.1x is worth a mention when the median P/S in China's Machinery industry is similar at about 2.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Jiangsu Yawei Machine Tool

What Does Jiangsu Yawei Machine Tool's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Jiangsu Yawei Machine Tool's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Jiangsu Yawei Machine Tool's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jiangsu Yawei Machine Tool's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Jiangsu Yawei Machine Tool's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 28%, which is not materially different.

With this in mind, it makes sense that Jiangsu Yawei Machine Tool's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Jiangsu Yawei Machine Tool's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Jiangsu Yawei Machine Tool maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Jiangsu Yawei Machine Tool (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Jiangsu Yawei Machine Tool, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002559

Jiangsu Yawei Machine Tool

Manufactures and sells metal forming machine tools and laser processing equipment in China and internationally.

Adequate balance sheet with acceptable track record.