Is Now The Time To Put Linzhou Heavy Machinery GroupLtd (SZSE:002535) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Linzhou Heavy Machinery GroupLtd (SZSE:002535), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Linzhou Heavy Machinery GroupLtd

How Fast Is Linzhou Heavy Machinery GroupLtd Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Linzhou Heavy Machinery GroupLtd has grown EPS by 43% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Linzhou Heavy Machinery GroupLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Linzhou Heavy Machinery GroupLtd is growing revenues, and EBIT margins improved by 6.0 percentage points to 16%, over the last year. That's great to see, on both counts.

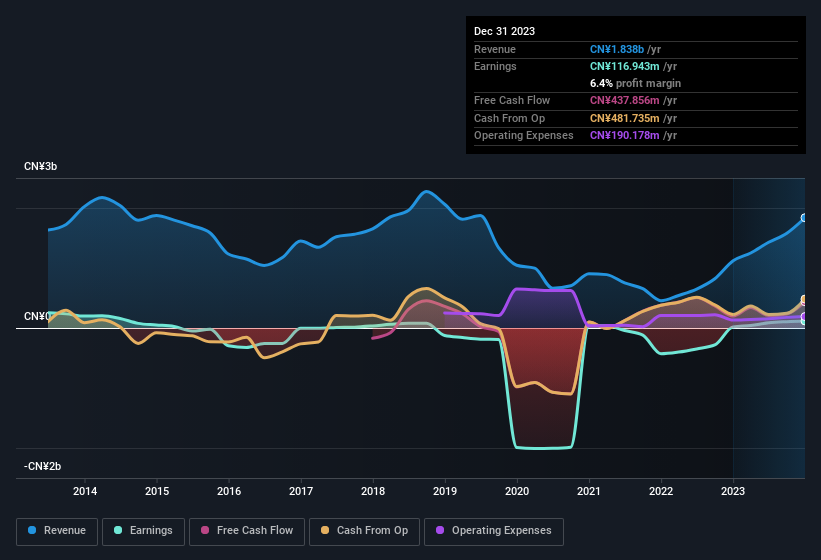

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Linzhou Heavy Machinery GroupLtd's balance sheet strength, before getting too excited.

Are Linzhou Heavy Machinery GroupLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Linzhou Heavy Machinery GroupLtd insiders own a significant number of shares certainly is appealing. In fact, they own 42% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have CN¥1.1b invested in the business, at the current share price. That's nothing to sneeze at!

Does Linzhou Heavy Machinery GroupLtd Deserve A Spot On Your Watchlist?

Linzhou Heavy Machinery GroupLtd's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Linzhou Heavy Machinery GroupLtd for a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Linzhou Heavy Machinery GroupLtd that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002535

Linzhou Heavy Machinery GroupLtd

Manufactures and sells coal mining machinery in China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives