- China

- /

- Construction

- /

- SZSE:002542

Top Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities experiencing declines amid inflation concerns and political uncertainty, investors are keenly observing how smaller companies perform. Penny stocks, often associated with smaller or newer firms, present unique opportunities for growth at lower price points. Despite their vintage name, these stocks can offer value and potential upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £413.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.60 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,822 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Zhonghua Geotechnical Engineering Group (SZSE:002542)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Zhonghua Geotechnical Engineering Group Co., Ltd. operates in the geotechnical engineering sector and has a market cap of approximately CN¥6.29 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥6.29B

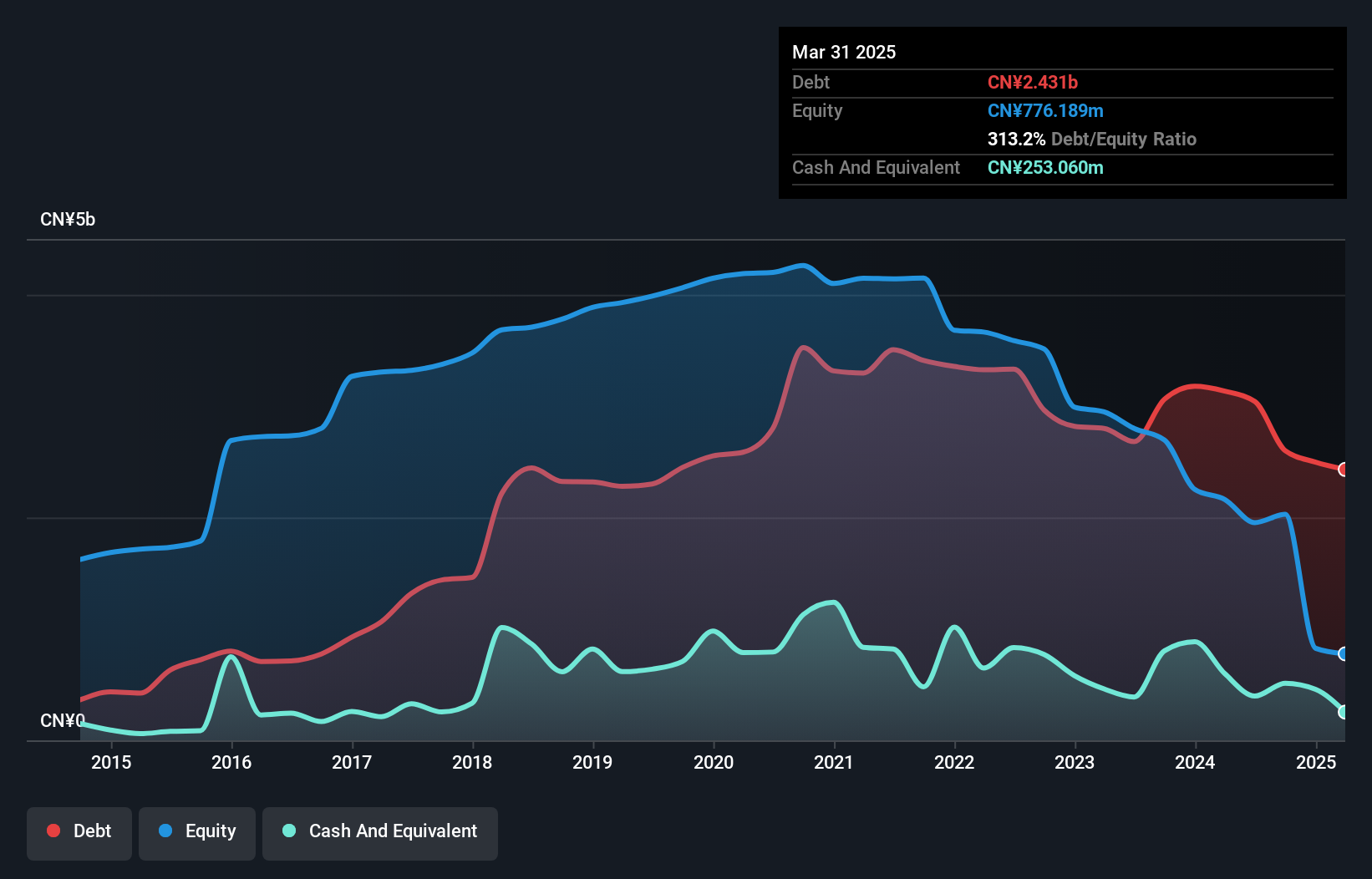

China Zhonghua Geotechnical Engineering Group has faced challenges with declining earnings, reporting a net loss of CN¥192.76 million for the nine months ending September 2024. Despite this, the company maintains a solid cash runway exceeding three years due to positive free cash flow. Its short-term assets also comfortably cover both short and long-term liabilities, suggesting financial stability in the near term. However, high volatility in share price and a significant net debt to equity ratio of 102.9% highlight risks for investors. Recent shareholder meetings focused on governance changes could impact future strategic directions.

- Unlock comprehensive insights into our analysis of China Zhonghua Geotechnical Engineering Group stock in this financial health report.

- Gain insights into China Zhonghua Geotechnical Engineering Group's historical outcomes by reviewing our past performance report.

Jiangxi Hengda Hi-TechLtd (SZSE:002591)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangxi Hengda Hi-Tech Co., Ltd. focuses on the research, development, production, and sale of anti-wear and anti-corrosion materials for industrial equipment in China, with a market cap of CN¥1.42 billion.

Operations: The company generates revenue of CN¥427.44 million from its operations within China.

Market Cap: CN¥1.42B

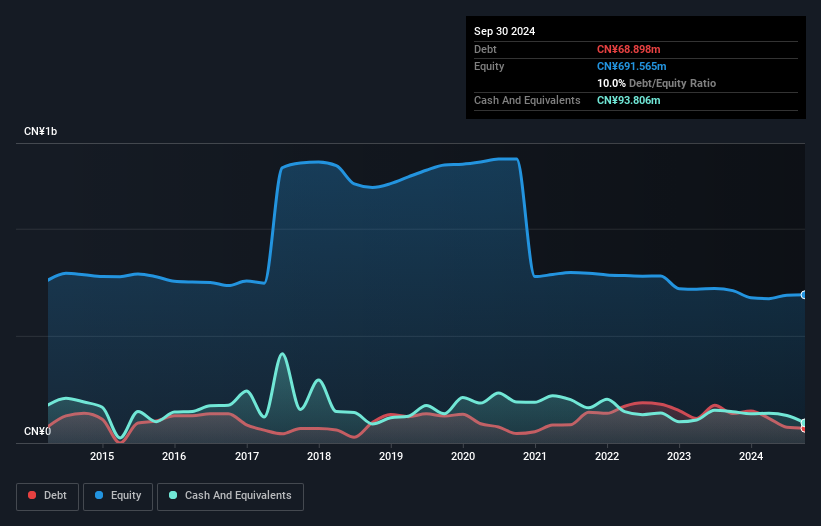

Jiangxi Hengda Hi-Tech Ltd. has demonstrated financial improvement, reporting a net income of CN¥14.21 million for the nine months ending September 2024, compared to a net loss the previous year. Despite being unprofitable historically, the company has reduced losses over five years and maintains a positive cash flow with enough runway for over three years. With short-term assets exceeding liabilities and no significant shareholder dilution recently, it shows some financial resilience. However, its negative return on equity and relatively new board may pose challenges as it navigates future growth opportunities in China’s industrial sector.

- Dive into the specifics of Jiangxi Hengda Hi-TechLtd here with our thorough balance sheet health report.

- Examine Jiangxi Hengda Hi-TechLtd's past performance report to understand how it has performed in prior years.

Tong Petrotech (SZSE:300164)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tong Petrotech Corp. provides perforation technology services to oilfield customers both in China and internationally, with a market cap of CN¥2.47 billion.

Operations: The company generates revenue from its Petroleum Exploration Development segment, totaling CN¥1.11 billion.

Market Cap: CN¥2.47B

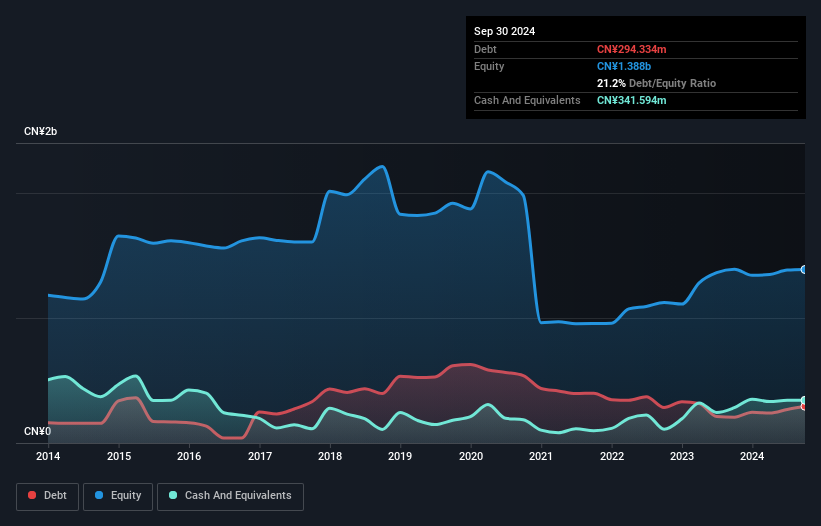

Tong Petrotech Corp. has shown mixed financial results, with sales increasing to CN¥866.67 million for the nine months ending September 2024, up from CN¥790.21 million a year prior. However, net income decreased to CN¥48.12 million from CN¥90.72 million due to lower profit margins of 0.7% compared to last year's 9.2%. Despite this, the company remains financially stable with short-term assets exceeding liabilities and no significant shareholder dilution over the past year. Its debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT coverage of 12.4 times interest expenses.

- Get an in-depth perspective on Tong Petrotech's performance by reading our balance sheet health report here.

- Learn about Tong Petrotech's historical performance here.

Taking Advantage

- Get an in-depth perspective on all 5,822 Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Zhonghua Geotechnical Engineering Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002542

China Zhonghua Geotechnical Engineering Group

China Zhonghua Geotechnical Engineering Group Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives