- China

- /

- Commercial Services

- /

- SZSE:300172

Beijing LeiKe Defense Technology And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a turbulent start to the year, with U.S. equities facing declines amid inflation concerns and political uncertainties, while European markets show cautious optimism about potential interest rate cuts. In such a fluctuating landscape, investors often seek opportunities in areas that promise both affordability and growth potential. Penny stocks, despite their outdated moniker, continue to capture attention as they represent smaller or newer companies that may offer significant returns when backed by strong financials. This article will explore three penny stocks that demonstrate financial resilience and potential for growth in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £413.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.60 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,822 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Beijing LeiKe Defense Technology (SZSE:002413)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing LeiKe Defense Technology Co., Ltd. operates in the defense technology sector and has a market cap of CN¥5.24 billion.

Operations: The company generates revenue primarily from the Computer, Communications and Other Electronic Equipment Manufacturing segment, amounting to CN¥1.18 billion.

Market Cap: CN¥5.24B

Beijing LeiKe Defense Technology has faced challenges, reporting a net loss of CN¥134.45 million for the first nine months of 2024, compared to a profit in the previous year. Despite being unprofitable, it maintains a strong cash position with short-term assets exceeding both long-term and short-term liabilities, indicating financial stability. The company’s board is relatively new with an average tenure of 2.3 years, while its management team is more seasoned with four years' experience on average. Recent changes in company bylaws and director elections reflect ongoing strategic adjustments within the firm.

- Unlock comprehensive insights into our analysis of Beijing LeiKe Defense Technology stock in this financial health report.

- Evaluate Beijing LeiKe Defense Technology's prospects by accessing our earnings growth report.

Cec Environmental ProtectionLtd (SZSE:300172)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CEC Environmental Protection Co., Ltd offers ecological environmental management services and has a market capitalization of CN¥3.32 billion.

Operations: CEC Environmental Protection Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.32B

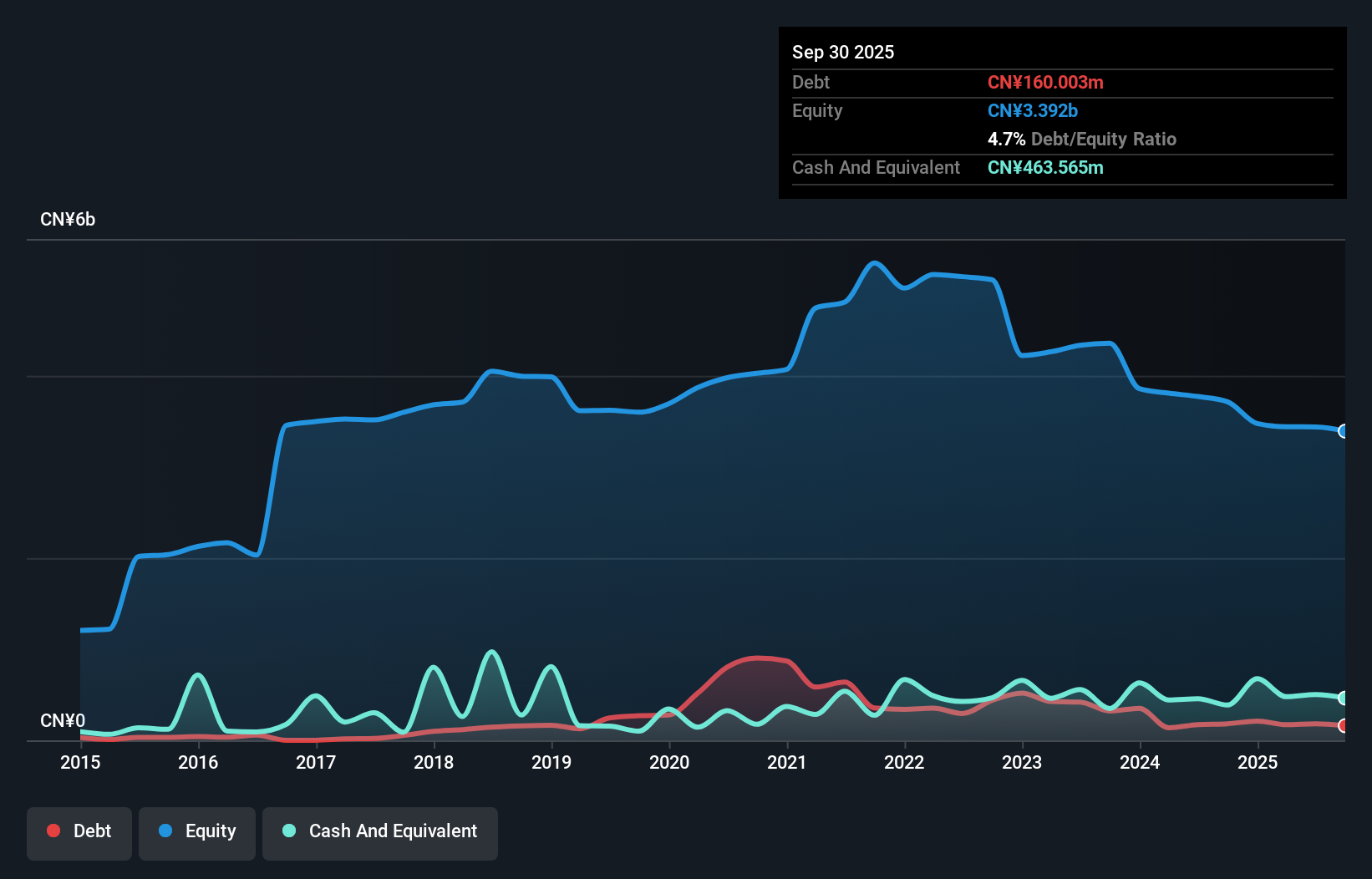

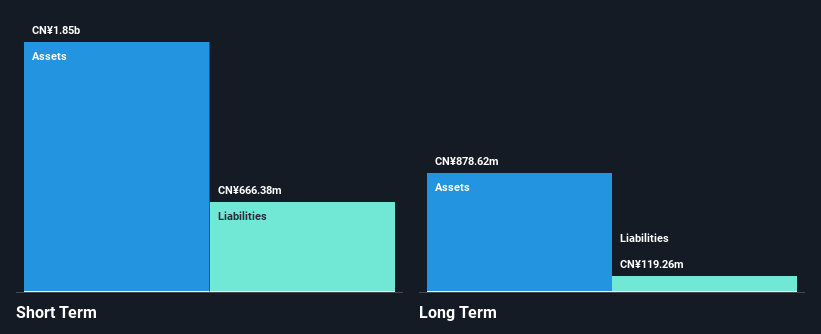

CEC Environmental Protection Co., Ltd, with a market cap of CN¥3.32 billion, reported decreased earnings for the first nine months of 2024, with sales dropping to CN¥601.15 million from CN¥773.19 million year-on-year and net income declining to CN¥84.53 million. Despite these challenges, the company has a strong balance sheet; short-term assets of CN¥1.9 billion surpass both short-term and long-term liabilities significantly. The board's average tenure is considered experienced at 5.1 years, while debt levels have been reduced over five years, enhancing financial stability despite recent negative earnings growth and lower profit margins compared to last year.

- Click to explore a detailed breakdown of our findings in Cec Environmental ProtectionLtd's financial health report.

- Gain insights into Cec Environmental ProtectionLtd's historical outcomes by reviewing our past performance report.

Beijing Philisense Technology (SZSE:300287)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Philisense Technology Co., Ltd. offers informatization solutions in China and has a market cap of CN¥5.64 billion.

Operations: The company generates revenue of CN¥593.23 million from its operations within China.

Market Cap: CN¥5.64B

Beijing Philisense Technology Co., Ltd. has a market cap of CN¥5.64 billion and reported a revenue decline to CN¥431.62 million for the first nine months of 2024, down from CN¥661.86 million the previous year, alongside a reduced net loss of CN¥124.05 million compared to CN¥145.17 million last year. Despite being unprofitable with negative return on equity, the company has improved its debt position significantly over five years and maintains short-term assets exceeding liabilities by a comfortable margin, offering some financial stability amidst high share price volatility and limited cash runway if current growth rates persist.

- Dive into the specifics of Beijing Philisense Technology here with our thorough balance sheet health report.

- Understand Beijing Philisense Technology's track record by examining our performance history report.

Taking Advantage

- Click this link to deep-dive into the 5,822 companies within our Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cec Environmental ProtectionLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300172

Cec Environmental ProtectionLtd

CEC Environmental Protection Co.,Ltd provides ecological environmental management services.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives