In a week marked by busy earnings reports and mixed economic signals, global markets showed varied performance, with major U.S. indices like the Nasdaq Composite and S&P MidCap 400 reaching highs only to retreat sharply. Amidst this backdrop of fluctuating market conditions, dividend stocks offer a compelling opportunity for investors seeking stability and income in their portfolios. A good dividend stock typically combines consistent payout history with strong fundamentals, making it an attractive option during periods of economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2023 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Hongqiao Group (SEHK:1378)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Hongqiao Group Limited is an investment holding company that manufactures and sells aluminum products in the People's Republic of China and Indonesia, with a market cap of approximately HK$124.13 billion.

Operations: The company generates revenue primarily through its manufacture and sales of aluminum products, totaling CN¥141.48 billion.

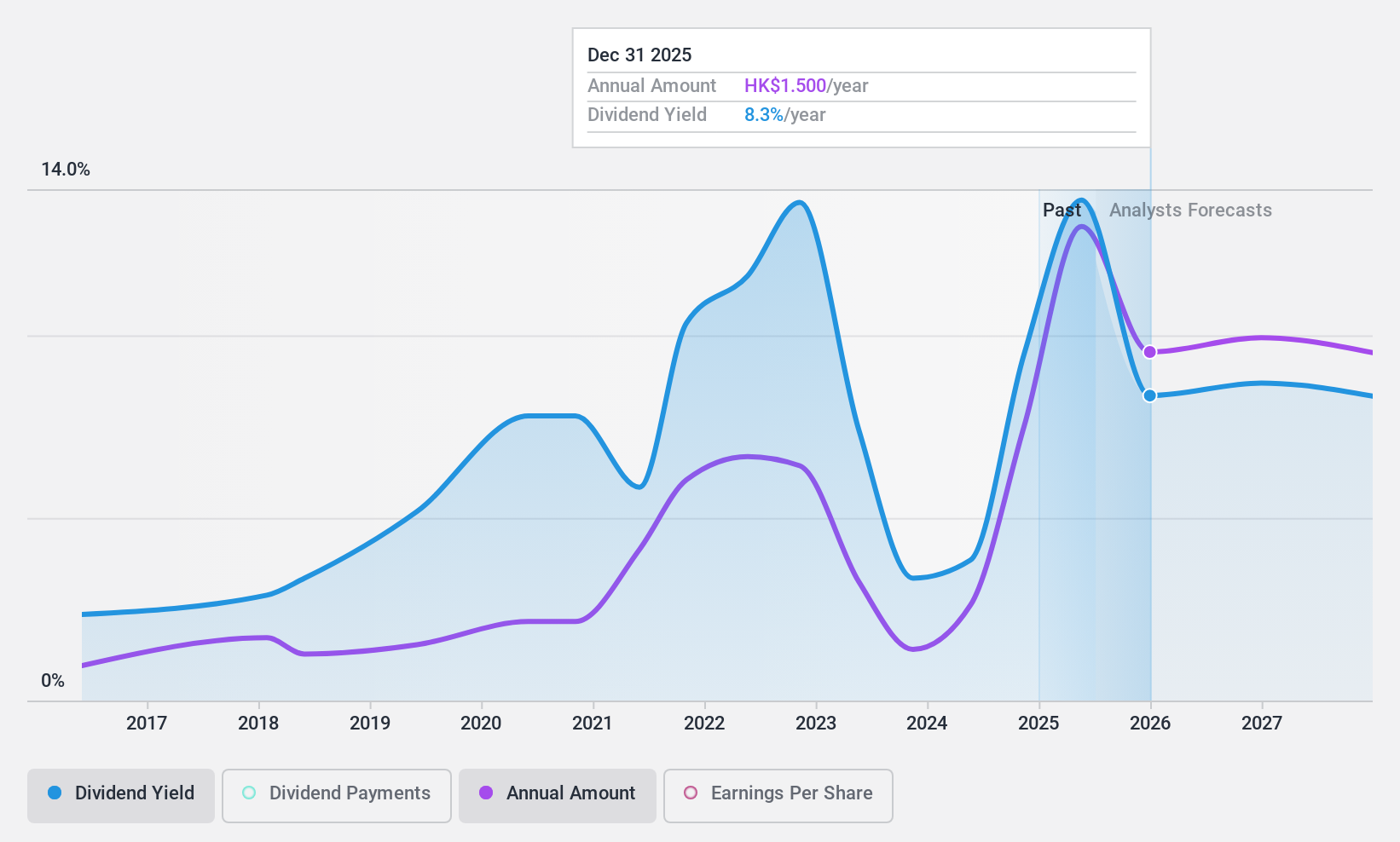

Dividend Yield: 8.5%

China Hongqiao Group's dividend yield of 8.5% ranks among the top 25% in Hong Kong, supported by a low payout ratio of 42.3%, indicating coverage by earnings and cash flows. However, its dividend history is volatile, with past instability despite recent increases. The stock trades at a significant discount to its estimated fair value and shows strong earnings growth, as indicated by net income rising to CNY 9.15 billion for the first half of 2024 from CNY 2.46 billion year-on-year.

- Click here to discover the nuances of China Hongqiao Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility China Hongqiao Group's shares may be trading at a discount.

KCE Electronics (SET:KCE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KCE Electronics Public Company Limited, along with its subsidiaries, manufactures and distributes electric printed circuit boards (PCBs) globally under the KCE trademark, with a market cap of THB41.37 billion.

Operations: KCE Electronics generates revenue primarily from its Printed Circuit Board Business (THB17.94 billion), followed by the Prepreg and Laminate Business (THB3.31 billion) and the Chemical Business (THB941.29 million).

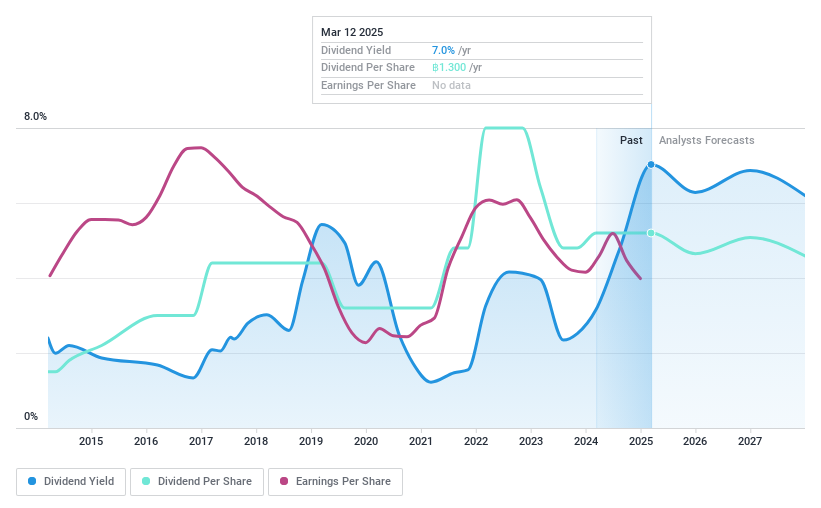

Dividend Yield: 3.6%

KCE Electronics' dividend yield of 3.59% is modest compared to Thailand's top payers, but dividends are covered by earnings (71.6% payout ratio) and cash flows (39.3% cash payout ratio). Despite past volatility, recent earnings growth and a THB 0.60 per share dividend for early 2024 reflect improved stability. The stock's price-to-earnings ratio of 19.9x is below the industry average, suggesting reasonable valuation amidst forecasts of continued earnings growth.

- Unlock comprehensive insights into our analysis of KCE Electronics stock in this dividend report.

- The valuation report we've compiled suggests that KCE Electronics' current price could be quite moderate.

Canny Elevator (SZSE:002367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canny Elevator Co., Ltd. focuses on the research, development, production, sale, installation, and maintenance of elevators in China and has a market cap of CN¥5.13 billion.

Operations: Canny Elevator Co., Ltd. generates revenue from the research, development, production, sale, installation, and maintenance of elevators within China.

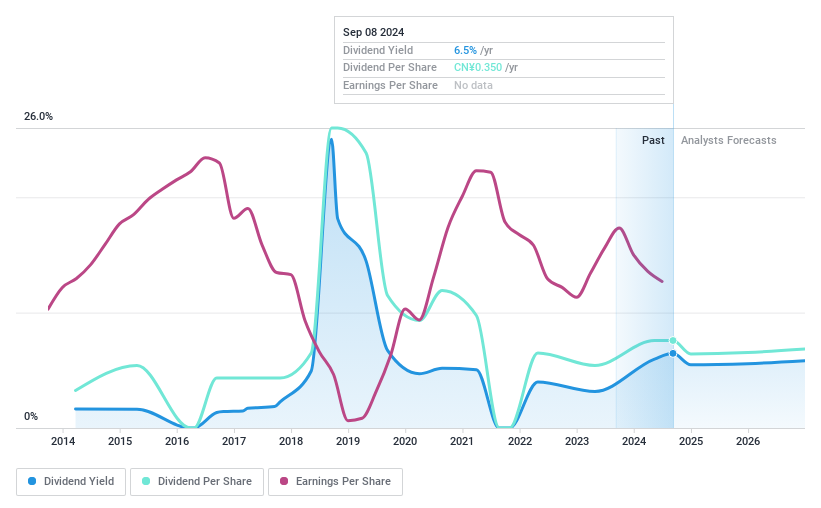

Dividend Yield: 5.2%

Canny Elevator's dividend yield of 5.2% ranks in the top 25% of Chinese payers but is not well covered by earnings, with a high payout ratio of 94.3%. Cash flow coverage is more reasonable at 54.5%, though dividends have been volatile and unreliable over the past decade. Recent earnings declined, with net income dropping to CNY 281.71 million for nine months ending September 2024, suggesting potential challenges in sustaining dividends without improved profitability or revenue growth.

- Get an in-depth perspective on Canny Elevator's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Canny Elevator shares in the market.

Where To Now?

- Investigate our full lineup of 2023 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KCE Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KCE

KCE Electronics

Manufactures and distributes electric printed circuit boards (PCBs) under the KCE trademark worldwide.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives