- Japan

- /

- Electrical

- /

- TSE:5659

Exploring Bosun And 2 Other Promising Small Caps With Solid Potential

Reviewed by Simply Wall St

In the wake of recent market fluctuations, including a pullback in U.S. stocks and shifts in economic indicators such as inflation and interest rates, small-cap companies have found themselves under the spotlight. The S&P 600 index for small-cap stocks reflects these dynamics, offering both challenges and opportunities amid broader market sentiment. In this environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and potential resilience to navigate policy changes and economic trends effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.59% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Bosun (SZSE:002282)

Simply Wall St Value Rating: ★★★★★★

Overview: Bosun Co., Ltd. is engaged in the research, manufacture, and sale of diamond tools both in China and internationally, with a market capitalization of CN¥3.80 billion.

Operations: The company generates revenue primarily from the sale of diamond tools. Its cost structure includes expenses related to research and manufacturing. The net profit margin has shown significant variability, reflecting changes in operational efficiency and market conditions.

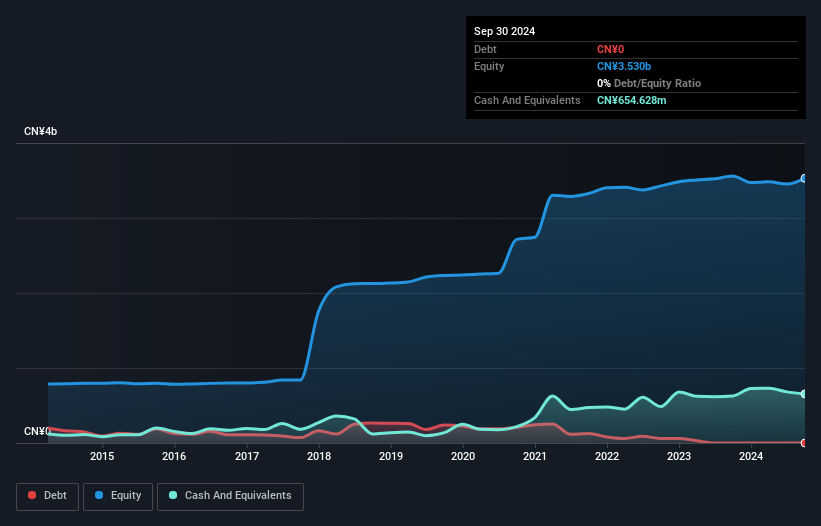

Bosun, a nimble player in its industry, has shown impressive financial health with no debt and a price-to-earnings ratio of 18.5x, which is notably below the broader CN market's 35.9x. The company's earnings growth over the past year soared by 49%, outpacing the Machinery industry's -0.4%. For the nine months ending September 2024, Bosun reported sales of CNY 1.25 billion compared to CNY 1.16 billion last year, while net income jumped to CNY 164.75 million from CNY 88.2 million previously, reflecting strong operational performance and high-quality earnings amidst competitive pressures in its sector.

- Get an in-depth perspective on Bosun's performance by reading our health report here.

Gain insights into Bosun's past trends and performance with our Past report.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippon Seisen Co., Ltd. is engaged in the manufacturing and sale of stainless steel wires both domestically in Japan and internationally, with a market capitalization of ¥40.43 billion.

Operations: Nippon Seisen generates revenue primarily from its domestic market in Japan, contributing ¥41.34 billion, followed by Thailand with ¥5.44 billion, and China and South Korea with ¥1.59 billion.

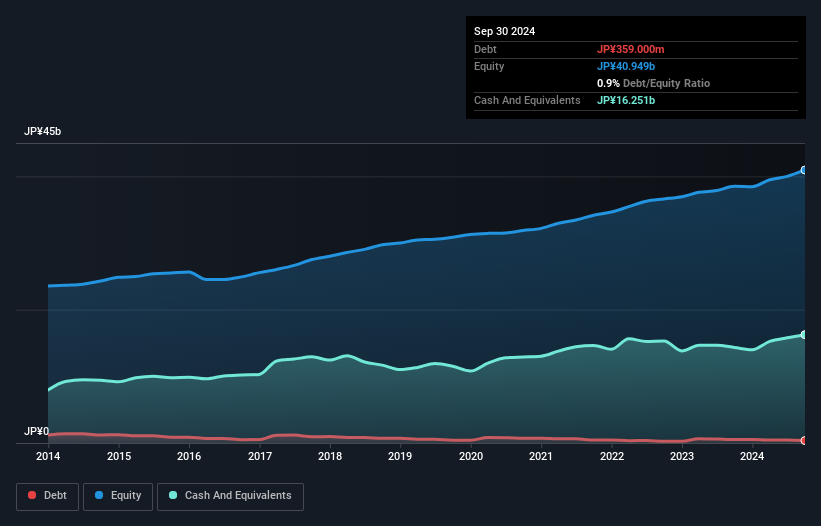

Nippon Seisen, a relatively small player in the industry, showcases promising financial health. Over the past five years, earnings have grown annually by 12.9%, although last year's growth of 3.1% lagged behind the Electrical industry's 15%. The company's debt-to-equity ratio has improved from 1.3 to 0.9 over this period, indicating prudent financial management. Trading at approximately 72% below its estimated fair value suggests potential undervaluation in the market's eyes. Recent guidance forecasts net sales of ¥47.7 billion and an operating profit of ¥4.9 billion for fiscal year-end March 2025, reflecting a stable outlook despite dividend reductions from ¥105 to ¥28 per share year-on-year.

- Take a closer look at Nippon SeisenLtd's potential here in our health report.

Understand Nippon SeisenLtd's track record by examining our Past report.

ScinoPharm Taiwan (TWSE:1789)

Simply Wall St Value Rating: ★★★★★★

Overview: ScinoPharm Taiwan, Ltd. is engaged in the research, development, production, and sale of active pharmaceutical ingredients (API) to pharmaceutical companies across Taiwan and globally, with a market cap of NT$18.70 billion.

Operations: ScinoPharm Taiwan generates revenue primarily through the sale of active pharmaceutical ingredients (API) to various regions, including Asia, Europe, India, and the United States. The company's financial performance is highlighted by its market capitalization of NT$18.70 billion.

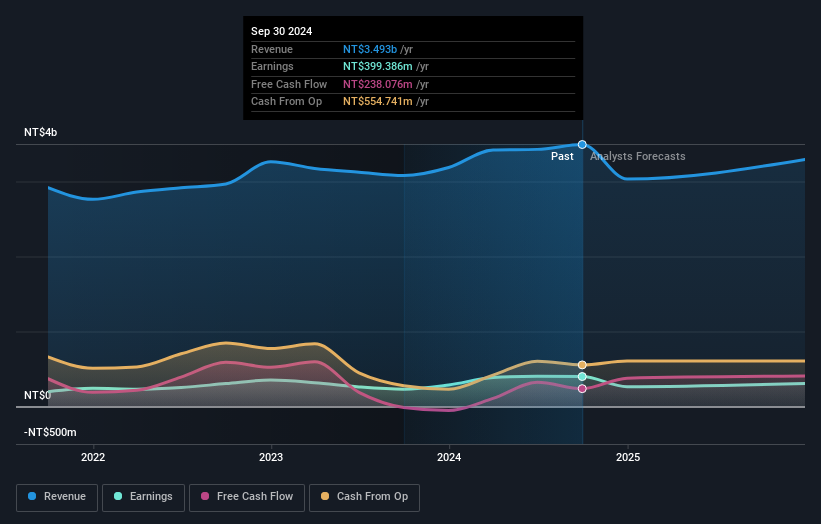

ScinoPharm Taiwan, a player in the pharmaceutical sector, has shown impressive growth with earnings increasing by 72.7% over the past year, outpacing the industry average of 11.9%. The company's financial health is underscored by its cash position exceeding total debt and a significantly reduced debt-to-equity ratio from 2.6 to 0.3 over five years. Recent results indicate sales for Q3 at TWD 724 million compared to TWD 660 million last year, though net income slipped slightly to TWD 27 million from TWD 31 million previously. Notably, nine-month figures reveal net income surged to TWD 242 million from TWD 130 million a year ago.

- Click here and access our complete health analysis report to understand the dynamics of ScinoPharm Taiwan.

Evaluate ScinoPharm Taiwan's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 4627 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nippon SeisenLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nippon SeisenLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5659

Nippon SeisenLtd

Manufactures and sells stainless steel wires in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.