- China

- /

- Electrical

- /

- SZSE:002323

Why Investors Shouldn't Be Surprised By Shandong Yabo Technology Co., Ltd's (SZSE:002323) 26% Share Price Surge

Shandong Yabo Technology Co., Ltd (SZSE:002323) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

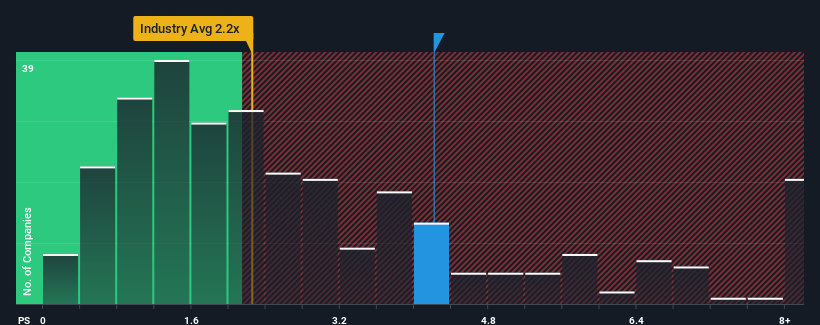

Following the firm bounce in price, given close to half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Shandong Yabo Technology as a stock to potentially avoid with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shandong Yabo Technology

How Has Shandong Yabo Technology Performed Recently?

Shandong Yabo Technology has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shandong Yabo Technology will help you shine a light on its historical performance.How Is Shandong Yabo Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Shandong Yabo Technology would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 26%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Shandong Yabo Technology is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Shandong Yabo Technology's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Shandong Yabo Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Shandong Yabo Technology is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002323

Shandong Yabo Technology

Engages in the design, research, and development of new materials for metal roof and wall enclosure systems.

Very low with weak fundamentals.