The Price Is Right For Jiangxi Haiyuan Composites Technology Co.,Ltd. (SZSE:002529)

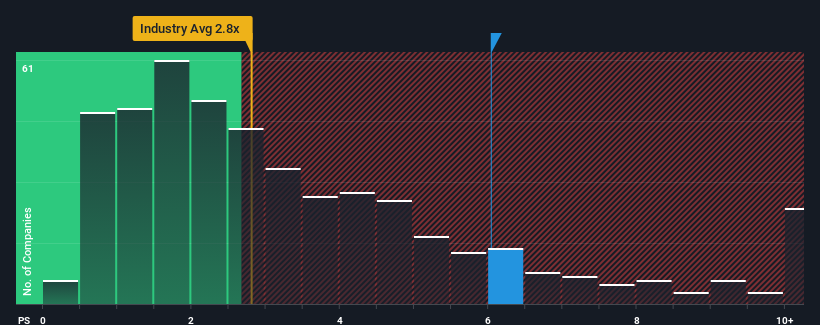

When you see that almost half of the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") below 2.8x, Jiangxi Haiyuan Composites Technology Co.,Ltd. (SZSE:002529) looks to be giving off strong sell signals with its 6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Jiangxi Haiyuan Composites TechnologyLtd

How Jiangxi Haiyuan Composites TechnologyLtd Has Been Performing

The revenue growth achieved at Jiangxi Haiyuan Composites TechnologyLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Jiangxi Haiyuan Composites TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Jiangxi Haiyuan Composites TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Jiangxi Haiyuan Composites TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Pleasingly, revenue has also lifted 152% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 28% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Jiangxi Haiyuan Composites TechnologyLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangxi Haiyuan Composites TechnologyLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You always need to take note of risks, for example - Jiangxi Haiyuan Composites TechnologyLtd has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Jiangxi Haiyuan Composites TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002529

Jiangxi Haiyuan Composites TechnologyLtd

Jiangxi Haiyuan Composites Technology Co., Ltd.

Mediocre balance sheet very low.

Market Insights

Community Narratives