- China

- /

- Electrical

- /

- SZSE:002533

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a mix of record highs and inflationary pressures, investors are keenly observing the evolving economic landscape. In such an environment, dividend stocks can offer a stable income stream and potential for long-term growth, making them a compelling consideration for those looking to navigate market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

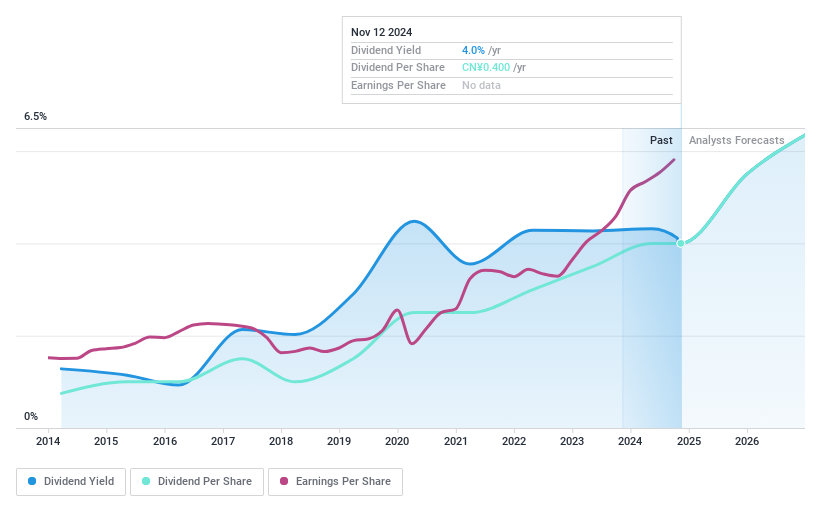

Gold cup Electric ApparatusLtd (SZSE:002533)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gold cup Electric Apparatus Co., Ltd. is engaged in the research, development, manufacturing, and sale of wires and cables both in China and internationally, with a market cap of CN¥6.96 billion.

Operations: Gold cup Electric Apparatus Co., Ltd. generates revenue primarily through its research, development, manufacturing, and sale of wires and cables.

Dividend Yield: 4%

Gold cup Electric Apparatus Ltd. offers a dividend yield of 3.96%, placing it in the top 25% of CN market dividend payers, though its track record is unstable with past volatility over 20%. The dividends are covered by earnings and cash flows, with payout ratios at 74.6% and 65.8%, respectively. Despite trading at a significant discount to estimated fair value, recent shareholder meeting discussions on financing and wealth management may impact future payouts.

- Click here to discover the nuances of Gold cup Electric ApparatusLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Gold cup Electric ApparatusLtd is priced lower than what may be justified by its financials.

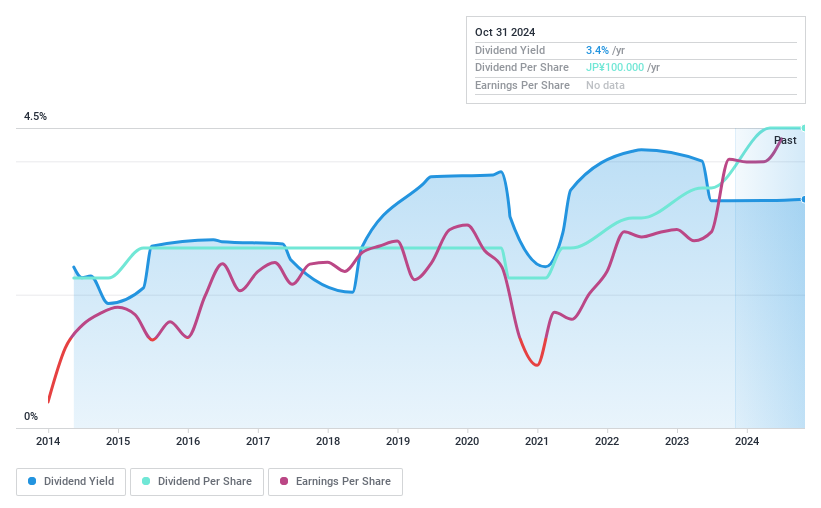

Chugai Ro (TSE:1964)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugai Ro Co., Ltd. and its subsidiaries specialize in developing thermal technology solutions both in Japan and internationally, with a market capitalization of ¥26.24 billion.

Operations: Chugai Ro Co., Ltd.'s revenue segments include ¥9.33 billion from Plant, ¥2.80 billion from Development, and ¥17.75 billion from Heat Treatment Furnace.

Dividend Yield: 3.3%

Chugai Ro's dividend yield of 3.27% is below the top tier in Japan, though its dividends have grown steadily over the past decade with minimal volatility. While earnings growth has been positive, large one-off items affect financial results, and dividends are not covered by free cash flows. Despite a low payout ratio of 25.1%, sustainability concerns arise due to insufficient free cash flow coverage, although earnings do cover payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Chugai Ro.

- The analysis detailed in our Chugai Ro valuation report hints at an inflated share price compared to its estimated value.

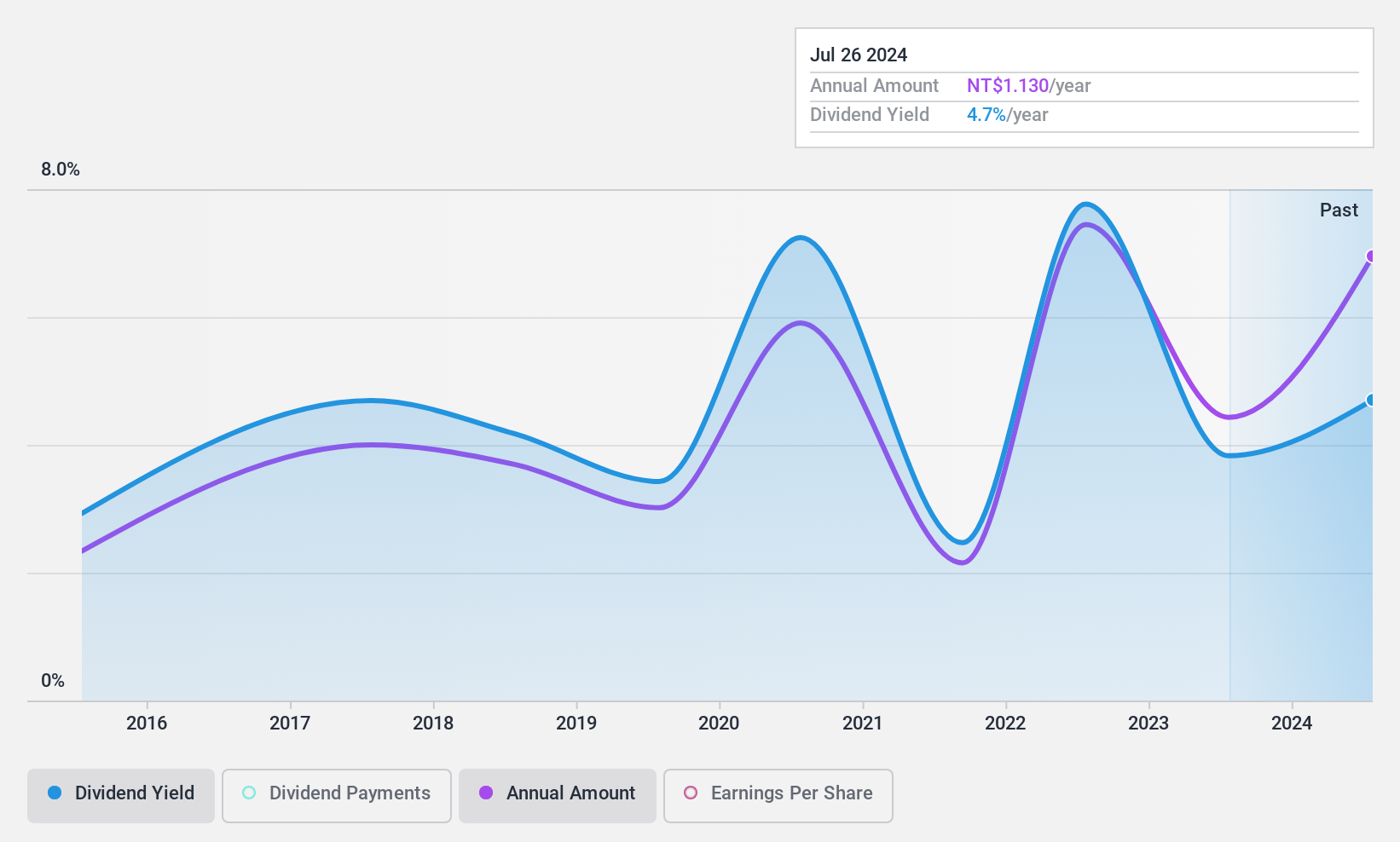

First Insurance (TWSE:2852)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The First Insurance Co., Ltd. provides a variety of insurance products and related services to both commercial and personal line customers in Taiwan, with a market cap of NT$7.69 billion.

Operations: First Insurance Co., Ltd. generates its revenue primarily from Property and Casualty Insurance, amounting to NT$7.75 billion.

Dividend Yield: 4.2%

First Insurance's dividend payments have increased over the past decade, supported by a low payout ratio of 37.4%, indicating strong earnings coverage. However, dividends have been unreliable and volatile, with fluctuations exceeding 20% annually. While trading at a discount to its estimated fair value, the dividend yield of 4.22% is slightly below the top quartile in Taiwan's market. Cash flow coverage is reasonable at 58%, but sustainability concerns persist due to historical volatility.

- Dive into the specifics of First Insurance here with our thorough dividend report.

- Upon reviewing our latest valuation report, First Insurance's share price might be too pessimistic.

Where To Now?

- Investigate our full lineup of 1990 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002533

Gold cup Electric ApparatusLtd

Researches, develops, manufactures, and sells wires and cables in China and internationally.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives