Returns On Capital Are A Standout For Linzhou Heavy Machinery GroupLtd (SZSE:002535)

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Linzhou Heavy Machinery GroupLtd (SZSE:002535) looks great, so lets see what the trend can tell us.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Linzhou Heavy Machinery GroupLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

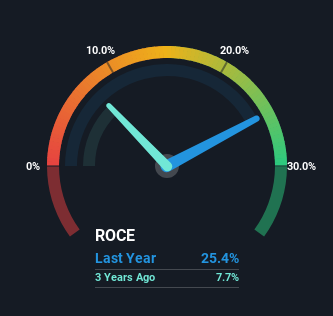

0.25 = CN¥292m ÷ (CN¥3.9b - CN¥2.8b) (Based on the trailing twelve months to March 2024).

Therefore, Linzhou Heavy Machinery GroupLtd has an ROCE of 25%. That's a fantastic return and not only that, it outpaces the average of 5.6% earned by companies in a similar industry.

Check out our latest analysis for Linzhou Heavy Machinery GroupLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Linzhou Heavy Machinery GroupLtd has performed in the past in other metrics, you can view this free graph of Linzhou Heavy Machinery GroupLtd's past earnings, revenue and cash flow.

The Trend Of ROCE

You'd find it hard not to be impressed with the ROCE trend at Linzhou Heavy Machinery GroupLtd. We found that the returns on capital employed over the last five years have risen by 4,522%. That's a very favorable trend because this means that the company is earning more per dollar of capital that's being employed. In regards to capital employed, Linzhou Heavy Machinery GroupLtd appears to been achieving more with less, since the business is using 65% less capital to run its operation. A business that's shrinking its asset base like this isn't usually typical of a soon to be multi-bagger company.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Effectively this means that suppliers or short-term creditors are now funding 71% of the business, which is more than it was five years ago. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

The Bottom Line

From what we've seen above, Linzhou Heavy Machinery GroupLtd has managed to increase it's returns on capital all the while reducing it's capital base. Given the stock has declined 13% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. With that in mind, we believe the promising trends warrant this stock for further investigation.

On a separate note, we've found 2 warning signs for Linzhou Heavy Machinery GroupLtd you'll probably want to know about.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002535

Linzhou Heavy Machinery GroupLtd

Manufactures and sells coal mining machinery in China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives