There's Reason For Concern Over RongFa Nuclear Equipment Co., Ltd.'s (SZSE:002366) Massive 35% Price Jump

Those holding RongFa Nuclear Equipment Co., Ltd. (SZSE:002366) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.1% in the last twelve months.

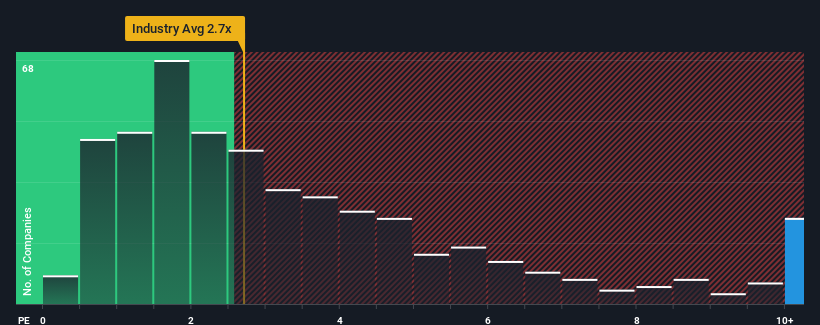

Following the firm bounce in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider RongFa Nuclear Equipment as a stock to avoid entirely with its 14.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for RongFa Nuclear Equipment

What Does RongFa Nuclear Equipment's P/S Mean For Shareholders?

RongFa Nuclear Equipment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on RongFa Nuclear Equipment's earnings, revenue and cash flow.How Is RongFa Nuclear Equipment's Revenue Growth Trending?

In order to justify its P/S ratio, RongFa Nuclear Equipment would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 59% last year. The latest three year period has also seen an excellent 52% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that RongFa Nuclear Equipment's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

The strong share price surge has lead to RongFa Nuclear Equipment's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that RongFa Nuclear Equipment currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You always need to take note of risks, for example - RongFa Nuclear Equipment has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002366

RongFa Nuclear Equipment

Through its subsidiaries, engages in the manufacturing of high-end equipment and machinery, including nuclear power, military products, and petrochemical equipment in China and internationally.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives