- China

- /

- Electrical

- /

- SZSE:002533

Gold cup Electric Apparatus Co.,Ltd.'s (SZSE:002533) Price Is Right But Growth Is Lacking After Shares Rocket 33%

Gold cup Electric Apparatus Co.,Ltd. (SZSE:002533) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

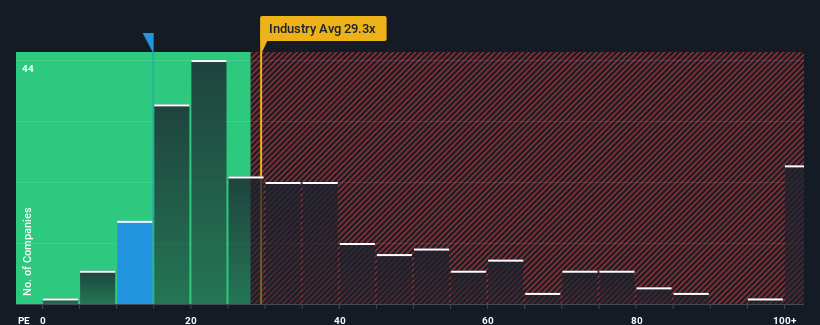

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Gold cup Electric ApparatusLtd as a highly attractive investment with its 14.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Gold cup Electric ApparatusLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Gold cup Electric ApparatusLtd

Is There Any Growth For Gold cup Electric ApparatusLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Gold cup Electric ApparatusLtd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 39% gain to the company's bottom line. Pleasingly, EPS has also lifted 83% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's understandable that Gold cup Electric ApparatusLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Gold cup Electric ApparatusLtd's P/E?

Shares in Gold cup Electric ApparatusLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Gold cup Electric ApparatusLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Gold cup Electric ApparatusLtd has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002533

Gold cup Electric ApparatusLtd

Researches, develops, manufactures, and sells wires and cables in China and internationally.

Undervalued with solid track record and pays a dividend.