Market Might Still Lack Some Conviction On Tianrun Industry Technology Co., Ltd. (SZSE:002283) Even After 29% Share Price Boost

Those holding Tianrun Industry Technology Co., Ltd. (SZSE:002283) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.9% over the last year.

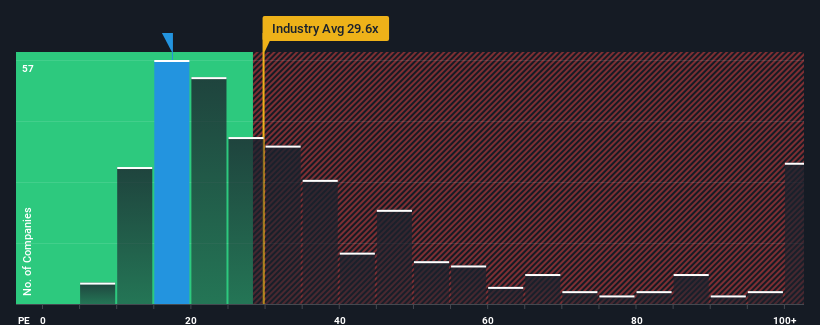

Although its price has surged higher, Tianrun Industry Technology's price-to-earnings (or "P/E") ratio of 17.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Tianrun Industry Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Tianrun Industry Technology

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Tianrun Industry Technology's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 40%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 18% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 44% over the next year. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

In light of this, it's peculiar that Tianrun Industry Technology's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Tianrun Industry Technology's P/E

The latest share price surge wasn't enough to lift Tianrun Industry Technology's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tianrun Industry Technology currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Tianrun Industry Technology that you should be aware of.

Of course, you might also be able to find a better stock than Tianrun Industry Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tianrun Industry Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002283

Tianrun Industry Technology

Manufactures and sells internal combustion engine crankshafts in China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives