The Market Lifts Chengdu Xinzhu Road&Bridge Machinery Co.,LTD (SZSE:002480) Shares 27% But It Can Do More

The Chengdu Xinzhu Road&Bridge Machinery Co.,LTD (SZSE:002480) share price has done very well over the last month, posting an excellent gain of 27%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

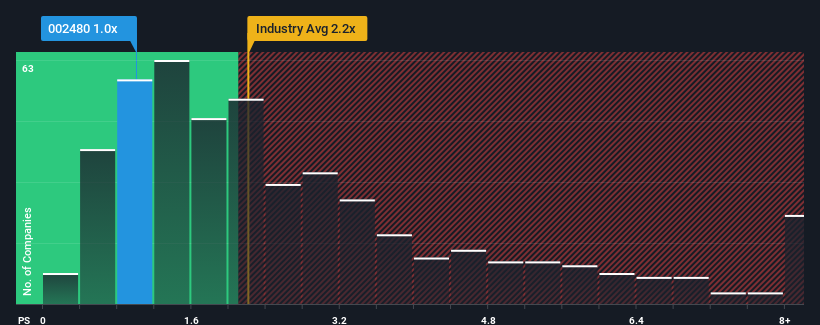

Even after such a large jump in price, considering around half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") above 2.2x, you may still consider Chengdu Xinzhu Road&Bridge MachineryLTD as an solid investment opportunity with its 1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Chengdu Xinzhu Road&Bridge MachineryLTD

How Chengdu Xinzhu Road&Bridge MachineryLTD Has Been Performing

Recent times have been quite advantageous for Chengdu Xinzhu Road&Bridge MachineryLTD as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chengdu Xinzhu Road&Bridge MachineryLTD's earnings, revenue and cash flow.How Is Chengdu Xinzhu Road&Bridge MachineryLTD's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chengdu Xinzhu Road&Bridge MachineryLTD's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 71%. Pleasingly, revenue has also lifted 168% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 23% shows it's noticeably more attractive.

In light of this, it's peculiar that Chengdu Xinzhu Road&Bridge MachineryLTD's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

The latest share price surge wasn't enough to lift Chengdu Xinzhu Road&Bridge MachineryLTD's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Chengdu Xinzhu Road&Bridge MachineryLTD currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chengdu Xinzhu Road&Bridge MachineryLTD that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002480

Chengdu Xinzhu Road&Bridge MachineryLTD

Provides products and services for urban rail transit systems in China and internationally.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.